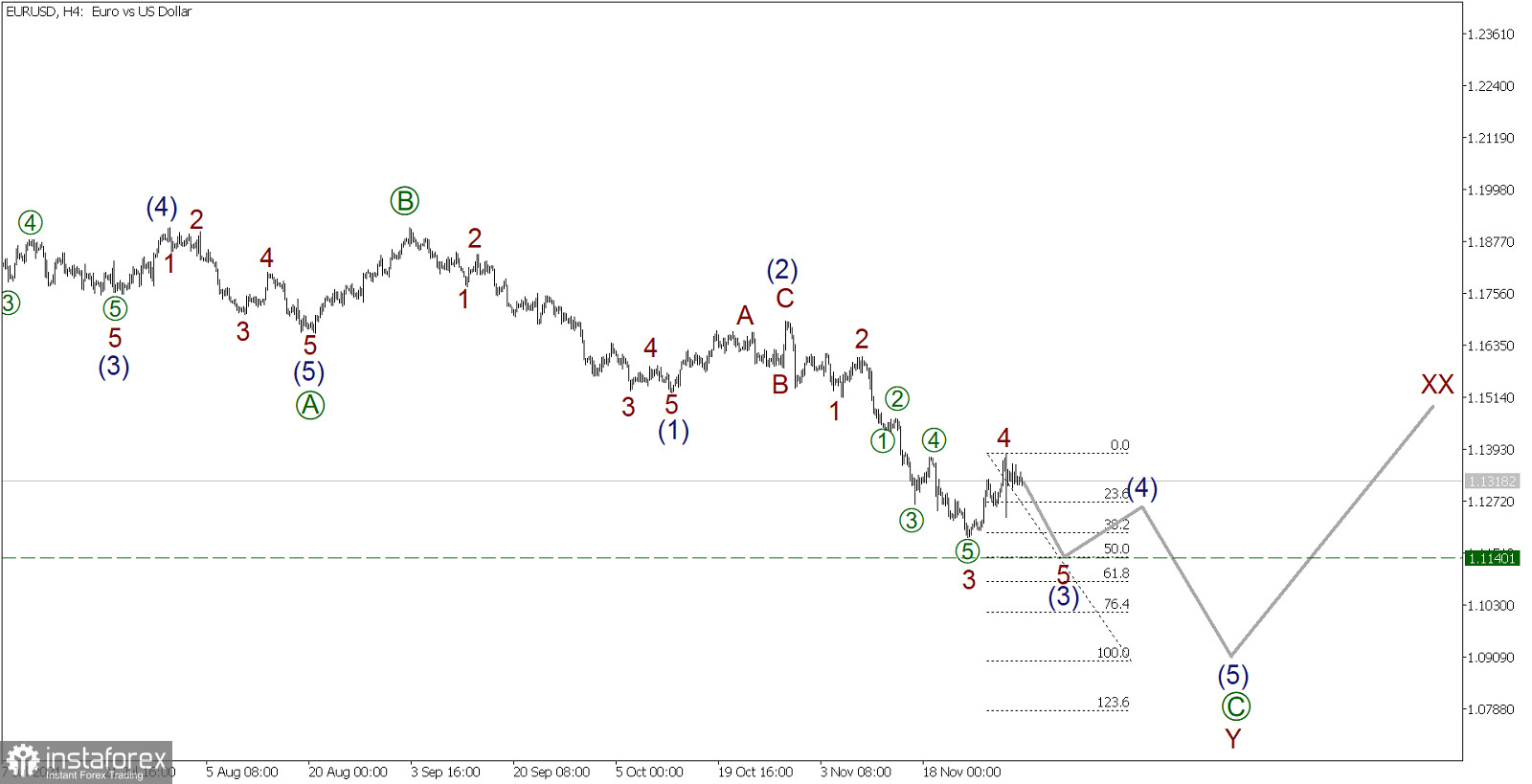

EUR/USD, H4 timeframe:

Let's continue to analyze the situation of the EUR/USD in the currency market using the Elliott theory. A weekly report is expected to be published today at 13:30 Universal time with the number of initial applications for unemployment benefits in the United States, which may affect the market as a whole.

The formation of a global correction wave consisting of sub-waves W-X-Y-XX-Z can be observed. Now, the middle part is in the process of development – the acting wave Y. This wave takes the form of a simple zigzag, where the first two parts have already been built, and the last impulse wave [C] is still being formed.

Wave [C] consists of sub-waves (1)-(2)-(3)-(4)-(5), where the first two parts are already fully done. Currently, a sub-wave (3) is in the process of development. It is similar to a five-wave impulse consisting of 1-2-3-4-5 sub-waves.

It is highly possible that the formation of a small bullish correction 4 has come to an end. Thus, the price may begin to decline in the final wave 5 in the near future. Wave 5 may end around the level of 1.1140. At this level, the magnitude of wave 5 will be 50% of the previous pulse wave 3. The probability of achieving this coefficient is high.

Currently, it is recommended to consider opening sell deals.