The speeches of Federal Reserve Chairman and US Treasury Secretary Janet Yellen at the House of Representatives Committee on Financial Affairs were the main event yesterday. There is no doubt that the positions of Powell and Yellen were aligned and corrected before the speech. Perhaps for the first time at such a high level, Jerome Powell admitted that the US central bank has to abandon the term temporary inflation. Powell has thus officially confirmed the fallacy of the Fed's initial assessment of inflation as a temporary factor and added that the risks of more persistent inflation have increased considerably. However, according to Powell and Yellen, significantly higher wages are not provoking the current inflationary increase.

Perhaps this is another misconception by the monetary authorities in the United States. Probably, the Fed and the Ministry of Finance consider that the main reason for such a steep rise in inflation is the rapid recovery of the world's leading economy from the impact of COVID-19. Regarding the future inflation outlook, according to the Fed Chief and the US Treasury Secretary, it should fall substantially closer to the middle of next year. However, there is no certainty. And that, in my view, is the key point with regard to inflationary pressures. Another very important issue for investors is the tapering of quantitative easing. As the Fed chief hopes, this process should not shock the markets, as everyone has been ready for it for some time. Jerome Powell said that at the next Fed meeting, which will be held on December 14-15, the issue of QE tapering would be given the closest attention. Currently, an overwhelming majority of the Open Market Committee (FOMC) members are in favor of a faster winding down of the bond-buying program, i.e. a tightening of monetary policy.

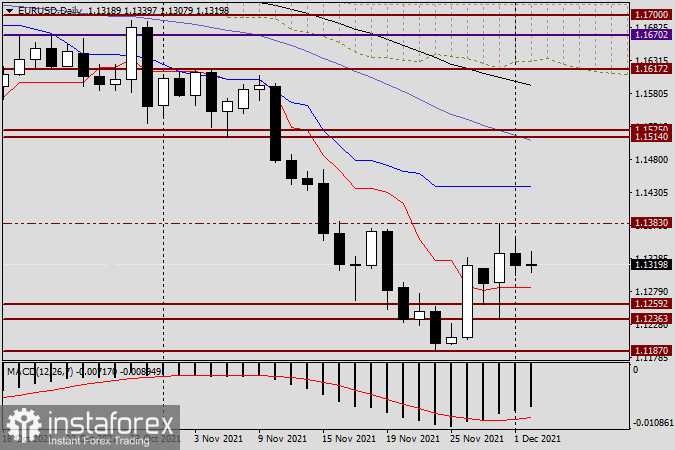

Daily