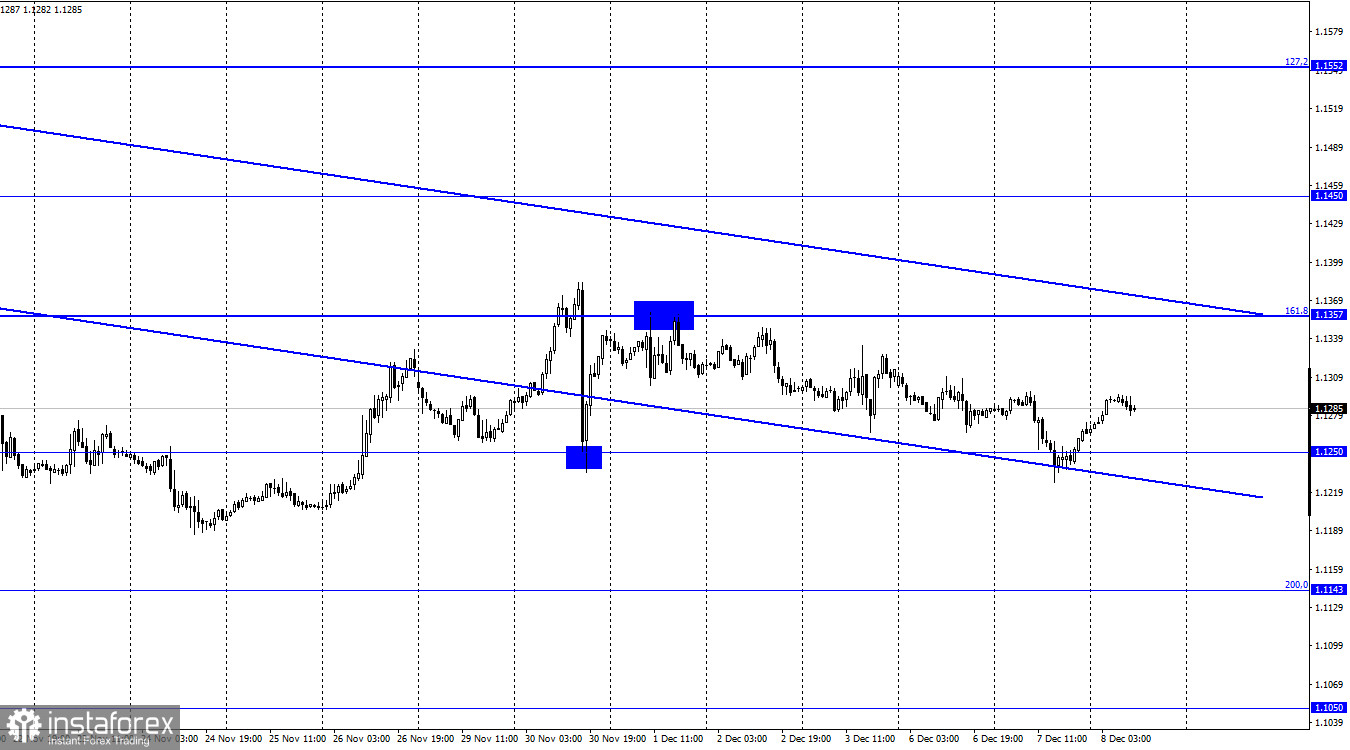

EUR/USD – 1H.

The EUR/USD pair performed a new fall towards the 1.1250 level on Tuesday and even closed below it. However, this consolidation did not lead to a continuation of the fall in quotes. The pair continues to move inside the downward trend corridor, which continues to characterize the current mood as "bearish". Thus, for the euro currency to have at least a small chance of growth, a closure over this corridor is required. However, the euro currency cannot show growth in recent weeks. There were a few days when the pair was growing, but in general, it remains at the very "bottom" of 2021, as can be seen on the older charts. The information background is also not an assistant to the euro currency now. Yesterday, the European Union released a report on GDP in the third quarter, but it was no different from the previous value of 2.2%. Thus, traders did not work out this report in any way. The same applies to the report from the ZEW Institute on the mood in the business environment. Christine Lagarde, president of the ECB, was supposed to give a speech today. However, judging by the fact that the pair was moving with minimal activity during the first half of Wednesday, I assume that Lagarde did not tell traders anything interesting.

