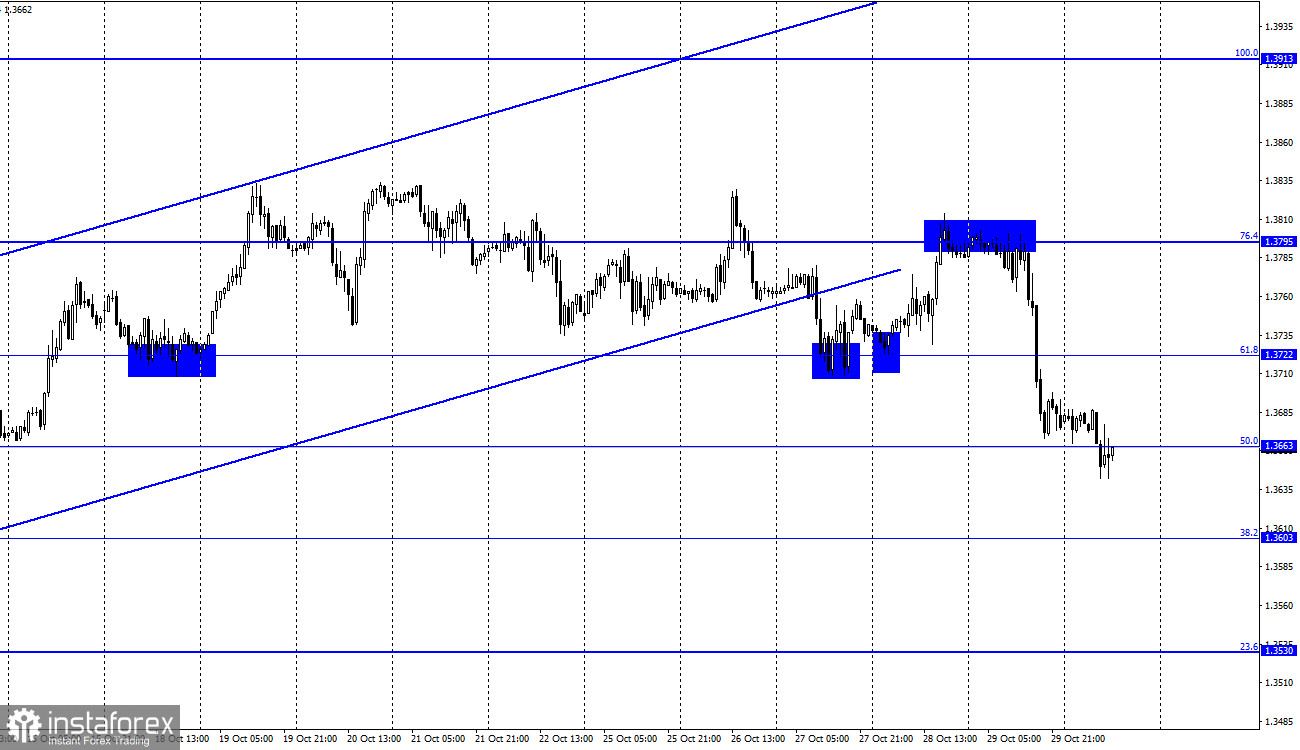

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a rebound from the corrective level of 76.4% (1.3795) and then the process of falling continues. The quotes have already closed at the levels of 1.3722 and 1.3663. Thus, the fall in quotes continues in the direction of the next corrective level of 38.2% (1.3603). Last Thursday, there was a fairly strong growth in the British dollar, which was due to a poor report on GDP in America. But why the British started falling on Friday and continues it on Monday, when even the European currency is trying to pull back up, is a big question. On Friday, the information background in the UK was completely absent, and in the US there were only two far from the most important reports on income and expenses of Americans in October. It is unlikely that this data could bring the pair down by 120 points. And today, on Monday, not a single report has yet been released either in the UK or in the USA.

Therefore, why the pound is falling today is even more difficult to say. However, this week, the results of the Fed meeting will be summed up. And one of the most anticipated solutions is the curtailment of the economic stimulus program. Thus, the dollar may be growing on expectations of curtailing the QE program. Also this week, on Thursday, the results of the Bank of England meeting will be summed up, from which traders also expect certain "hawkish measures". Or at least an increase in the number of those voting "for" a reduction in the incentive program for board members. Both can support the British, but traders now seem to be in a state of euphoria about the Fed's future decisions. At least, it is quite difficult to explain the growth of the dollar against the British and the European with something else. But I want to note that the Fed may postpone the decision to curtail QE at a later date. And on Friday, Nonfarm Payrolls may be worse than expected for the third time in a row. Thus, the growth of the dollar may be short-lived.

