Against the background of the general hegemony of the US currency, the pound continues to resist, fighting for every point. At the end of last week, the GBP/USD pair updated its 11-month low, reaching 1.3352. However, the bears stopped at this mark. Almost immediately, bulls seized the initiative, taking advantage of a favorable fundamental background. Rumors of a rate hike by the Bank of England were again on the agenda, thereby increasing the appeal of the British currency. Today's macroeconomic reports have only added fuel to the fire, allowing the GBP/USD bulls to organize counterattacks.

We are talking about the publication of data on the growth of inflation in the UK. The release turned out to be quite strong: all components came out in the "green zone", exceeding the forecast values (in some cases – very significantly). The published figures supported the pound, especially against the background of hawkish reasoning of some representatives of the British central bank. That is why the GBP/USD pair differs from the other dollar pairs of the major group. "Oppositional sentiments" towards the greenback are quite strong here, and the fundamental background allows bulls to "hold the line", restraining the onslaught of dollar bulls.

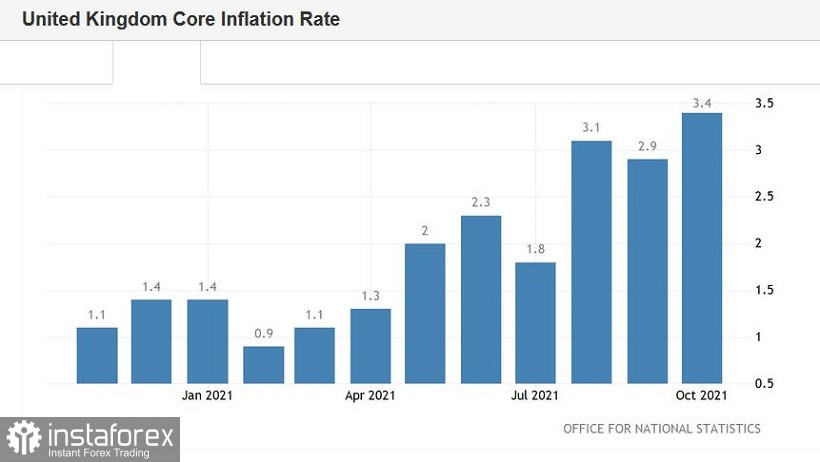

But let's return to the resonant macroeconomic report. It really turned out to be resonant. The published results surpassed even the wildest assumptions of experts. Judge for yourself. The general consumer price index on a monthly basis in October came out at 1.1%, updating a multi-year high. This is the strongest growth rate since May 1993. In annual terms, the indicator also showed a jumpy growth, reaching 4.2%. And here again we can talk about a long-term record: the indicator showed the strongest growth rate since February 2012. Core inflation also showed a similar trend – the core consumer price index jumped to 3.4%. In addition, the retail price index was published today (a long-term record in annual terms), the producer price index (strong growth was recorded in both monthly and annual terms), as well as the producer purchase price index (the indicator also reflected positive dynamics). All components of the release were released in the green zone.

In other words, British inflation has once again surprised with a breakthrough growth. This fact has again brought the issue of raising the rate back on the agenda. Let me remind you that some representatives of the Bank of England (including the head – Andrew Bailey) hypothetically allowed the option of an early resolution of this issue. In view of this fact, on the eve of the November meeting, rumors were circulating in the market that the central bank would raise the interest rate by 15 basis points, ahead of the Federal Reserve. But de facto Bailey disappointed the supporters of a strong pound by taking a wait-and-see attitude. Moreover, he stated that none of the Committee members had said that the issue of tightening monetary policy would be considered at a certain meeting. Following the results of the November meeting, the pound sank, updating the annual low in a few days.

The situation changed dramatically this Monday, when the head of the Bank of England once again stunned market participants with a statement that a decision to raise the rate could be made "at any meeting." Bailey made this statement in the House of Representatives of the British Parliament, outlining the prospects for monetary policy. He was followed by his colleague, Michael Saunders. He also voiced hawkish remarks, warning of the risks of "delaying the rate hike for too long." In his opinion, in this case, the central bank will face another problem when it will be necessary to raise the interest rate "faster than the optimal pace." Another representative of the Committee, Hugh Fill, expressed a similar position. Against the background of such statements, the market started talking about the prospects of the December meeting again. According to a number of experts, the Bank of England can really "overtake" the Fed in raising the rate, which, as a rule, is at the forefront of such events. The latest inflation release allowed us to talk about hawkish prospects in a more confident tone.

A kind of anchor for GBP/USD is Brexit. And to be more precise, its "echoes". Earlier, Brussels refused to revise the protocol on Northern Ireland, after which representatives of the government of Boris Johnson made it clear that they could use the 16th article of the protocol. It involves the unilateral introduction of so-called "protective measures". According to experts, we are talking about the unilateral suspension of all trade obligations that were provided for in the document. On the one hand, the situation has escalated to the limit, after weeks of fruitless negotiations. On the other hand, the dialogue between representatives of London and Brussels is still ongoing. According to the British Brexit minister David Frost, a deal on the Northern Ireland protocol can be concluded with the European Union "before Christmas." However, not all experts share his optimism.

In other words, the fundamental background for the GBP/USD pair is contradictory. Short positions are very risky, as the pound is in high demand amid increasing hawkish expectations. However, longs cannot be unequivocally recommended, given the "Brexit mine" of delayed action. So, on November 19, that is, this Friday, Lord Frost will meet with Vice-President of the European Commission Sefcovic for key negotiations. According to analysts, this meeting will either become a starting point for de-escalation of the conflict, or will increase the risks of a trade war between Britain and the EU. In such conditions, it is not safe to make trading decisions, therefore, in the medium term, it is advisable to take a wait-and-see position for the GBP/USD pair.