I am not surprised by this, since Lagarde has already indicated her position on monetary policy many times before. And this position is very simple: the European economy is not ready for tightening and the maximum it can count on is a slow withdrawal from a stimulus, which is likely to take longer than in the US. Let me remind you that the Fed, under certain circumstances (for example, with inflation continuing to rise), may complete the QE program as early as March-April next year. The same applies to the interest rate, which may be raised for the first time in June 2021, and maybe even earlier. But in the European Union, the central bank is unlikely to raise rates at all next year. Thus, the euro currency can fall in tandem with the dollar based on this difference between the Fed and the ECB alone. The Omicron strain seems to have already become less interested in the markets. At least, the stock market recovered very quickly from the fall, and the panic went away.

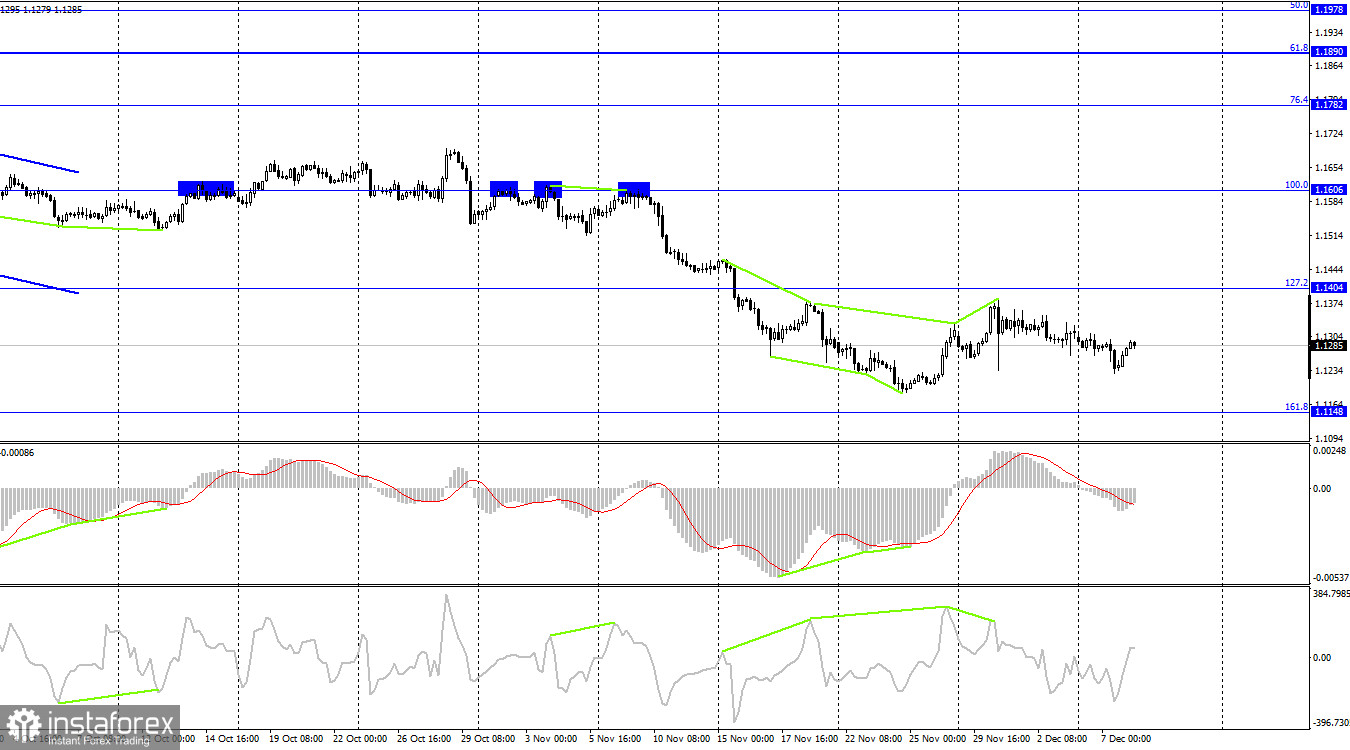

EUR/USD – 4H

On the 4-hour chart, the pair continues the process of falling in the direction of the corrective level of 161.8% (1.1148) after the formation of a bearish divergence at the CCI indicator. The fall is currently weak, and there are no new brewing divergences. Fixing the pair's exchange rate above the level of 127.2% (1.1404) will work in favor of the EU currency and the resumption of growth in the direction of the corrective level of 100.0% (1.1606).

News calendar for the USA and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (08:15 UTC).

On December 8, the calendar of economic events in the United States is again empty. Christine Lagarde's speech has already taken place in the European Union today, which gave nothing to either traders or the euro currency. There will be no background information for the rest of the day.

