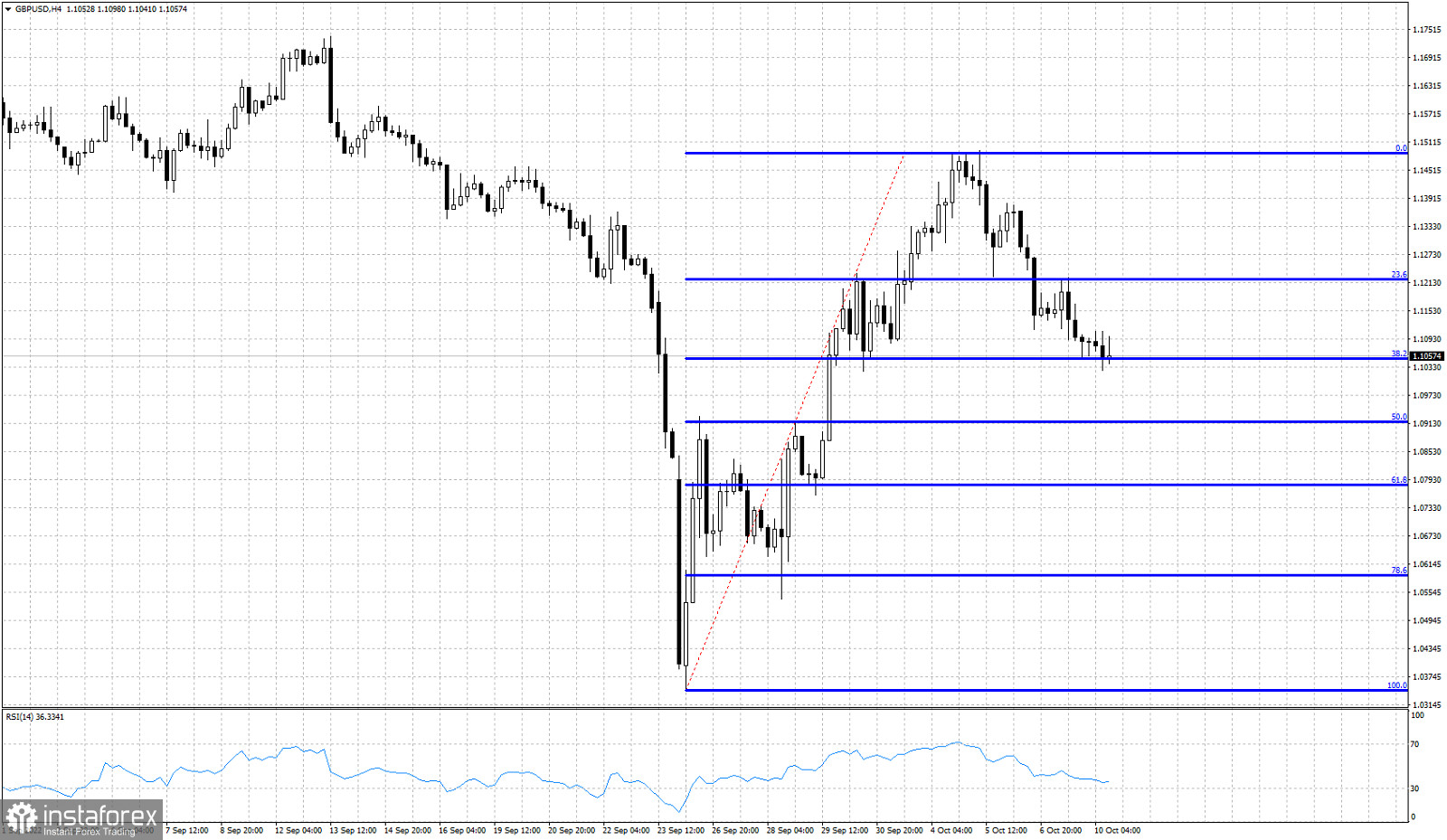

Blue lines- Fibonacci retracement levels

In our previous analysis we warned traders of GBPUSD that the price formation was showing vulnerability signs and that a move lower towards 1.1050 was expected. This week starts with GBPUSD price hovering above the 38% Fibonacci retracement level. The 38% Fibonacci retracement level is important short-term Fibonacci support. Failure to hold above this level will lead GBPUSD towards at least the 1.0920 level. Price is making lower lows and lower highs after the top at 1.1494. So far there increased chances of forming a higher low relative to the 1.0344 low. The key Fibonacci retracement levels to keep an eye on are at 1.0920 and at 1.0785. A break below these levels will open the way for a bigger decline even below 1.0344.