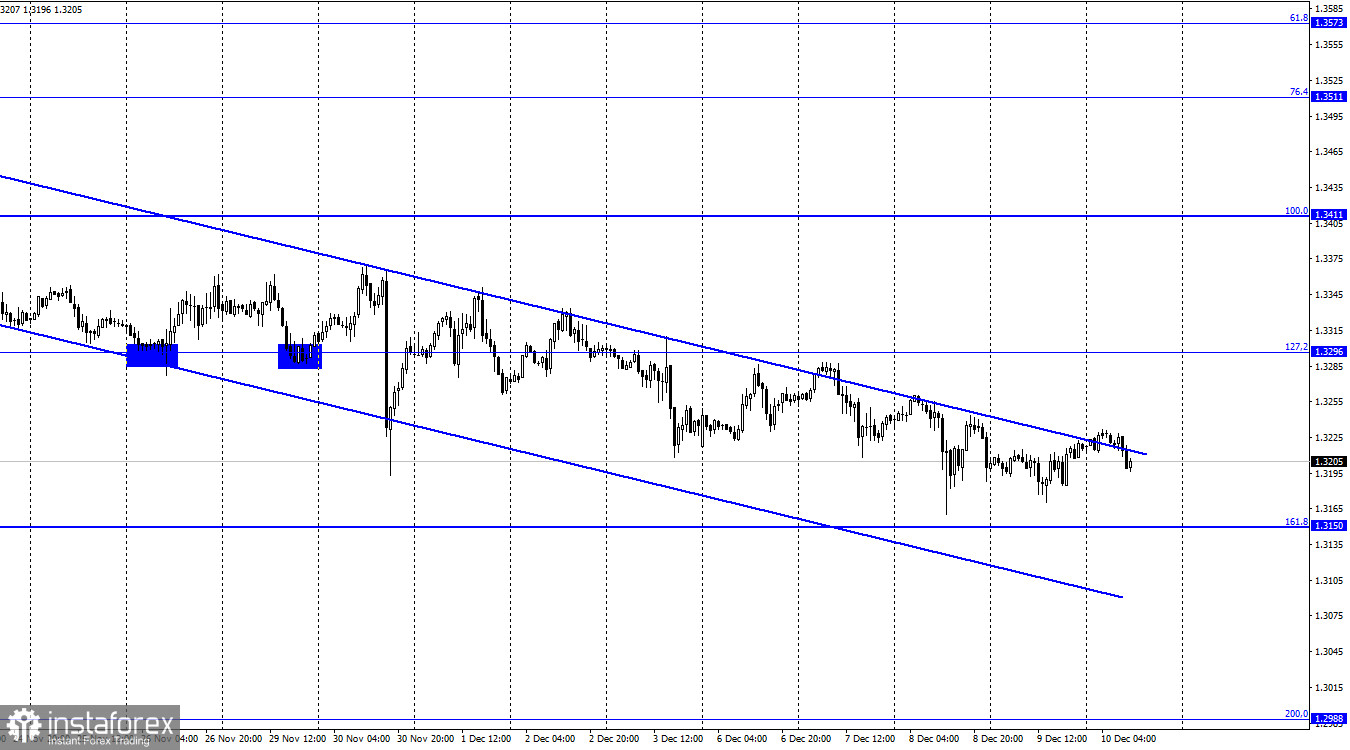

GBP/USD – 1H.

On the hourly chart, the GBP/USD pair performed slightly higher on Thursday and again managed to consolidate above the downtrend corridor by 5 points. This is the second time that the GBP has closed above the corridor by 5 points. It should have signaled a change in traders' bullish sentiment. However, this has not been the case. The pair then moves back inside the corridor and continues to fall. Thus, I believe that the fall of the pound will continue. This morning the UK released GDP and industrial production reports. GDP rose by 0.9% in the last three months and by 0.1% in October. Traders were expecting higher figures. Industrial production jumped by 1.4% in October, although traders were expecting growth of at least 2.2%. Less important reports were also weak. For example, manufacturing production was up by 1.3% in October against expectations of 1.7%. Construction was up by 3.2% against the forecast of 5%. Thus, the GBP did not receive any support from the information background on Friday morning.

Traders are already focused on the US inflation report, which will be released in a few hours. Therefore, they did not pay attention to the weak data from the UK. However, the pound is currently in a very difficult situation. The information backdrop from the US is quite strong and the news from the UK is not so good. It has previously been mentioned that France and the UK are in conflict over the fisheries issue. The countries have also quarrelled over illegal migrants heading to the UK from France. In addition, the issue of the border regime with Northern Ireland remains unresolved. Negotiations with the European Union on this problem are also ongoing. Furthermore, the UK has tightened quarantine regulations for fear of a new strain of the coronavirus. The situation is getting worse by the day. So, the pound continues to fall day by day.

GBP/USD – 4H.

On the 4-hour chart, the pair closed under the correction level of 61.8% (1.3274), which allows us to expect a further drop of the quotes towards the Fibonacci level of 76.4% (1.3044). Bullish divergence of the MACD indicator has been canceled, and the pair continues to decline along the upper boundary of the downtrend corridor, which is very similar to the corridor on the hourly chart. The fixation of the pair's rate above it will allow expecting the growth of the British pair towards the correctional level of 560.0% (1.3457). There are no new emerging divergences in any indicator today.

