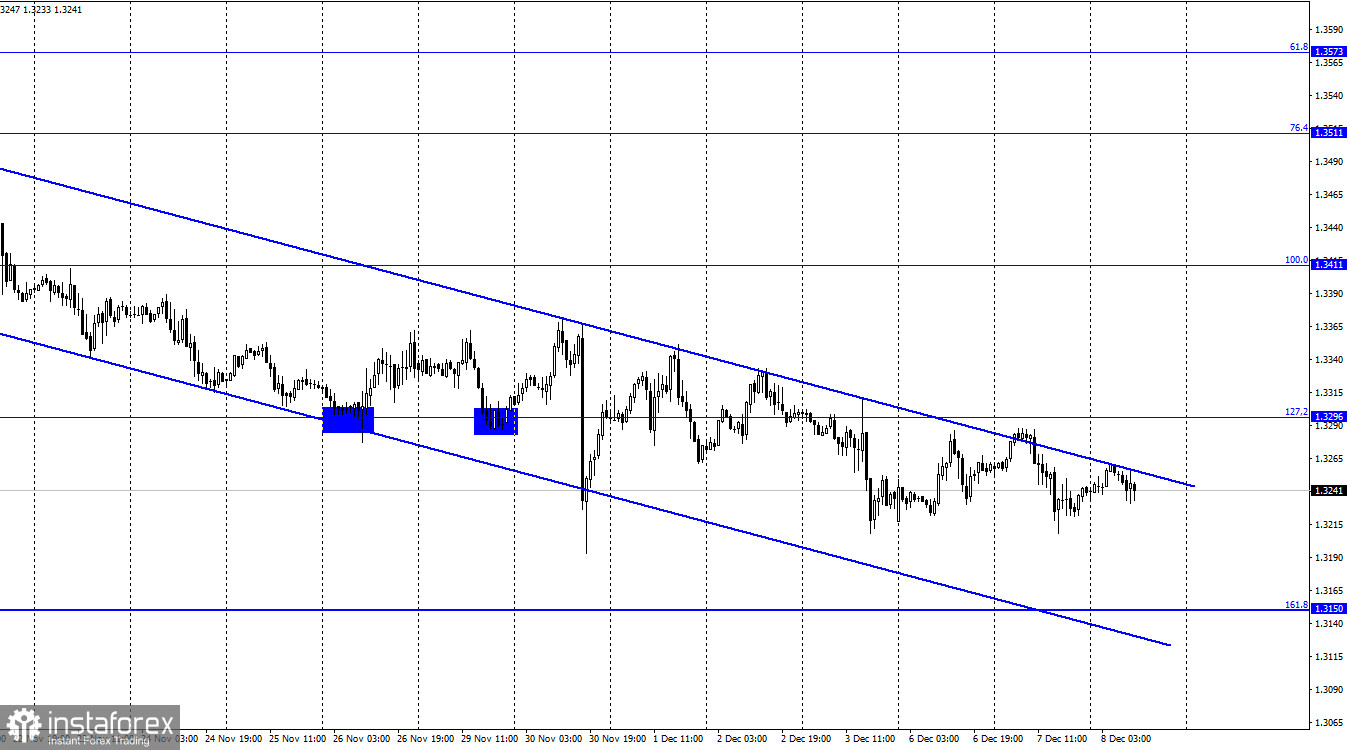

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair on Tuesday performed an increase to the upper line of the descending trend corridor, rebound from it, a reversal in favor of the US currency, and resumed the process of falling in the direction of the corrective level of 161.8% (1.3150). However, I should also note that at the moment of rebound from the corridor line, the pair behaved rather ambiguous, since there was still a minimum closure above it. Earlier, the quotes just perfectly fought off this line, but not yesterday. Thus, I assume that today or tomorrow there will be new attempts to close over the corridor, which, however, are not one hundred percent likely to lead to further growth of the British dollar. Today, the pair has already managed to test the strength of this line once again. But while the pair remains inside the trend corridor, thus, the mood of traders is still characterized as "bearish". Meanwhile, the coronavirus, which Boris Johnson is trying to ignore, continues to take over the UK. This is the fourth time. On December 5, 51.5 thousand new coronavirus diseases were detected in the UK, which is the highest value among all European countries.

Even in Germany, where the coronavirus has been raging in recent weeks, it has retreated to second place among European countries. Thus, it seems that Boris Johnson's policy of containing the virus is still not working. In the UK, almost the entire adult population received both doses of the vaccine, and vaccination of adolescents and children began. But, as we can see, this does not affect the spread of the virus in any way. It only affects the number of hospitalizations, which has become much less, and the number of deaths, which also decreased with the beginning of the vaccination process. It seems that this is quite enough for Boris Johnson since the main thing for him remains the economy, which in no case can be "closed". After all, the British economy was dealt a double blow in the form of Brexit and the form of a pandemic. Thus, if quarantine has been introduced in Germany and several other European countries and measures to counter the spread of the virus have been tightened in many places, then in Britain they only called on everyone to wear masks in public places. It is still difficult for a Briton to find motivation for growth.

GBP/USD – 4H.

