The global increase in inflation scares the possibility of a sharp end to the emerging recovery of the world economy and the resumption of recession so that the acceleration of consumer price growth is perceived rather as a negative factor. However, not in the case of the pound. The fact is that the Bank of England not only recently announced its plans to tighten monetary policy, but even outlined the timing of interest rate increases. At the same time, the British regulator has clearly indicated that it intends to do all this solely for the purpose of curbing inflation, whose growth threatens economic recovery. Thus, the rapid acceleration of consumer price growth from 3.1% to 4.2% did not lead to a weakening of the pound, but its significant strengthening. It is worth noting that they expected growth only to 3.7%. After all, if the Bank of England intends to fight the growth of inflation, then its acceleration may cause the regulator to raise the refinancing rate faster and on a larger scale than planned. Such a prospect itself became the reason for the pound's growth.

Inflation (UK):

With regard to European statistics, everything was clear long before its publication. The final data on EU inflation should have been left without any attention. And so it happened. They only confirmed the preliminary estimate, according to which, Europe's inflation accelerated from 3.4% to 4.1%. In this case, investors have not seen anything new for themselves, which means there is no reason for any fuss there. The market behaved as if nothing had happened at all.

Inflation (Europe):

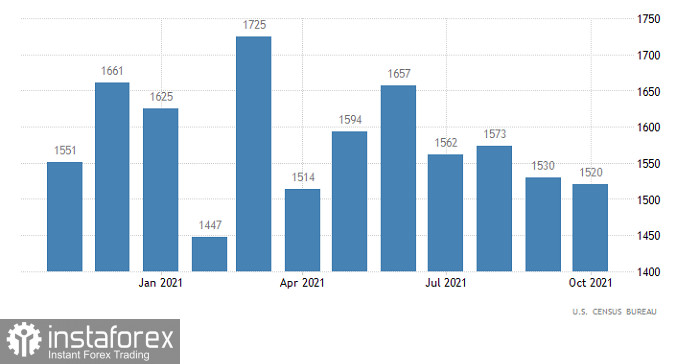

Meanwhile, the US statistics, which were supposed to lead to the growth of the US dollar, turned out to be noticeably worse than forecasts. It did not cope with the task set for it. Perhaps, the most significant thing is that the volume of construction of new houses decreased by 0.7%, while an increase of 2.3% was expected. The number of construction permits issued, which was supposed to increase by 4.5%, increased only by 4.0%.

This inspires optimism that the volume of construction will increase slightly next month, but still not as expected. So, the data was really disappointing. In fact, they did not affect the market at all. Although the pound continued to grow, the euro was still standing still. Therefore, the growth of the pound was rather due to the morning data on inflation in the United Kingdom.

New Home Construction (United States):

Today, America's data on applications for unemployment benefits will be released, but due to their extremely insignificant changes, they are unlikely to be able to change the current market situation. After all, the number of initial appeals should decrease by 4 thousand, and repeated ones by another 20 thousand. This is extremely small, or rather, we can say that they will remain unchanged. Moreover, the US dollar has strengthened so much over the past couple of weeks that it is necessary to state the fact that it is clearly overbought. Therefore, some serious enough data is needed so that it can continue to strengthen its position. However, the very fact that the data indicate an improvement in the labor market situation will not allow it to weaken. In other words, the market is likely to just standstill.

A number of re-claims for unemployment benefits (United States):

The EUR/USD pair is moving in a slight pullback stage, despite the euro's high level of oversold. If speculative interest in short positions does not decrease, then another decline is possible. The sell signal is considered below the level of 1.1290. An alternative scenario will be considered by market participants if the price is kept above 1.1350, which may lead to a change of the pullback to a correction.

The GBPUSD currency pair moves in a corrective pattern from the pivot point of 1.3350, where market participants managed to reach the level of 1.3500. At the moment, there is a stagnation in the borders of 1.3480/1.3500, where the outgoing impulse method is considered the best trading tactic.