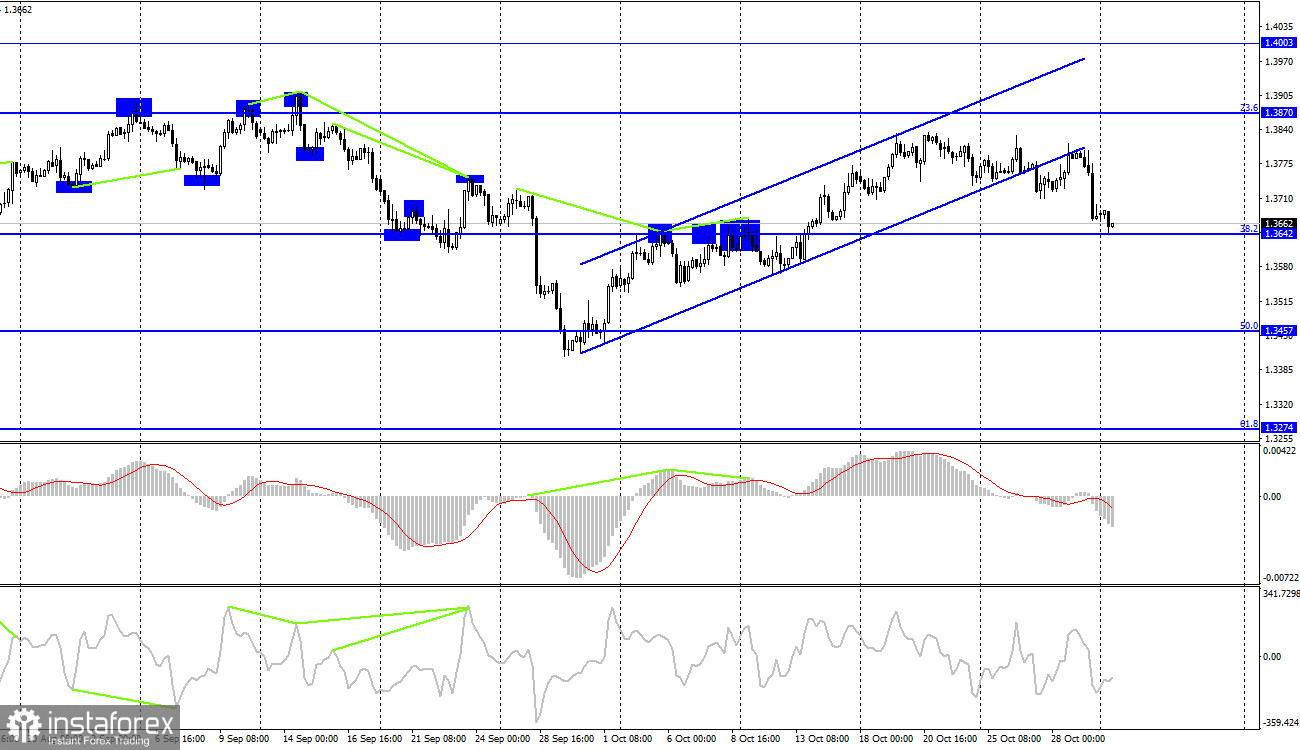

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed consolidation under the upward trend corridor and fell to the corrective level of 38.2% (1.3642). The rebound of the pair's rate from this level will allow traders to expect a reversal in favor of the British and some growth in the direction of the Fibo level of 23.6% (1.3870). Fixing quotes below the correction level of 38.2% will increase the probability of a further fall in the direction of the next level of 50.0% (1.3457).

News calendar for the USA and the UK:

US - ISM manufacturing index (14:00 UTC).

On Monday, the information background in the US will be quite weak, and in the UK - zero. Thus, today the activity of traders will be much weaker than on Friday. Graphic factors will be in the first place in importance.