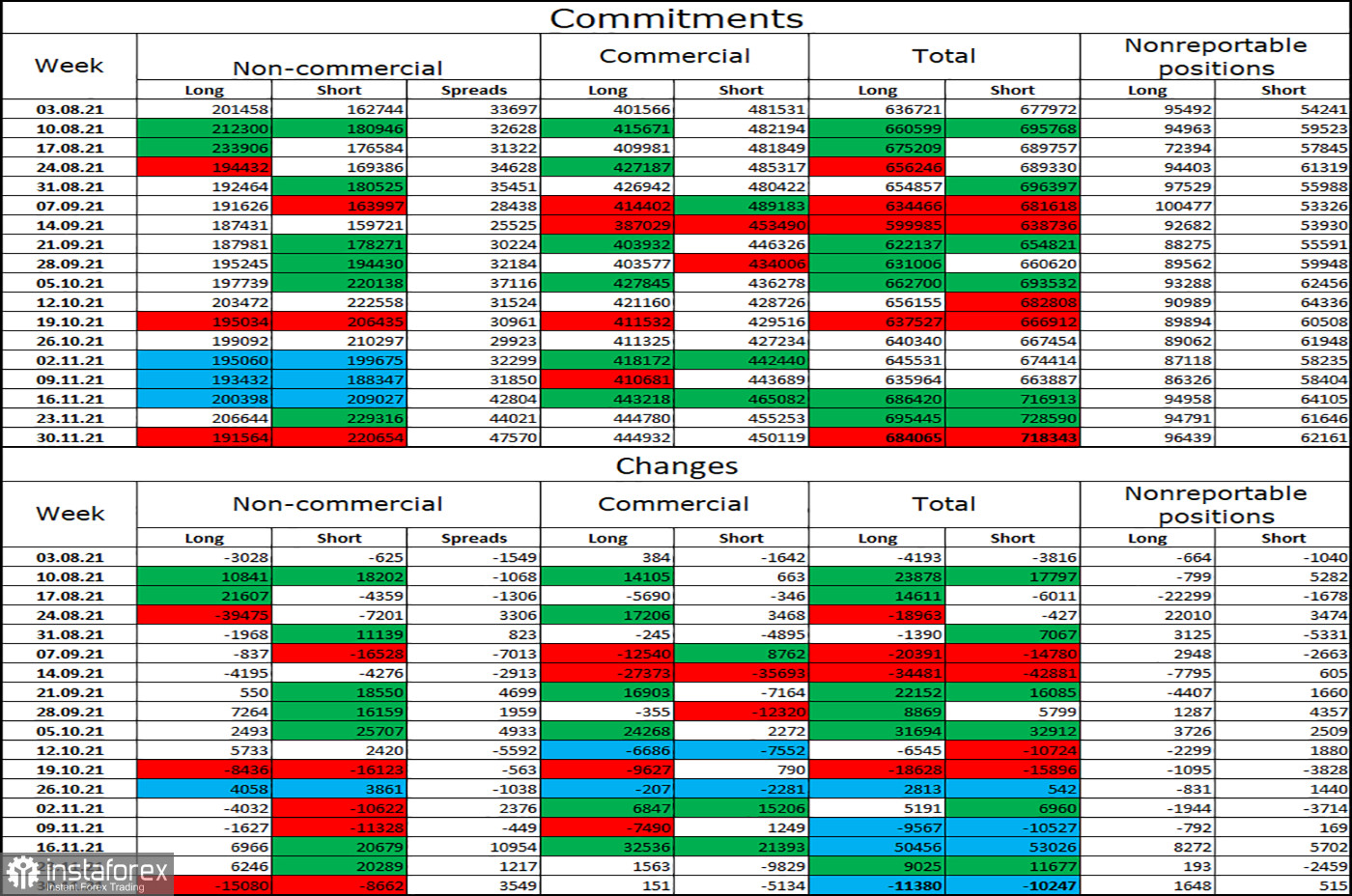

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became much more "bearish" again. However, this time speculators did not increase shorts but closed about the category of contracts. But longs and large volumes. In total, 15080 long contracts on the euro currency and 8662 short contracts were closed. Thus, the total number of long contracts in the hands of speculators decreased to 191 thousand, and the total number of short contracts – to 220 thousand. Thus, the "bearish" mood among the most important category of traders continues to strengthen. Consequently, the European currency may resume falling in the near future. According to COT reports, there are no signs of possible long-term growth of the euro yet.

Forecast for EUR/USD and recommendations to traders:

New sales of the pair can be opened when closing below the level of 1.1250 on the hourly chart with a target of 1.1143. I recommend buying the euro currency when closing above the corridor on the hourly chart with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.