GBP/USD

Analysis:

The 4-hour chart of the major pair has been dominated by a downward wave since February. The ascending section dated November 12 forms an intermediate correction. Its structure at the moment of the analysis is not completed.

Outlook:

Today it is expected that the price will move mainly sideways between the opposing zones. After probable pressure on the support zone, a change of vector and a price climb up to the resistance zone can be expected.

Potential reversal zones

Resistance:

- 1.3440/1.3470

Support:

- 1.3360/1.3330

Recommendations:

Trading in the pound market today is only possible in individual trading sessions with fractional lots. Until the current correction is completed, selling is not advisable.

AUD/USD

Analysis:

The downward wave of the Australian dollar dated February 25 is forming a correction in a larger upward pattern. The structure of the wave is incomplete. Its final part (C) has been forming on the chart since October 21.

Outlook:

A general bearish trend is expected to continue over the next 24 hours. A sideways flat along the resistance zone is likely in the next session. Active declines can be expected at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 0.7240/0.7270

Support:

- 0.7170/0.7140

Recommendations:

Today, trading transactions with the Australian dollar are recommended to be carried out only within the framework of the intraday. In the next 24 hours on the market of the main pair, short-term sales from the resistance zone will be possible.

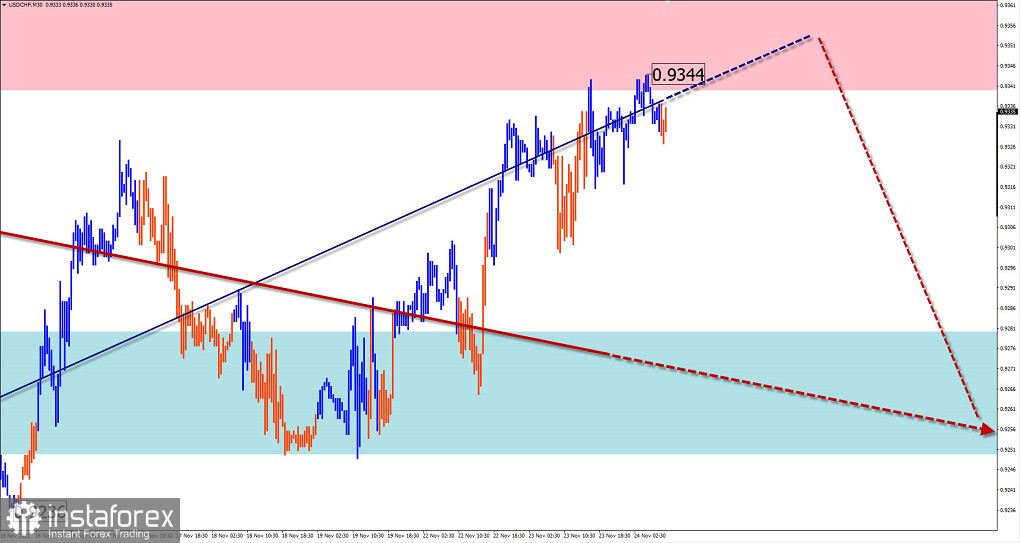

USD/CHF

Analysis:

The incomplete short-term wave of the main Swiss franc pair dates back to 18 June. This descending wave has the form of a stretched horizontal plane. Its structure lacks the final part (C). Quotes are in the vicinity of the strong pivot zone of the large timeframe.

Outlook:

The upward movement is expected to end today. In the remaining resistance area, a reversal in a flat area and the start of descent can be expected. A sharp increase in volatility and a short-term pierce of the upper resistance zone are possible with the change of course.

Potential reversal zones

Resistance:

- 0.9340/0.9370

Support:

- 0.9280/0.9250

Recommendations:

There are no conditions to buy the franc today. Trading on the pair's market will be possible after clear signals to sell the instrument.

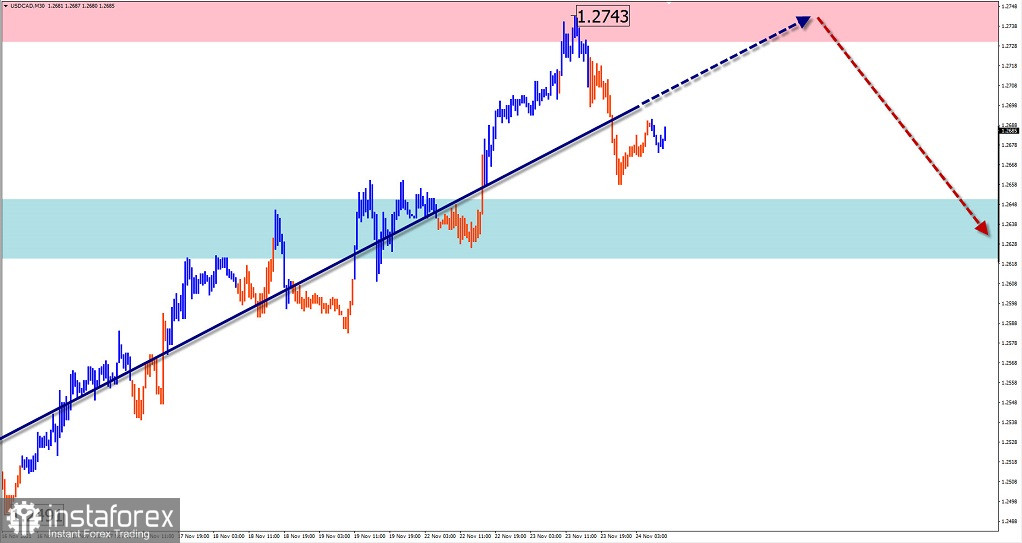

USD/CAD

Analysis:

The Canadian dollar market has been dominated by a bearish trend for the last 18 months. At the end of the completed latent correction, a downward stretching flat has been forming since July. The price has reached another large scale resistance.

Outlook:

Today, after possible pressure on the support zone, a resumption of the upward trend with prices rising again to the estimated resistance zone can be expected.

Potential reversal zones

Resistance:

- 1.2730/1.2760

Support:

- 1.2650/1.2620

Recommendations:

Trading the pair in a flat market is risky and can lead to losses. Short-term buying in small lots from the support zone is possible.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!