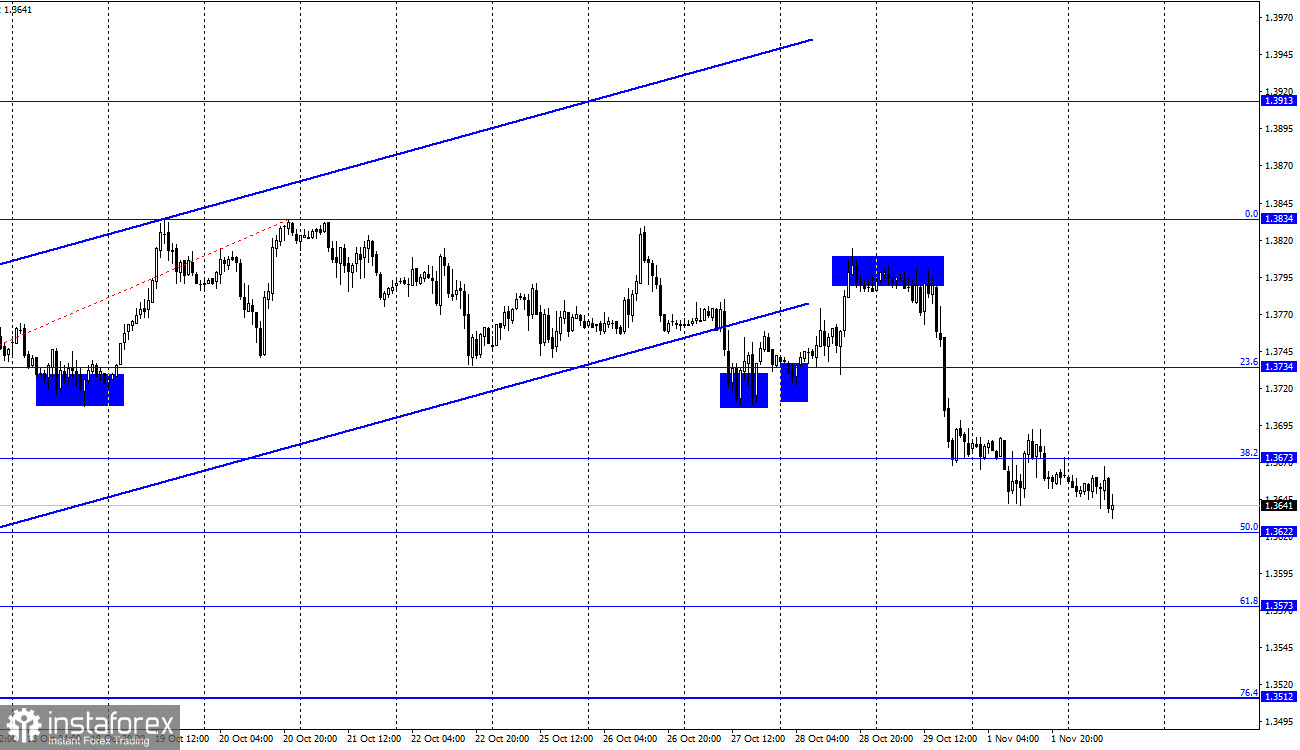

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair has secured under the corrective level of 38.2% (1.3673) and continues the process of falling towards the next Fibo level of 50.0% (1.3622). The rebound of the pair's exchange rate from this level will allow us to count on a reversal in favor of the EU currency and some growth towards the level of 1.3673. Closing below the level of 1.3622 will increase the chances of continuing the fall towards the next corrective level of 61.8% (1.3573). The information background of the last day was as weak as for the euro/dollar. The same reports on business activity in the US manufacturing sector did not have much impact on the mood of traders. Today, the situation is even more boring, since the calendars of economic events in Britain and the United States are empty on Tuesday. However, yesterday, it became known that a "fish conflict" is flaring up with renewed vigor between France and the UK.

Let me remind you that under the terms of Brexit, the UK is obliged to provide access to its waters to European fishermen to catch fish and seafood. France accused London of the fact that recently some French vessels did not receive permission to fish, and threatened to blockade British vessels in French ports, as well as tighten checks on British sailors and cargo transported by British vessels. In turn, London replied that it did not understand why Paris began to set conditions and ignited a conflict situation. According to the British authorities, only a few French vessels have not received a license. London noted that it honestly fulfills all the conditions of the Brexit agreement, but also noted that if Paris does not stop fueling the conflict out of the blue, it will be forced to demand appropriate compensation. Paris also demanded to settle all problems with French vessels that did not get access to British waters within 48 hours. Already today, on November 2, the deadline that both sides gave each other to resolve mutual claims expires. The pound continues a moderate decline against the background of this news.

