Analysis of previous deals:

30M chart of the EUR/USD pair

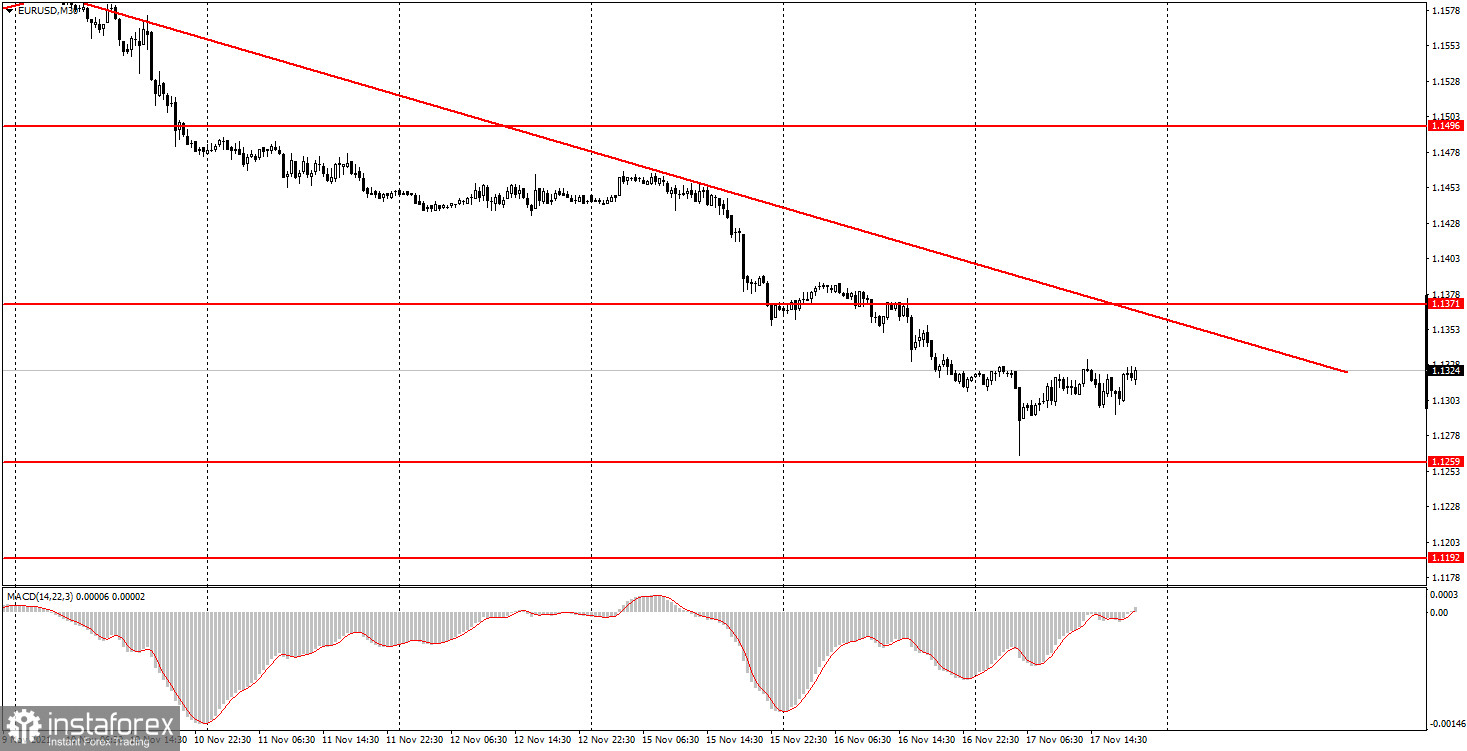

The EUR/USD pair tried to correct for most of the day on Wednesday. It "tried", since the upward movement was very weak. However, the downward trend line is not far away, so the pair can work it out tomorrow. And then everything will depend on whether traders will be able to overcome it or not. If so, the European currency will have the opportunity to recover a bit after a rather noticeable drop. If not, the US dollar will continue to strengthen. A rebound from the trend line can be regarded as a sell signal and it could be worked out. As well as a similar buy signal. As for macroeconomic statistics, only a secondary inflation report was published in the European Union today. "Secondary" - because it was the second estimate for October and the markets were already ready for the value of 4.1% y/y. Thus, there was no reaction to it. Everything was even more boring in America, because there was not a single important publication at all. You can also note two speeches by European Central Bank President Christine Lagarde, but one of them took place at night and in any case did not interest novice traders, and the other started a couple of hours ago, so it will not work out either. And in any case, no special movements were observed after these speeches.

5M chart of the EUR/USD pair

The picture is quite strange on the 5-minute timeframe. The strongest movement during the day was observed at night for 5 minutes. During these 5 minutes, the pair's quotes fell by 46 points, and it happened a few hours after the start of Lagarde's speech, so it's not a fact that these two events are related to each other. But on the contrary, there were no strong movements during the European and US trading sessions. There was a minimal upward bias in the European session, and a flat in the US session. Volatility was low, if not minimal. And not a single trading signal was formed during the day, since the price did not approach important levels (except for the overnight drop, which still could not be predicted and could not be worked out). Thus, newcomers did not have to open a single position today, therefore, they did not receive any profit or loss.

How to trade on Thursday:

The downward trend persists on the 30-minute timeframe, as the trend line remains relevant. Thus, before settling above the trend line, it is definitely not necessary to consider buying the pair. And in case of a rebound from it, you should continue to trade for short positions. The key levels on the 5-minute timeframe for November 18 are 1,1259 – 1,1264, 1,1356, 1,1371, 1,1422. Take Profit, as before, we set at a distance of 30-40 points. Stop Loss - breakeven when the price passes in the right direction by 15 points. At the 5M TF, the target can be the nearest level, if it is not located too close or too far away. If it is located – then you should act on the situation or work on Take Profit. Novice traders will have absolutely nothing to pay attention to on Thursday. There are a lot of different events during the day, but there are no really important ones among them. Neither in the European Union, nor in the US. Thus, most likely, the pair will move very calmly tomorrow.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.