News calendar for the US and the UK:

UK - GDP (07-00 UTC).

UK - Industrial Production (07-00 UTC).

US - Consumer Price Index (13-30 UTC).

US - University of Michigan Consumer Sentiment Index (15-00 UTC).

Friday's UK reports are all released. The market is waiting for the US inflation report, which could have a big impact on the mood of traders. The information backdrop is likely to be strong today.

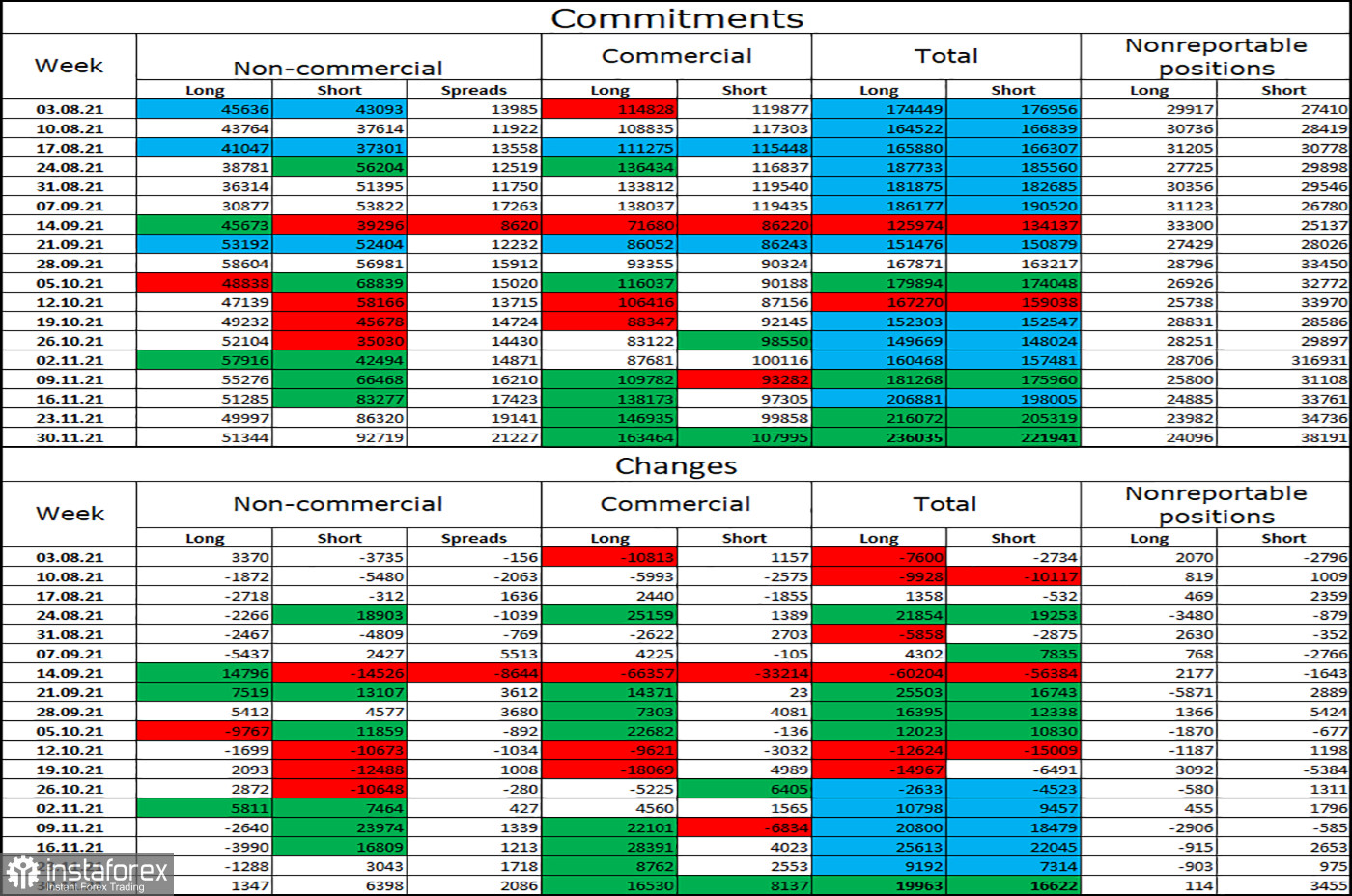

COT (Commitments of Traders) report:

The latest COT report from November 30 on the pound showed that the mood of major players has become more bearish. This trend has been observed for the fifth week in a row. In the reporting week, speculators opened 1,347 long contracts and 6,398 short contracts. In total, over the past month, speculators have opened about 56 thousand short contracts. That is, more than everything is now focused on their hands of long contracts. Thus, in recent weeks, speculators have developed a strong bearish mood, and he speaks of a possible continuation of the fall of the British. Graphical analysis is partly in favor of this since the pound sterling is in no hurry to grow. The total number of open long and short contracts for all categories of traders is almost the same now.

GBP/USD outlook and tips for traders:

I recommend new purchases of the pound if there is a close above the corridor on the 4-hour chart with a target of 1.3296. I recommended selling the pair at a close below 1.3274 with a target of 1.3150, but a bullish divergence cancelled that signal. I do not recommend to hurry up with new sales.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.