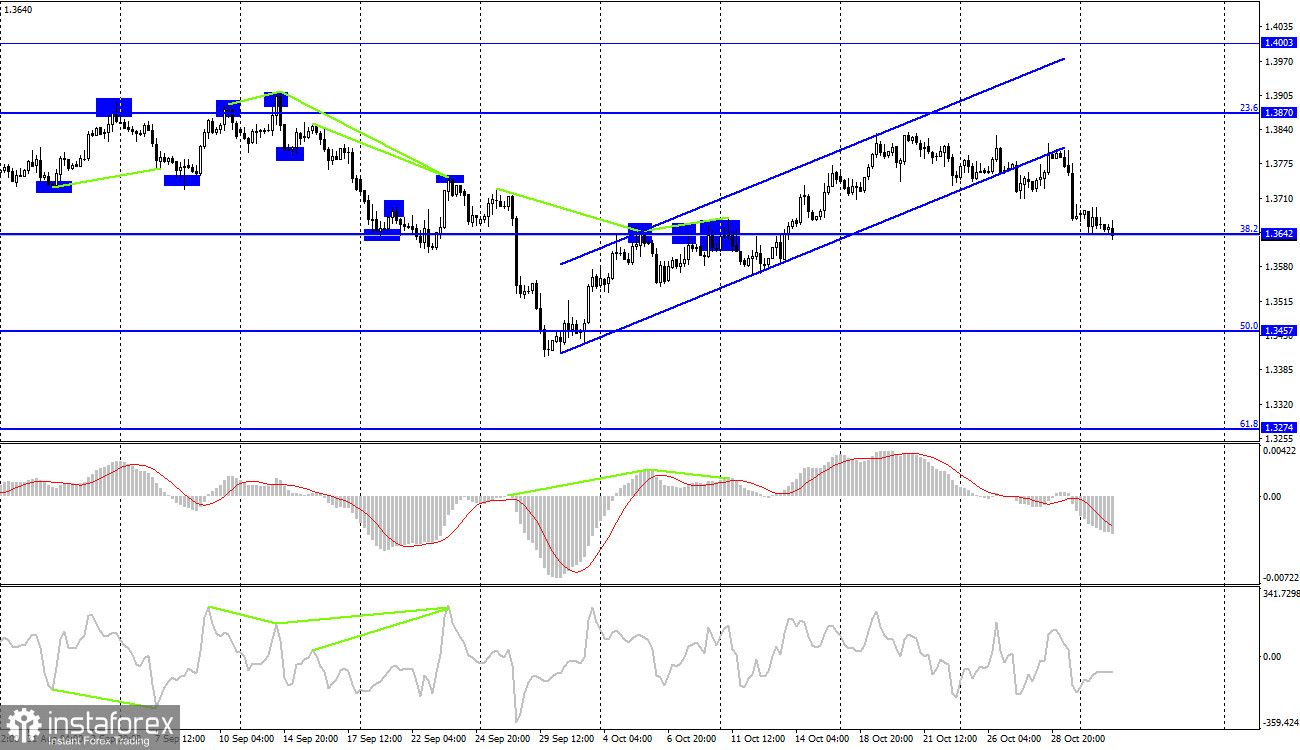

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed consolidation under the upward trend corridor and fell to the corrective level of 38.2% (1.3642). The rebound of the pair's rate from this level will allow traders to expect a reversal in favor of the British and some growth in the direction of the Fibo level of 23.6% (1.3870). Fixing quotes below the corrective level of 38.2% will increase the probability of a further fall in the direction of the next level of 50.0% (1.3457).

News calendar for the USA and the UK:

On Tuesday, there will be no information background in the US and the UK. Traders can only track the news coming from France or Britain concerning the "fish conflict", as they can potentially affect the British exchange rate.

