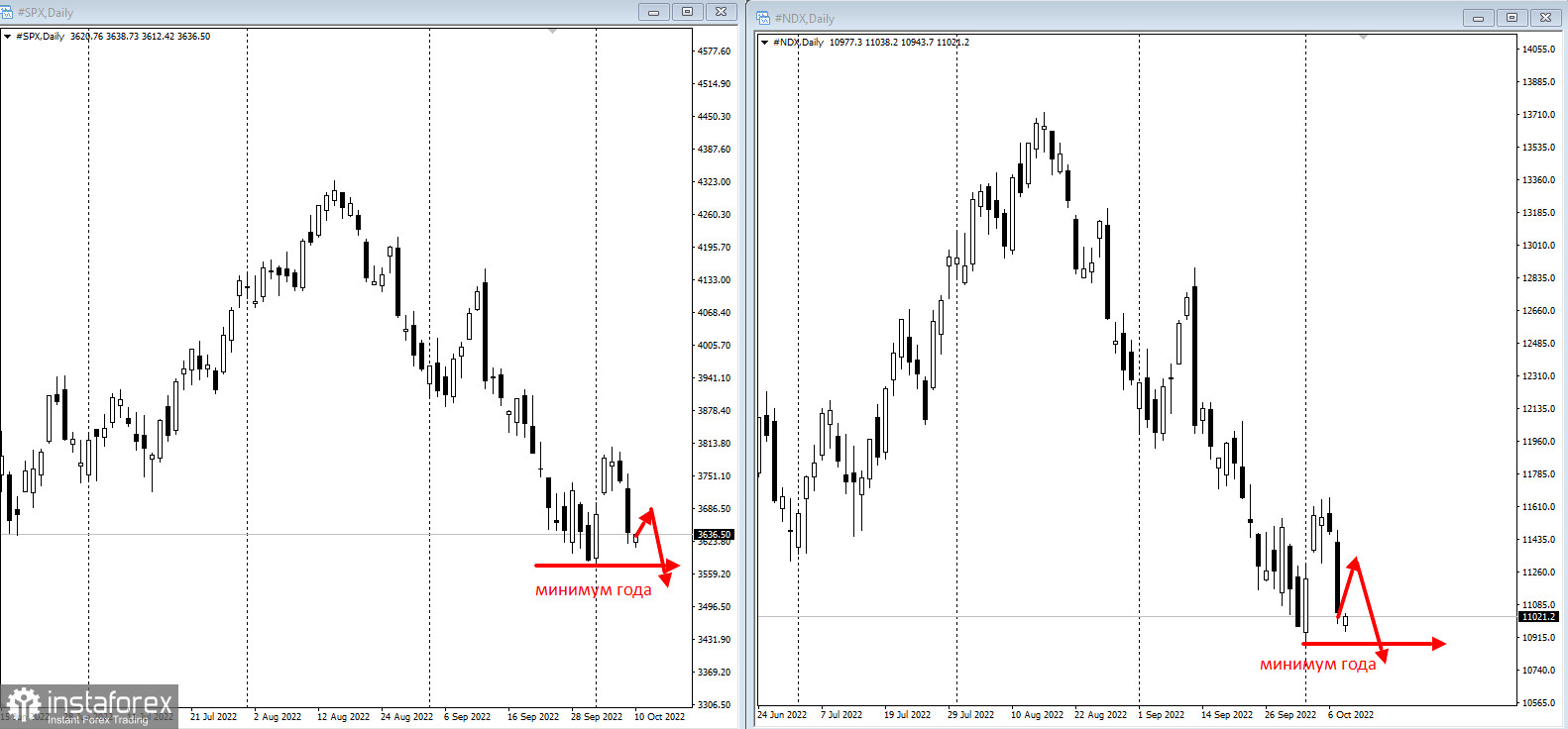

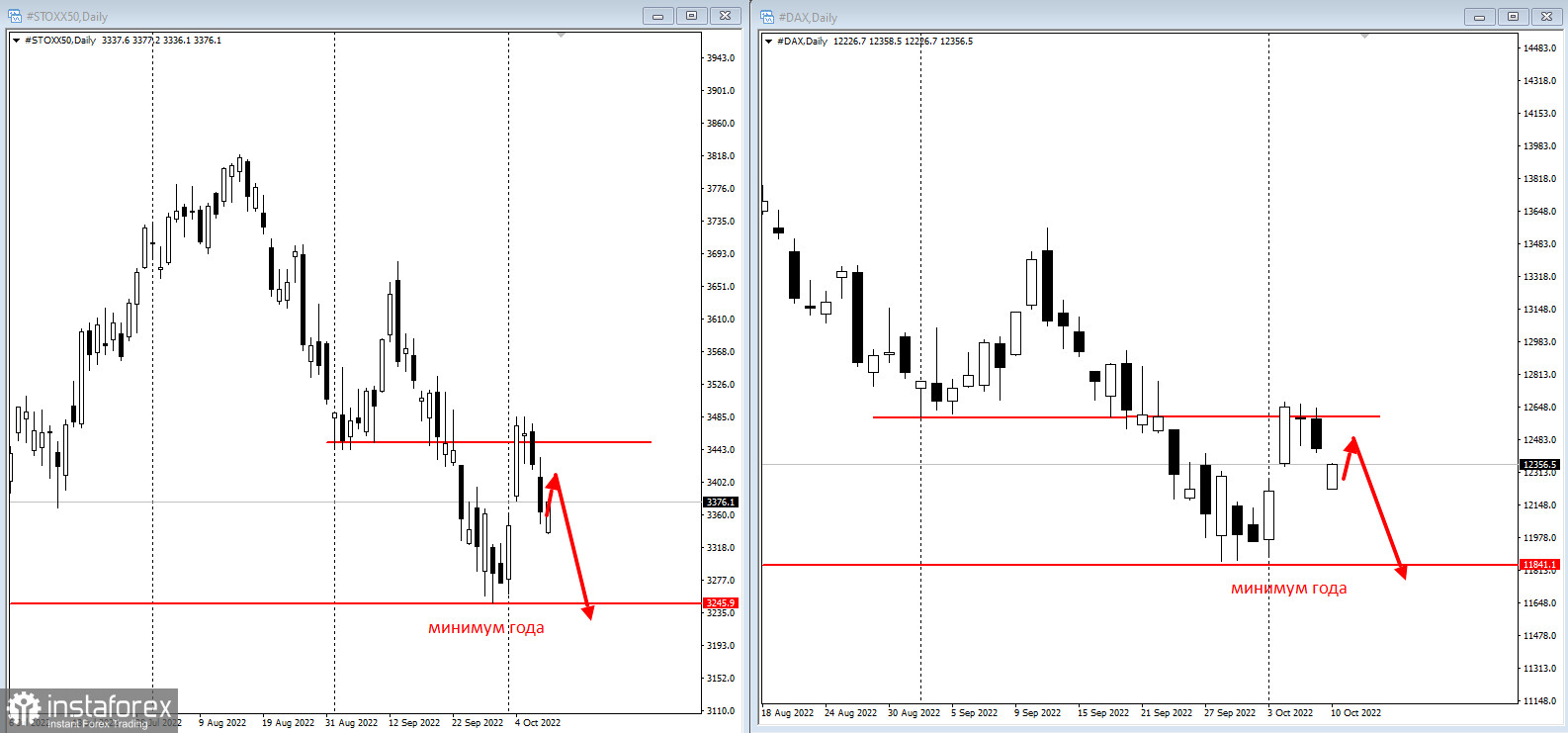

On Monday, European stock indices dropped for the fourth straight day, while US stock index futures declined as fears intensified that central bank policy tightening would seriously affect the global economy and corporate profits.

European Stoxx50 and S&P 500 index futures fell by 0.4%. Washington's move to further restrict China's access to US technology has hurt the semiconductor sector. Moreover, there are signs of slowing chip demand. Europe-listed Infineon, STMicro and OSRAM declined, while chip makers Nvidia and Advanced Micro Devices lost more than 1% each at the New York premarket.

A busy week is ahead. Inflation data will be released on Thursday. Moreover, the earnings season for the third quarter will start.

A possible rise in consumer prices will put pressure on policymakers to extend a 75 basis point rate hike beyond this year. The minutes of the Fed's last meeting on Wednesday may provide insight where the pain threshold lies for Fed officials. They are so far resolutely hawkish that neither financial market volatility nor the threat of an economic slowdown will deter them from raising rates.

Investors are also bracing for disappointment from earnings season as more than 60% of the 724 respondents to Bloomberg's latest MLIV Pulse survey predicted the earnings season would push the S&P 500 Index lower.