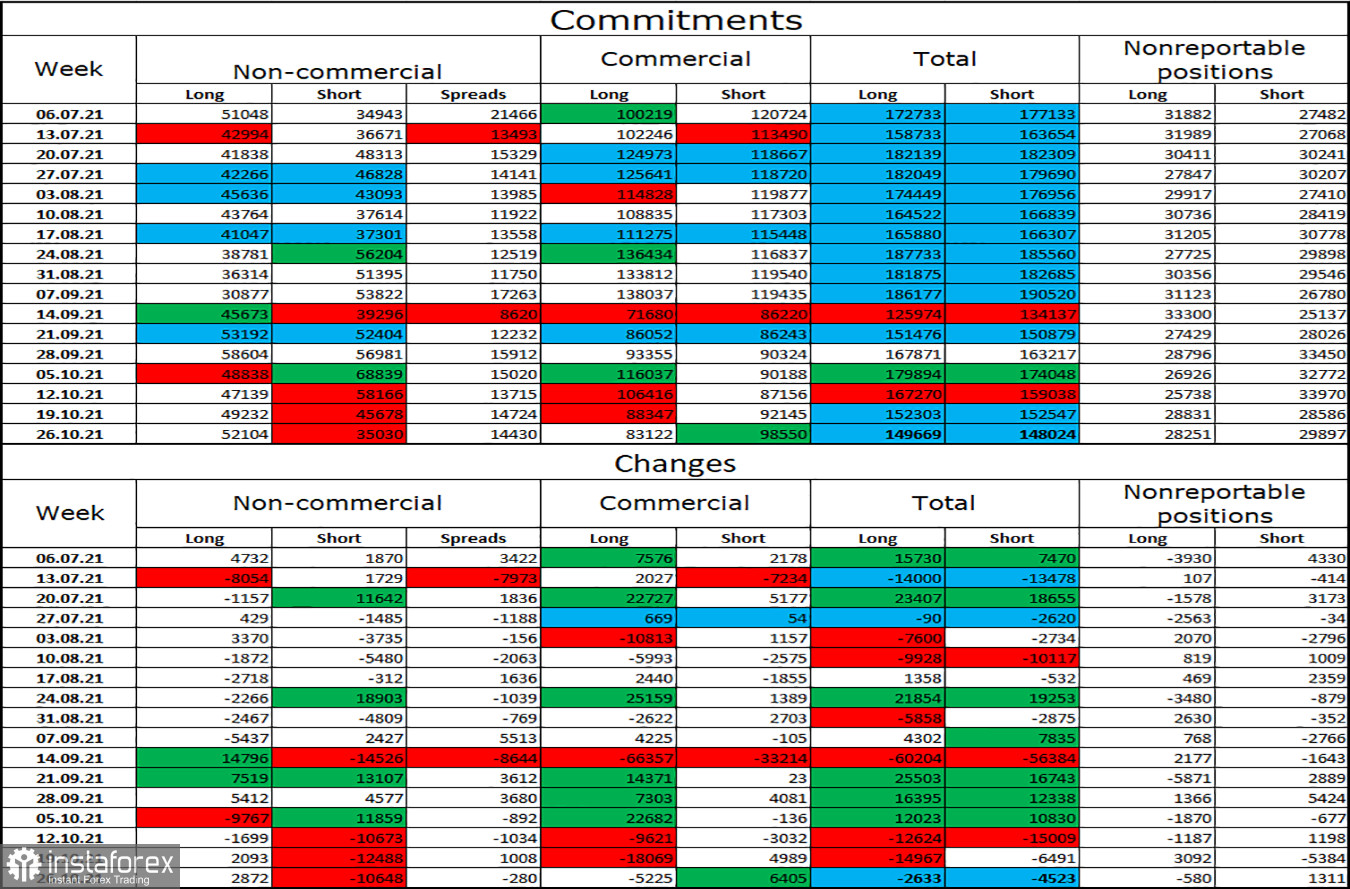

COT (Commitments of Traders) report:

The latest COT report on October 26 for the pound showed that the mood of the major players has become much more "bullish" again. In the reporting week, speculators opened 2,872 long contracts and closed 10,648 short contracts. Thus, the number of long contracts in the hands of major players now exceeds the number of short contracts by 17 thousand. Now we can say that the mood of the "Non-commercial" category of traders has become "bullish". However, at the same time, the graphic picture suggests a possible drop in the quotes of the British, since two trend corridors were abandoned at once. In recent weeks, major players have not had any clear mood and are now increasing purchases, then increasing sales, and the total number of long and short contracts is the same for all categories of traders. Thus, after four weeks of an active build-up of longs, it may be the turn of shorts.

GBP/USD forecast and recommendations to traders:

I recommend new purchases of the British if the rebound from the level of 38.2% (1.3642) is made on the 4-hour chart with a target of 1.3722. I recommended selling if there is a rebound from the 1.3795 level on the hourly chart, with a target of 1.3722. As a result, both this level and the 1.3663 level were reached. I do not recommend new sales now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.