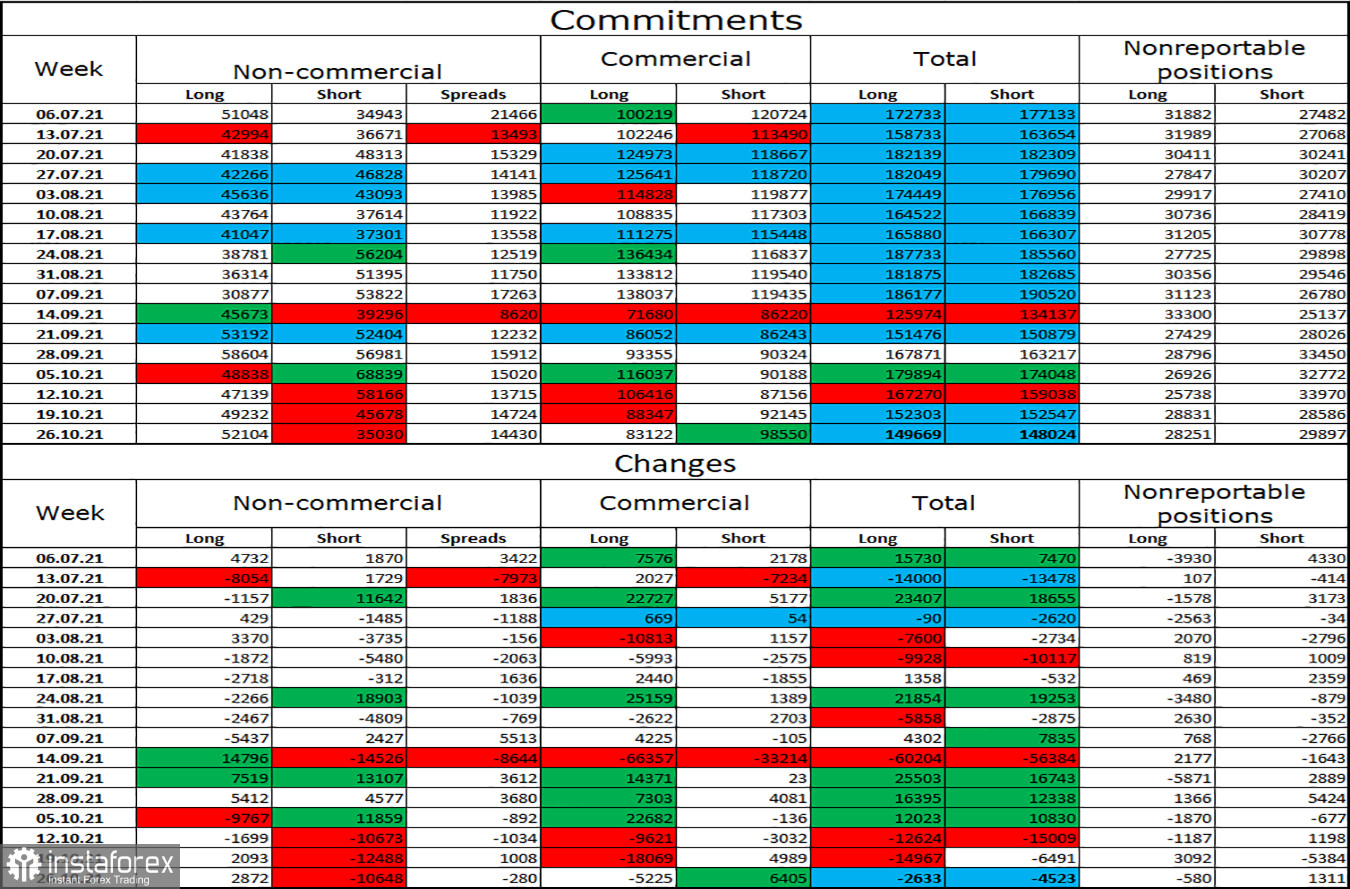

COT (Commitments of Traders) report:

The latest COT report on October 26 for the pound showed that the mood of the major players has become much more "bullish" again. In the reporting week, speculators opened 2,872 long contracts and closed 10,648 short contracts. Thus, the number of long contracts in the hands of major players now exceeds the number of short contracts by 17 thousand. Now we can say that the mood of the "Non-commercial" category of traders has become "bullish". However, at the same time, the graphic picture suggests a possible drop in the quotes of the British, since two trend corridors were abandoned at once. In recent weeks, major players have not had any clear mood and are now increasing purchases, then increasing sales, and the total number of long and short contracts is the same for all categories of traders. Thus, after four weeks of an active build-up of longs, it may be the turn of shorts.

GBP/USD forecast and recommendations to traders:

I recommend new purchases of the pound if the rebound from the level of 38.2% (1.3642) is made on the 4-hour chart with a target of 1.3722. I recommend new sales when closing quotes below the level of 1.3642 on a 4-hour chart with targets of 1.3622 and 1.3573.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.