Yesterday, world stock indices, and today, Asian ones, continued to rally on the news about the absence of registered deaths from Omicron, with its significant contagion and mutation ability. This news has a beneficial effect on market sentiment, and the easing of pressure from COVID-19 topics may contribute to the growth of stock indices before the Catholic Christmas.

Now, the market's focus will definitely be the publication of US consumer inflation data for November, which will be presented this Friday. According to the consensus forecast, the annual values of both basic and general consumer inflation should increase markedly, by 4.9% and 6.8%, respectively, but on the contrary, monthly November figures may show a weakening of inflationary pressure. The values of core inflation in November could decline from 0.6% to 0.5%, and the general consumer price index from 0.9% to 0.7%.

We believe that if the data turn out to be in line with expectations, this may have a softening effect on the tone of J. Powell after the Fed's monetary policy decision next week.

In addition to these important events and news, the attention of the market, primarily the European stock and currency market, will be focused on the speech of the ECB President C. Lagarde. She will be expected to comment on the possible reaction of the Central Bank to a strong increase in inflation in the region.

According to the data presented, November's growth of consumer inflation in the region increased markedly, to 4.9%, which cannot force the regulator to act. Nevertheless, we still believe that the ECB will try to do nothing until the last moment until the Fed's position regarding an earlier or, conversely, a late rate hike becomes clear. This will probably be seen at Powell's press conference on December 15.

How will the EUR/USD pair react if Lagarde does mention the risks to the economy against the background of rising inflation today?

We believe that if she really mentions this topic and shows investors about the high probability of an earlier change in the course of monetary policy, then the pair will receive local support since the US dollar cannot yet boast of an unambiguous decision by the Fed in favor of accelerating the rate hike. But if Lagarde does not say anything on this topic, which is still more real, then the pair will continue to consolidate around the local low of December 6.

Taking into account the overall picture in the markets, we are confident that stock indexes will continue to grow until Friday, and the currency market will consolidate around current levels before the publication of inflation data in the US, and then before the Fed meeting.

Forecast for the day:

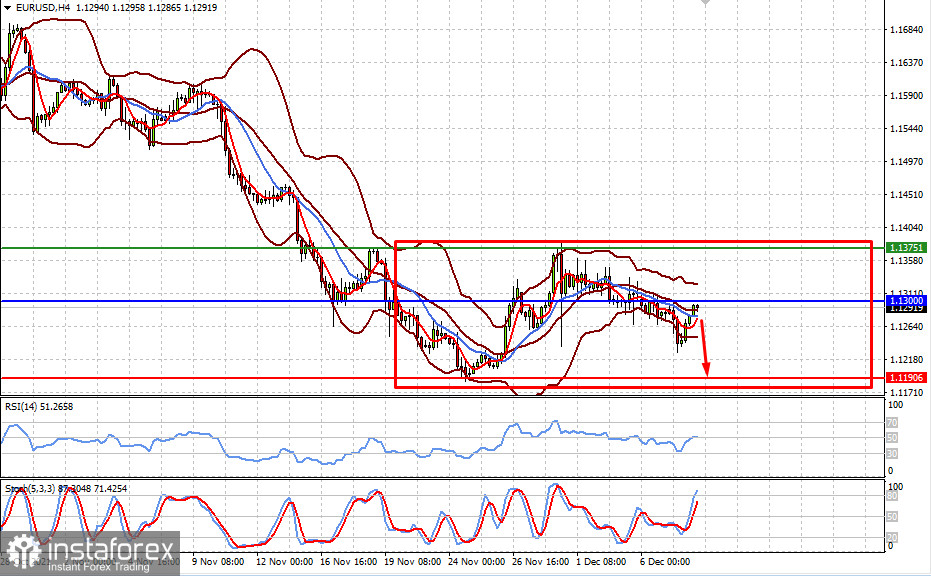

The EUR/USD pair is just below the level of 1.1300 in anticipation of Lagarde's speech. The lack of any hints about an early change in the monetary rate from a soft to a tougher one will lead to the pair's decline to the level of 1.1190, although in general, it may remain in the range of 1.1190-1.1375 before the Fed meeting.

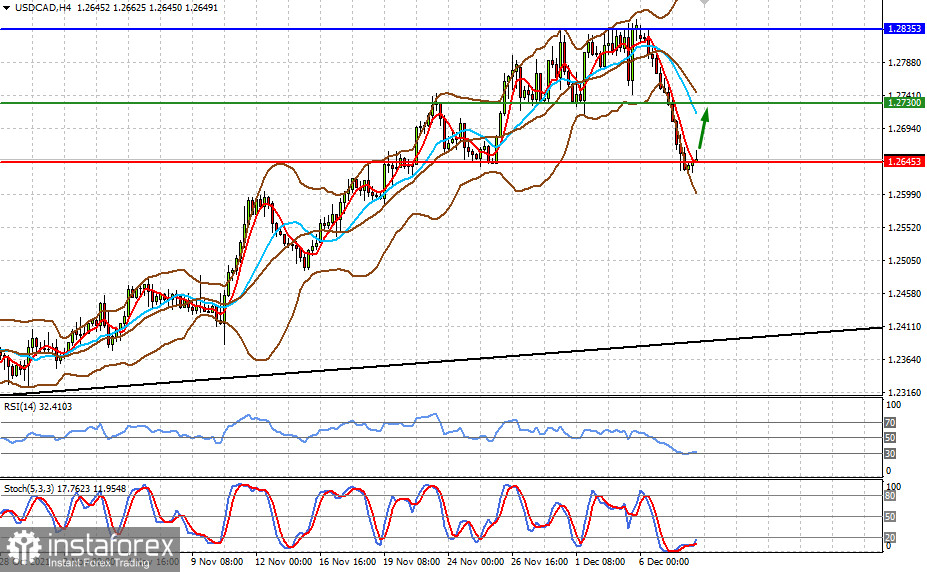

The USD/CAD pair has stopped around the level of 1.2645 in anticipation of the result of the Canadian Central Bank's monetary policy meeting. It is assumed that its current rate will remain unchanged for now, which may lead to a local growth to the level of 1.2730.