Yesterday, it was not possible to summarize the results of October trading on the pound/dollar currency pair. Well, let's do it today. Let me remind you that it makes sense to consider the monthly chart only after the closing of the next trading month to determine the likely monthly prospects of a particular trading instrument. I will not take up your time and immediately begin debriefing.

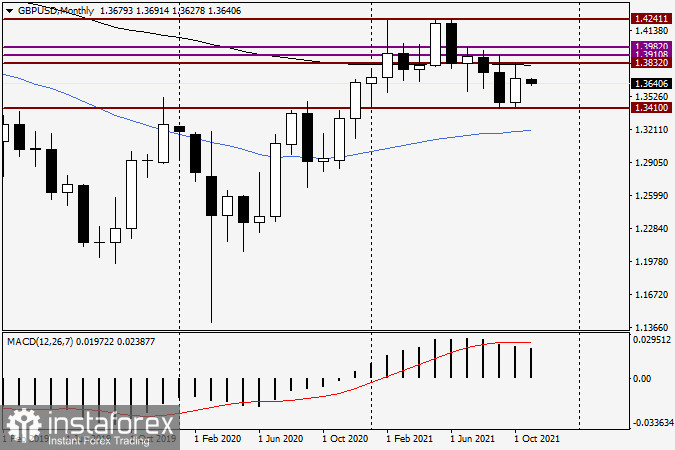

Monthly

So, the first thing that catches your eye when looking at the monthly timeframe of the GBP/USD currency pair is that the support at 1.3410 resisted again and the bears on the instrument failed to break through this quite a strong level for the second month in a row. Moreover, it was from the 1.3410 area that the pair rushed northward and ended last month's trading with an increase. The resistance level of 1.3832 and the black 89 exponential moving average, located near this mark, prevented the further rise of the exchange rate. Thus, the monthly range in which the British pound is traded in pairs with the US dollar can be defined as 1.3410-1.3832. Naturally, if you look into the prospects of this trading instrument, they will be determined by the true exit from the created range. Considering that there are still several strong technical levels above 1.3832, the task of bulls for the pound looks much more difficult. However, the bears on the British currency are not so easy and simple. At the moment of writing the article, the pair is trading near 1.3636, and to lower the cus to the support of 1.3410, it is also necessary to go down to an important and strong technical and psychological level of 1.3500. And yet, in my personal opinion, looking at the monthly chart, the downward scenario has a higher priority for its implementation. Now let's see what kind of picture is observed on a smaller graph.

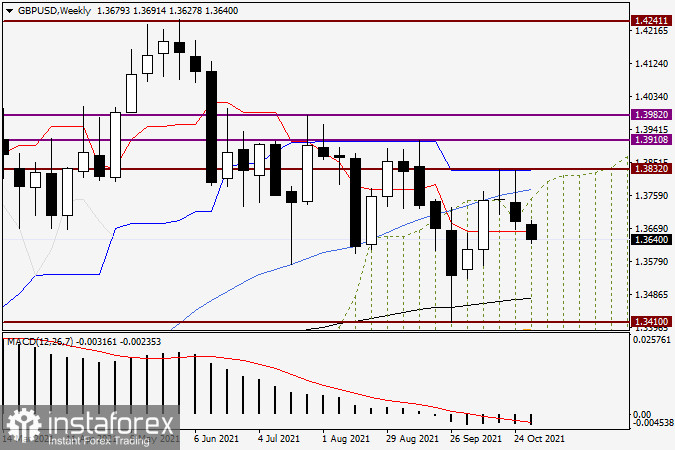

Weekly

And here the bearish nature of the price movement is visible. Why? Please note that having reached the level of 1.3832, the pair formed a reversal pattern of the Doji Cross candle analysis, after which it again tried to break through the sellers' resistance at 1.3832 next week. As you can see, all this ended with a decline in the exchange rate and the closing of weekly trading within the Ichimoku indicator cloud. If the red Tenkan line of the Ichimoku indicator stopped the further decline of the quote at the auction of the past five days, then the pair is trading below this line. If the decline continues, and even more so gains momentum, the pound/dollar risks falling to the black 89 exponential moving average, which runs at 1.3477. Well, it is already close to the support of 1.3410. Considering both timeframes considered, especially the weekly one, I consider the most likely scenario for GBP/USD to be bearish. If this assumption is correct, then we will consider selling the pair after its minor and short-term pullbacks upwards as the main trading recommendation. We will try to determine the specific entry points tomorrow when smaller time intervals will be considered. And at the moment, a downward scenario is most likely.