On the 4-hour chart, the pair closed under the corrective level of 61.8% (1.3274), which allows us to expect a slight drop in quotes. However, the bullish divergence of the MACD indicator allows us to count on some growth. For the second week in a row, the pair has been moving slightly below the upper limit of the descending trend corridor and cannot close above it in any way. The same pattern is observed on the hourly chart. The probability of closing over these two corridors is growing every day. When this happens, it will allow us to count on the continued growth of the British dollar in the direction of the Fibo level of 50.0% (1.3457).

News calendar for the USA and the UK:

On Wednesday, the calendars of the USA and the UK do not contain a single interesting entry. Thus, the influence of the information background on the mood of traders today will be absent.

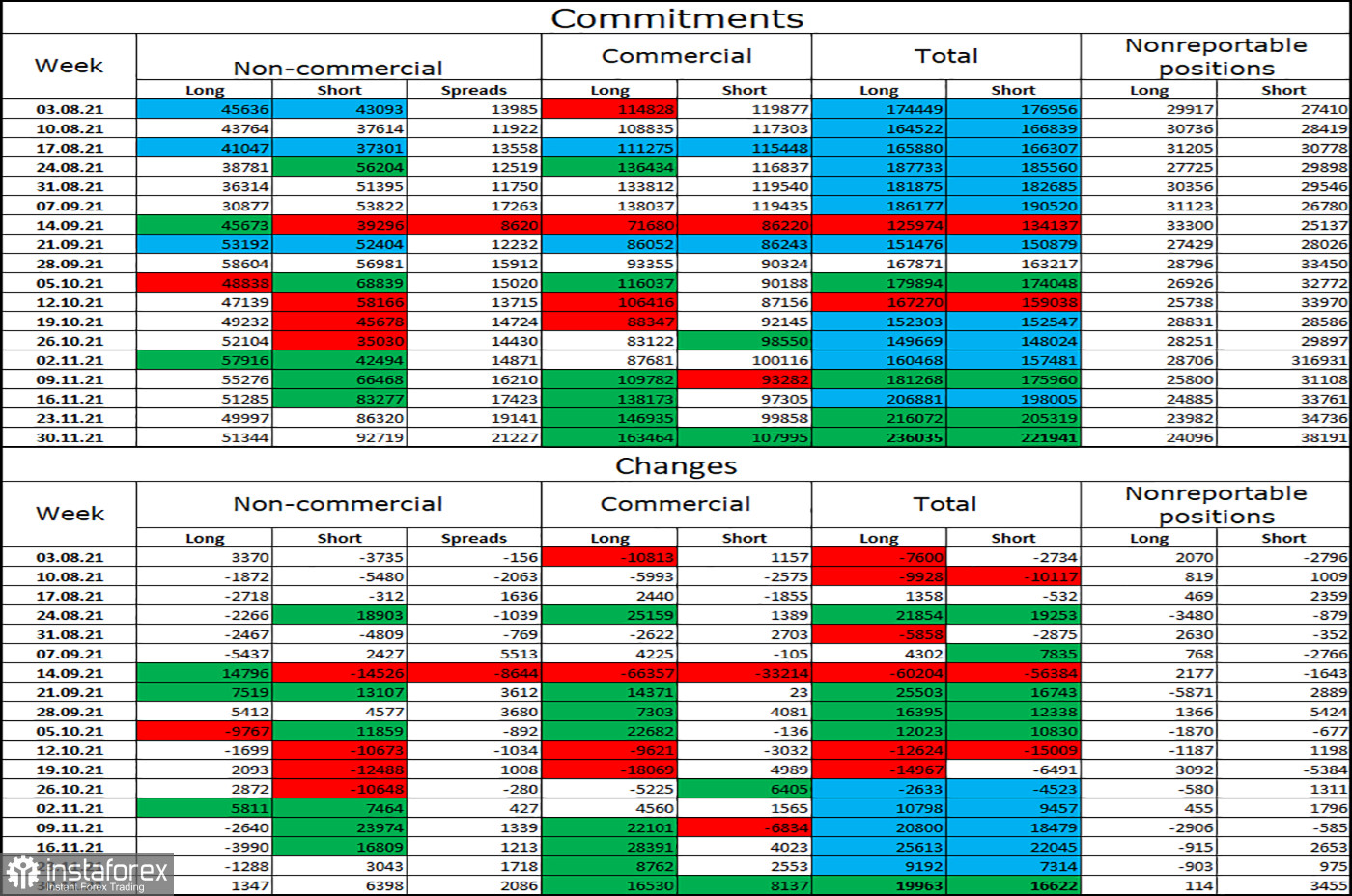

COT (Commitments of Traders) report:

The latest COT report from November 30 on the pound showed that the mood of major players has become more "bearish". This trend has been observed for the fifth week in a row. In the reporting week, speculators opened 1,347 long contracts and 6,398 short contracts. In total, over the past month, speculators have opened about 56 thousand short contracts. That is, more than everything is now focused on their hands of long contracts. Thus, in recent weeks, speculators have developed a strong "bearish" mood, and he speaks of a possible continuation of the fall of the British. Graphical analysis is partly in favor of this since the pound sterling is in no hurry to grow. The total number of open long and short contracts for all categories of traders is almost the same now.

Forecast for GBP/USD and recommendations to traders:

I recommend new purchases of the pound if the closing on the 4-hour chart above the corridor with targets of 1.3411 and 1.3457 is completed. I recommended selling the pair at the close under the level of 1.3274 with a target of 1.3150, but the "bullish" divergence canceled this signal.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.