Despite the fact that inflation growth in the UK and Canada turned out to be higher than forecasts, the markets were not inspired by the price increase, which usually indicated an increase in consumer demand and general economic recovery. Moreover, Brent futures have gone below $ 80 per barrel for the first time since the beginning of October. There is an increase in demand for gold and bonds, which indicates a threat to the development of the global economy in a stagflationary scenario. One of the obvious reasons is the recognition of the chief infectious disease specialist of the USA Anthony Fauci about the impossibility of preventing the spread of coronavirus in the world through vaccination, which translates the current economic crisis from temporary to chronic.

USD/CAD

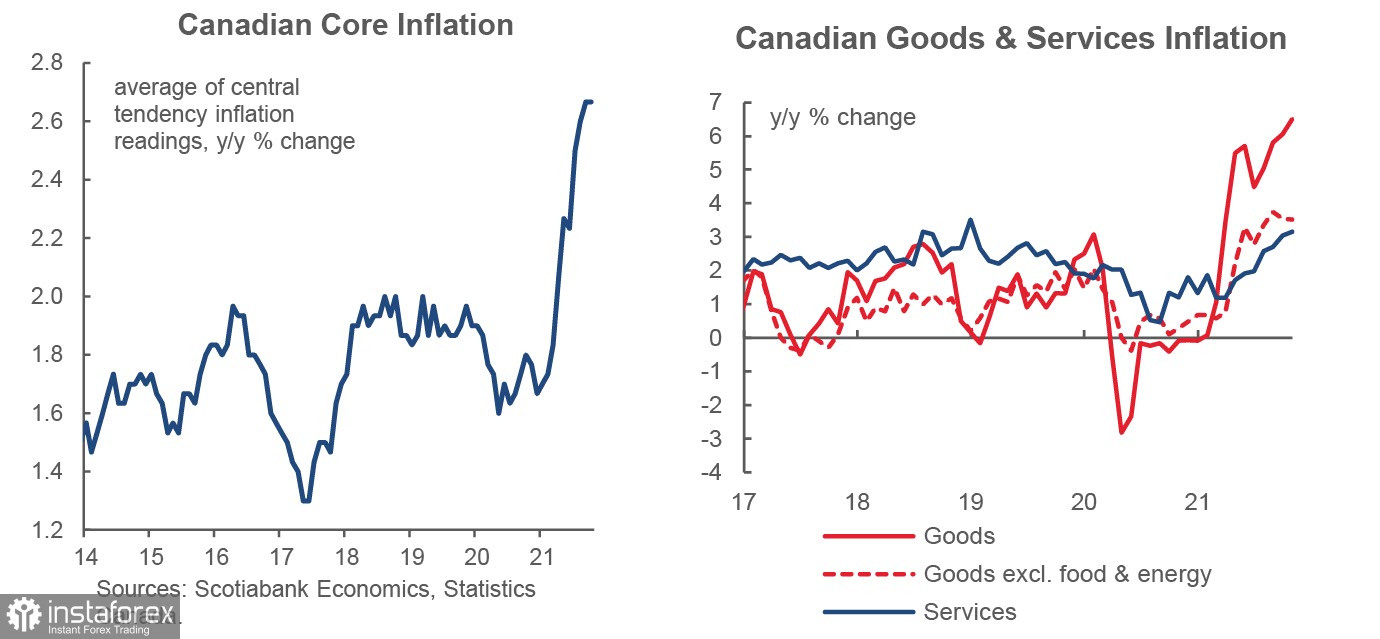

The Canadian dollar did not receive support after the publication of inflation data and could not resume growth, because although inflation rose to an 18-year high (+4.7%), it was not strong enough, and the average core inflation for 3 months, which is monitored by the Bank of Canada, remained at the same level of 2.7%. And while the main contribution to inflation is made by commodity prices, this is largely a consequence of the sharp rise in the price of food and energy, but the service sector has accelerated and has good potential for further growth.

Accordingly, market expectations for the expected actions of the Bank of Canada have not changed. It is assumed that the first rate hike will occur in March, and the increase will be 1.25% by the end of 2022. This is slightly more than the Fed's expected schedule, but still not aggressive enough to support the strengthening of the CAD.

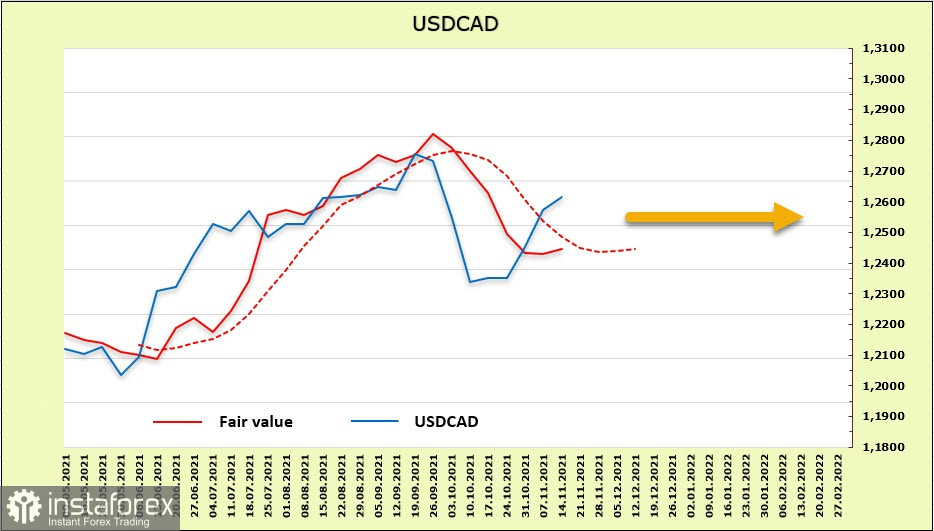

According to the CFTC report, weekly changes in the futures market are in favor of the Canadian dollar (+75 million). The accumulated net long position is +410 million, the preponderance is bullish, but weakly expressed, and there is no pressure on the Canadian dollar from this side either. The calculated price is still below the long-term average, but at the same time, it makes an attempt to turn up. The direction is currently not visible.