The poll underscores Wall Street's fears that even after this year's brutal sell-off, markets have not priced all the risks stemming from central banks' aggressive tightening and stubbornly high inflation. While JPMorgan Chase & Co., Citigroup Inc. and other major banks give their reports this week, iPhone maker Apple is in the spotlight. Its report is expected to provide insight into an array of key themes ranging from global consumer demand to the impact of a stronger dollar.

Morgan Stanley warned that the bear market in the US would not end until earnings forecasts were lowered or stock valuations better reflected risks.

After the destruction of the Crimean bridge and Russia's retaliatory strikes on Ukraine's infrastructure, the Moscow Exchange Index opened below 1,800 and has recovered half of its losses so far:

Key events this week:

- Earnings this week include: JPMorgan Chase & Co., Citigroup Inc., Morgan Stanley, BlackRock, Delta Air Lines, Fast Retailing, Infosys, PepsiCo, TSMC, Tata Consultancy, UnitedHealth, US Bancorp, Walgreens Boots, Wells Fargo, Wipro

- Fed's Lael Brainard and Charles Evans speak, Monday

- IMF's World Economic Outlook and Global Financial Stability Report, Tuesday

- Fed's Loretta Mester speaks, Tuesday

- BOE's Andrew Bailey speaks, Tuesday

- FOMC minutes for September meeting, Wednesday

- US PPI, mortgage applications, Wednesday

- OPEC Monthly Oil Market Report, Wednesday

- Fed's Michelle Bowman and Neel Kashkari speak

- US CPI, initial jobless claims, Thursday

- G-20 finance ministers and central bankers meet, Thursday

- China CPI, PPI, trade, Friday

- US retail sales, business inventories, University of Michigan consumer sentiment, Friday

- BOE emergency bond buying is set to end, Frida