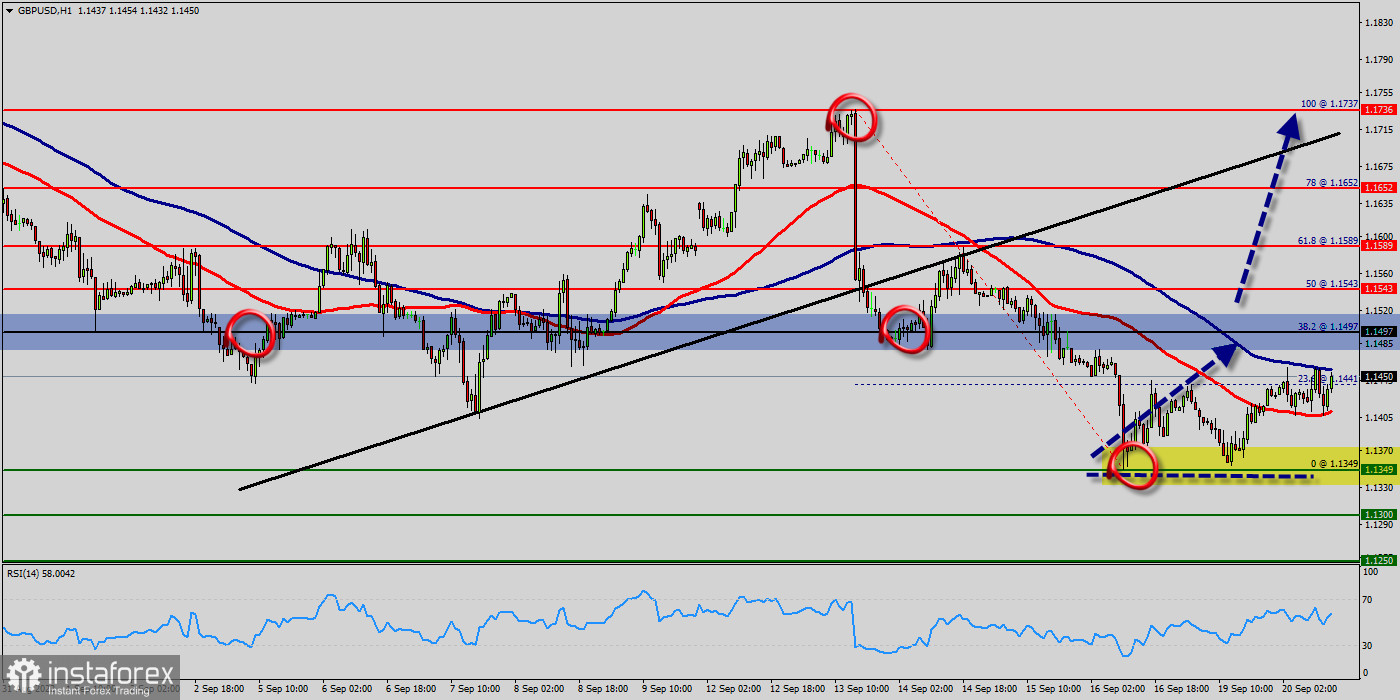

The GBP/USD pair's rise from the price of 1.1349 resumes today and accelerates to as high as 1.1440 so far. Immediate concentrate is now on 1.1400 resistance turned support, which is close to 100-day EMA (now at 1.1400).

Decisive break there argue that such rally is at least correcting the fall from 1.1497 to set at 1.1430. Also, it should be noted that U.S. inflation was 2.5% in Sept. 2022, holding close to its highest annual rate in four decades despite easing energy costs.

The GBP/USD pair retreated from around 1.1497, the 38.2% of Fibonacci retracement of the daily climb measured between 1.1349 and 1.1497, so holds above the former critical resistance, now support at 1.1349.

Today, the GBP/USD pair has broken resistance at the level of 1.1400 which acts as support now. Thus, the pair has already formed minor support at 1.1400.

The strong support is seen at the level of 1.1349 because it represents the weekly support 1. Technical readings in the daily chart favor a bullish continuation, as indicators maintain their firmly bullish slopes within positive levels, while the 100 MA heads firmly higher below the current level.

Equally important, the RSI and the moving average (100) are still calling for an uptrend. The RSI is becoming to signal an upward trend, as the trend is still showing strong above the moving average (100) and (50).

On the hourly chart, the GBP/USD pair continues to test the strength of the resistance - the moving average line MA (100) H1 (1.1400). On the four-hour chart, the AUD/USD pair is also still above the MA 50 H4 line. Based on the above, it is probably worth sticking to the north direction in trading, and as long as the GBP/USD pair remains below MA 50 H4, it may be necessary to look for entry points to buy at the end of the correction.

Therefore, the market indicates a bullish opportunity at the level of 1.1400 in the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: GBP is in an uptrend and USD is in a downtrend.

Buy above the minor support of 1.1441 (this price is coinciding with the ratio of 23.6% Fibonacci) with the first target at 1.1497 and continue towards 1.1543 (the daily resistance 2).

On the other hand, if the price closes below the minor resistance, the best location for the stop loss order is seen below 1.1497; hence, the price will fall into the bearish market in order to go further towards the strong support at 1.1349 to test it again. Furthermore, the level of 1.1349 will form a double bottom.

On the downside, break of 1.1349 minor support will suggest that such rebound has completed and bring retest of 1.1300 low instead. If the pair succeeds in passing through the level of 1.1300, the market will indicate the bearish opportunity below the level of 1.1300 in order to reach the second target at 1.1250.

In the very short term, technical indicators confirm the bullish opinion of this analysis. It is appropriate to continue watching any excessive bullish movements or scanner detections which might lead to a small bearish correction (1.1349 - 1.1250).