The USD/CAD pair has reached a 50% correction from the 1.2286 low, which is quite a strong resistance. However, there is no confidence that the growth will continue. The policy of the Bank of Canada looks a little more aggressive than the Fed, yields change synchronously, and the direction will largely depend on oil prices. It can be assumed that the growth may continue to the resistance zone of 1.2690/2700, where the formation of a local peak is likely. There is no direction in the long term, so it is likely to go into the side range.

USD/JPY

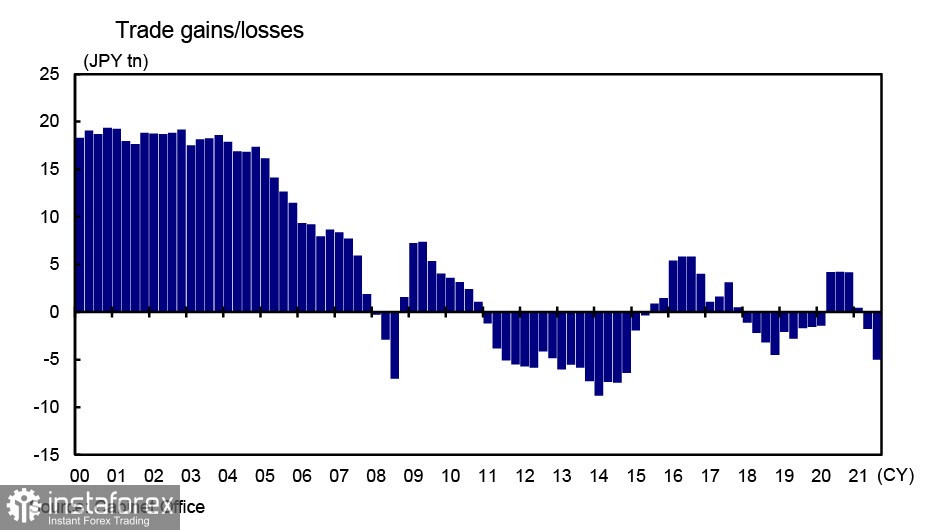

Japan's economy is clearly delaying the release of plausible growth indicators. Orders for equipment in the 3rd quarter were below the forecasts of the Cabinet of Ministers, despite the fact that capital investments were high in anticipation of an exit from covid restrictions. Private sector orders in mechanical engineering fell in September, while preliminary GDP data for Q3 showed a decrease of 3% yoy, which is significantly lower than market forecasts. All major categories of domestic demand – private consumption, private investment in non-residential housing, and private investment in housing construction, declined. The trade balance is negative.

At the same time, the stock market is trading at historical highs, which is a direct consequence of the bubble created by the actions of the government and the Central Bank of Japan. While for most Central banks, the market makes forecasts about the pace of QE curtailment and interest rate growth, the Bank of Japan is in a situation where a hypothetical exit from the stimulus policy is completely excluded. This means that the yield differential will inevitably change against the yen in the long term, which means that an outflow of investment capital is likely, which, in turn, will put strong bearish pressure on the yen.

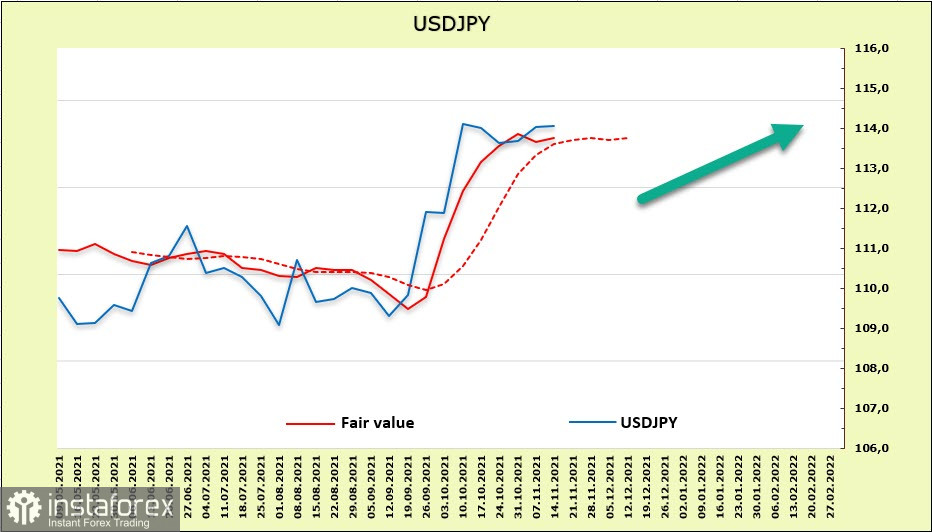

The accumulated net short position is -11.667 billion, which is a very strong bearish advantage. Major players are confident in the further decline of the yen. The estimated price is higher than the long-term average. The chances of USD/JPY growth remain high.

The yen failed to consolidate above the level of 114.70 on the first attempt. A local base can be found in the 113.80/90 zone, a decline into this zone (50% pullback from the top and at the same time, the former channel border) can be used for purchases with a target of 115.50/70.