The US dollar continues to increase pressure on the currency market, despite the positive economic data in America, which was published on Tuesday.

This increasing pressure on the whole currency market is supported, on the one hand, by the growth of Treasury yields and, on the other, by the comments of some Fed members, as well as the published positive economic statistics. The growth of US stock indices cannot prevent this.

What are the reasons for the growth of the US dollar?

On Tuesday, the Fed President of St. Louis J. Bullard went even further in an interview with the press, saying that if the Fed had started to reduce the volume of asset repurchases – government bonds and corporate mortgage securities, not by the expected $ 15 billion monthly, but, for example, by $ 30 billion, then it could have already made the first increase in interest rates in the first quarter of 2022. His statement clearly coincides with our vision of the likely start date of the interest rate hike cycle, which may begin as early as February after the appointment of a new Fed chairman. We believe that it was the strengthening of inflationary pressure that prompted the previously known proponent of a soft monetary policy to completely reconsider his view on the future of the monetary policy of the American regulator.

Another important signal for investors is the continued growth of the yield of treasuries, which have begun to grow again. In particular, the yield of the benchmark 10-year T-Note tends to the recent maximum of 1.705% from October 21 this year. The increase in profitability is an unambiguous factor indicating not only the fact of beginning of the process of reducing asset repurchase but also the upcoming increase in interest rates. In this regard, one more important reason should be taken into account – the beginning of a clear divergence in monetary policies between the Fed and other, primarily world banks, for example, the ECB, the Central Bank of Japan, the Bank of England, etc., which consists in the fact that these regulators will obviously not rush to tighten monetary policies, unlike the Fed, which has actually already announced this. Such prospects will definitely lead to a noticeable drop in the main currencies in the currency market against the US dollar.

In addition to the aforementioned, an undoubted signal in favor of a strengthening dollar is the market's reaction to good economic data from the United States. Earlier, the US dollar was under pressure amid this news, but the figures on retail sales and their volumes in America presented on Tuesday, which showed strong growth, did not lead to its weakening. This indicates a clear change in the market's mood, where an understanding of the high probability of starting the rate hike process at the beginning of next year, and not in its second half against the backdrop of continued high inflation, is beginning to play a more important role.

Will the US dollar continue to rise?

Assessing the current situation, we believe that the US dollar has every chance to continue growing in the market, where the euro, yen, franc, as well as commodity currencies – Australian and New Zealand dollars, may suffer the most. In turn, the Canadian dollar, as well as the Norwegian krone, will try to hold on to the US currency on the wave of demand for crude oil.

Forecast of the day:

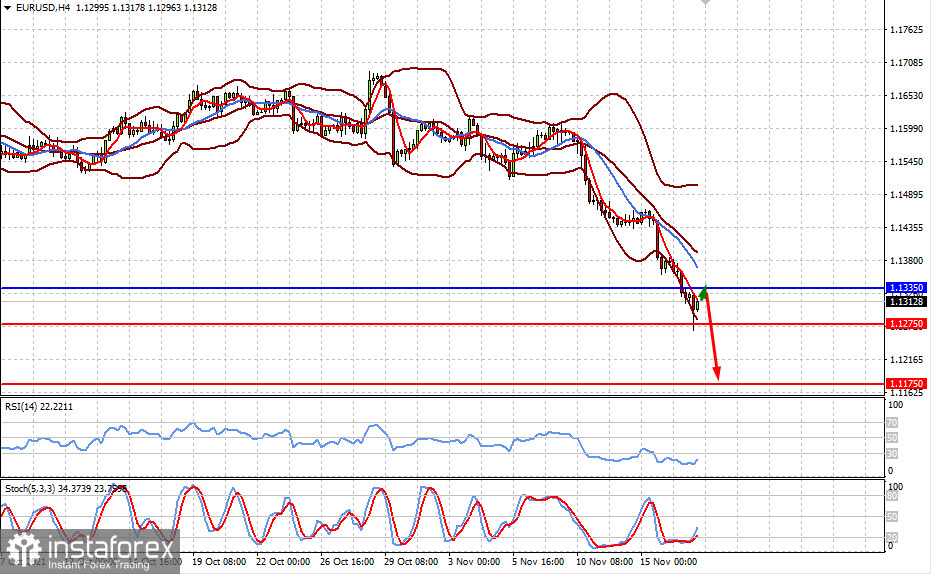

The EUR/USD pair remains under strong pressure. It can recover to the level of 1.1335, but if it keeps below it, then it will test the level of 1.1275 again with the prospect of further declining to the level of 1.1175.

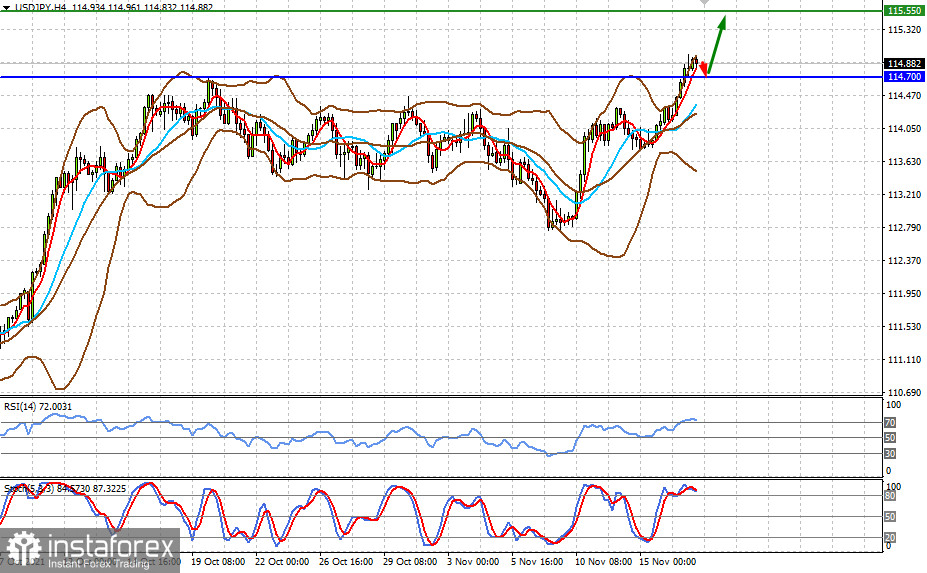

The USD/JPY pair is trading above the level of 114.70, from which it can make a correction. If this level holds, then the pair can be expected to reverse and resume its growth to the level of 115.55.