The price of oil on Tuesday showed rapid growth after the United States announced the release of 50 million barrels of oil from the Strategic Oil Reserve. China, Japan, Great Britain, India, and South Korea are ready to join this decision, which will add another 15-20 million barrels in total. The decision did not lead to a drop in oil prices, but on the contrary, Brent futures went above $ 82 for the barrel, since the players rightly judged that the provision of additional volumes could easily be stopped by OPEC+'s decision not to increase its own supply, but the strategic reserves of these countries after the implementation of the plan will no longer be. OPEC+ will meet for the next meeting on December 2.

Accordingly, the rapid rise in oil prices has led to additional pressure on protective assets. Gold and the Japanese yen's price have fallen, and there is a decrease in demand for bonds. By the end of the week, an increase in demand for risk is likely.

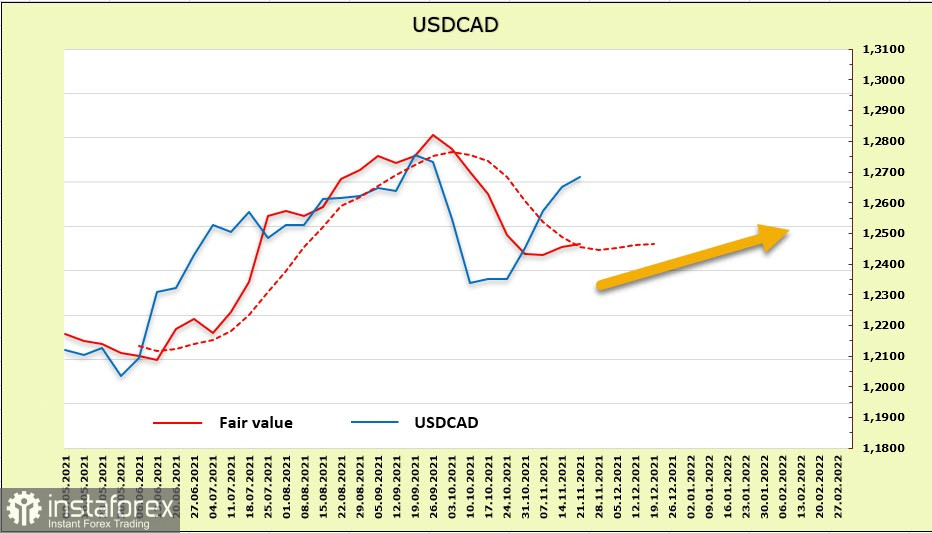

USD/CAD

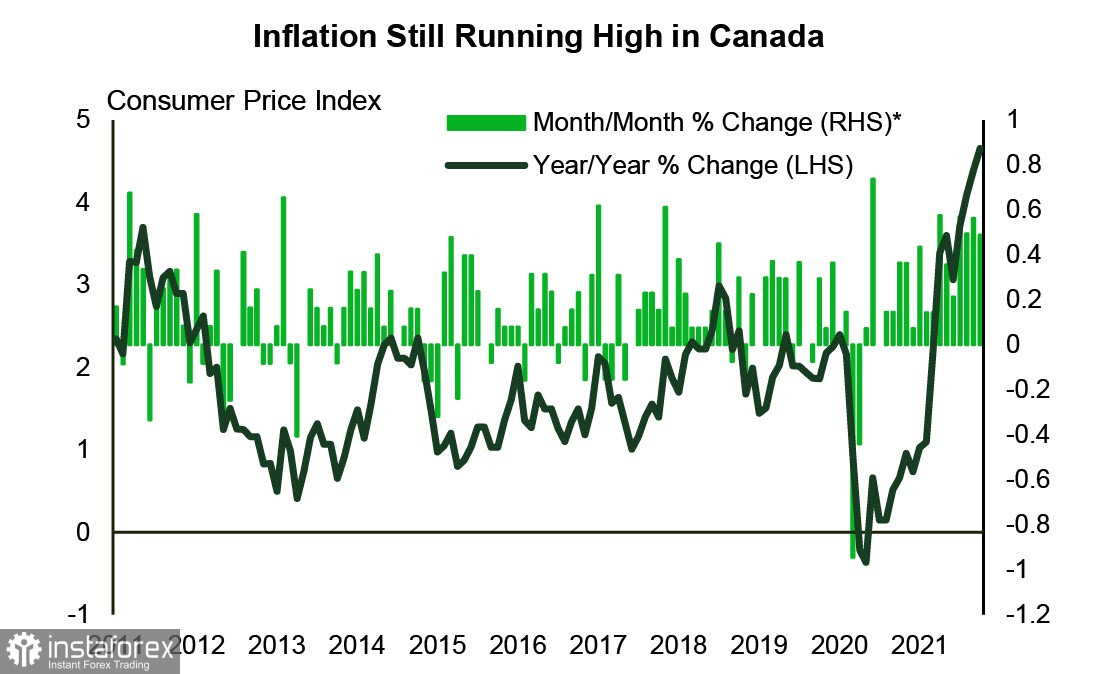

The recovery of the Canadian economy in recent months has been unstable, but a strong increase in inflation hints at a higher rate of growth in consumer spending, which is facilitated by a rapid recovery in the labor market (noticeably better than in the US) and a significant accumulation of excess savings.

If price pressures continue to accelerate, economic growth may suffer due to a decline in real wages and consumer purchasing power. Based on these risks, the Bank of Canada was one of the first to complete the quantitative easing program and is ready to start a rate hike cycle. In any case, the likelihood of an "earlier than predicted" increase was announced at the last meeting on October 28. The next Fed meeting will be held on December 8, respectively. The closer the date, the less likely it is that the USD/CAD will continue to grow.

As follows from the CFTC report, the net long position in the Canadian dollar increased over the reporting week by 283 million, to +694 million. The advantage is not strong, but in general, the outlook for the currency is rather optimistic. The target price is below the spot and close to the long-term average, but there is no clear direction.

The rise in oil prices combined with the fairly confident policy of the Bank of Canada will slow down the growth of the USD/CAD. It can be assumed that the recent high of 1.2744 will not be updated in the near future. A shallow pullback to the support of 1.2580/2600 is likely from the local high, after which growth may resume.

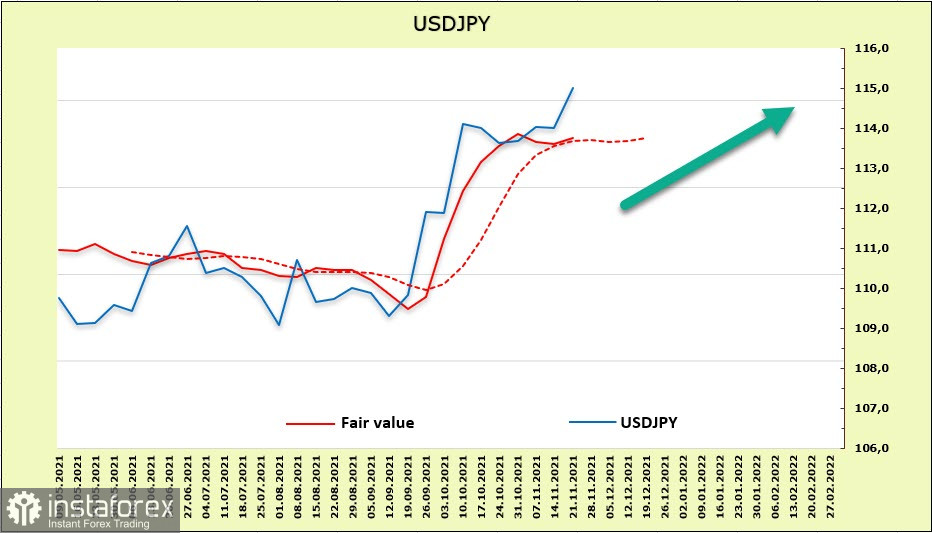

USD/JPY

While most central banks in developed economies, primarily the Fed, the Bank of England, and even the ECB, are developing schedules for exiting unconventional monetary policy, the Japanese authorities are acting in exactly the opposite way. At a special cabinet meeting on November 19, the government actually finalized an economic stimulus package that will include record fiscal spending of 55.7 trillion yen and total spending of 78.9 trillion yen. This is much more than the pre-election promises of the Prime Minister. Moreover, we should talk about compliance with financial discipline is generally off the agenda – both the ruling coalition and the opposition insist on increasing government spending.

The Japanese monetary authorities can be understood – while the rest of the world looks with horror at the "temporary" increase in inflation, Japan continues to unsuccessfully fight deflation. The increase in spending here is equivalent to an increase in consumer demand, which will serve as a strong bearish factor for the yen since the already low real profitability will decrease.

The yen's net short position fell by 1.5 billion, which is quite a lot, but the bearish advantage is still undeniable (-10.138 billion). The target price is above the long-term average, but the dynamics are weak.

It can be assumed that the USD/JPY pair's general upward trend will continue, but the probability of a downward correction has increased. The nearest support zone is 114.50/60. If a pullback occurs, one can try to buy again with the target at 118.40. A sharp rise in demand for defensive assets could provoke a deeper pullback to the support zone of 111.90/112.20, but the chances for such a development of events seem low.