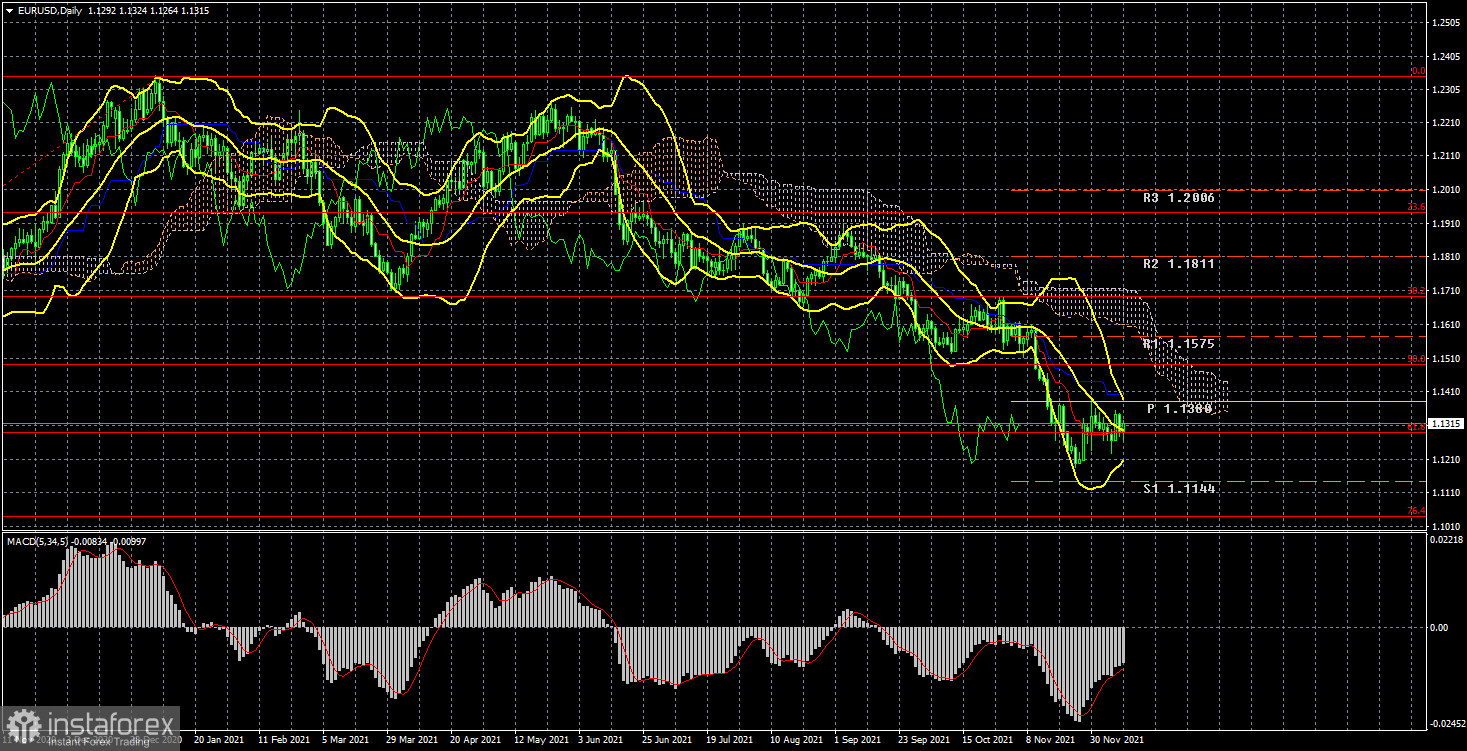

The next week promises to be very eventful in terms of fundamental events. In addition to several macroeconomic publications, the central banks of the United States and the European Union will summarize the results of the last meeting this year and the markets will expect decisions and information from them. However, we will talk about this a little later. We would like to draw traders' attention to the technical picture first. And according to the "technique", one conclusion can now be drawn: although the pair has been correcting for two weeks, the downward trend persists, which continues throughout 2021. At the moment, on the 24-hour TF, the pair's quotes could not even grow to the critical line. This suggests that the mood of traders is now as "bearish" as possible. However, we are also mindful of the COT reports. In particular, yesterday we talked about the fact that the mood of major players at the moment is "bearish", but it has not intensified in recent weeks and even months. It turns out a situation in which the euro continues to fall (in general and in general), but professional traders do not continue selling this currency. Thus, there are still grounds to assume the completion of the downward trend of 2021. Moreover, the whole trend-2021 still looks like the standard three waves of correction. The current downward movement can still be classified as a correction against the 2020 trend.

It is next week that the situation may become clearer. Although, to be honest, there are not too many chances for this. However, after the ECB and the Fed summarize the results of their meetings, it will be possible to draw certain conclusions, which is not bad. For example, it will be possible to understand whether traders are set up for further purchases of the US currency against the background of continued tightening of the Fed's monetary policy? As we said earlier, in recent months, the dollar could grow solely on the factor of the markets' belief in tightening monetary policy and playing ahead of the curve. However, this cannot go on forever. It is already clear to everyone that the Fed will continue to curtail QE, and next year it will raise the key rate at least twice. How much more time is market participants going to work out the same factor? We'll figure it out next week. I also want to recall the report on American inflation on Friday, which quite unexpectedly did not provoke a new growth of the US dollar. After all, inflation has increased once again and is already 6.8%. Previously, each acceleration of inflation was accompanied by a rise in the dollar, as the markets rightly believed that the probability of tightening the Fed's monetary policy was growing. However, this did not happen on Friday, which once again makes you think about whether it's time for the pair to turn up?

As for the meeting of the European Central Bank, surprises are not expected here. Christine Lagarde has repeatedly said in recent months that the European economy is too weak to raise rates. Lagarde's words are also confirmed by official GDP data, which show that the European economy barely accelerated to 2.2% in the third quarter. For example, the US economy slowed to 2.2% in the third quarter. Thus, the emergency PEPP program will most likely be completed in March, but the APP incentive program will be expanded immediately, so it will turn out to be an "awl for soap". In general, the European economy still needs to be stimulated, especially against the background of the fourth "wave" of the pandemic in the European Union, thanks to which some countries were forced to introduce a new "lockdown". Therefore, it is unlikely to expect "hawkish" rhetoric from the ECB, and hence the growth of the euro after the regulator's meeting.

And what do we have in the end? The Fed is likely to continue to adhere to "hawkish rhetoric", and the ECB – "dovish". The ideal situation for the euro/dollar pair to continue its decline. The only question is, are the market participants not sated with sales? So far, we can say that it is not, since on the 24-hour TF for two weeks, the pair's quotes could not even reach the critical line. In general, market participants are in no hurry to close short positions and this is a fact. But they are in no hurry to open new ones. Therefore, we would estimate the probability of a further fall in the euro currency at 70%. Perhaps the markets just need a new push in the form of accelerating the curtailment of the QE program in the US to 20-30 billion per month, which is very likely to be announced by Jerome Powell this Wednesday.

Trading recommendations for the EUR/USD pair:

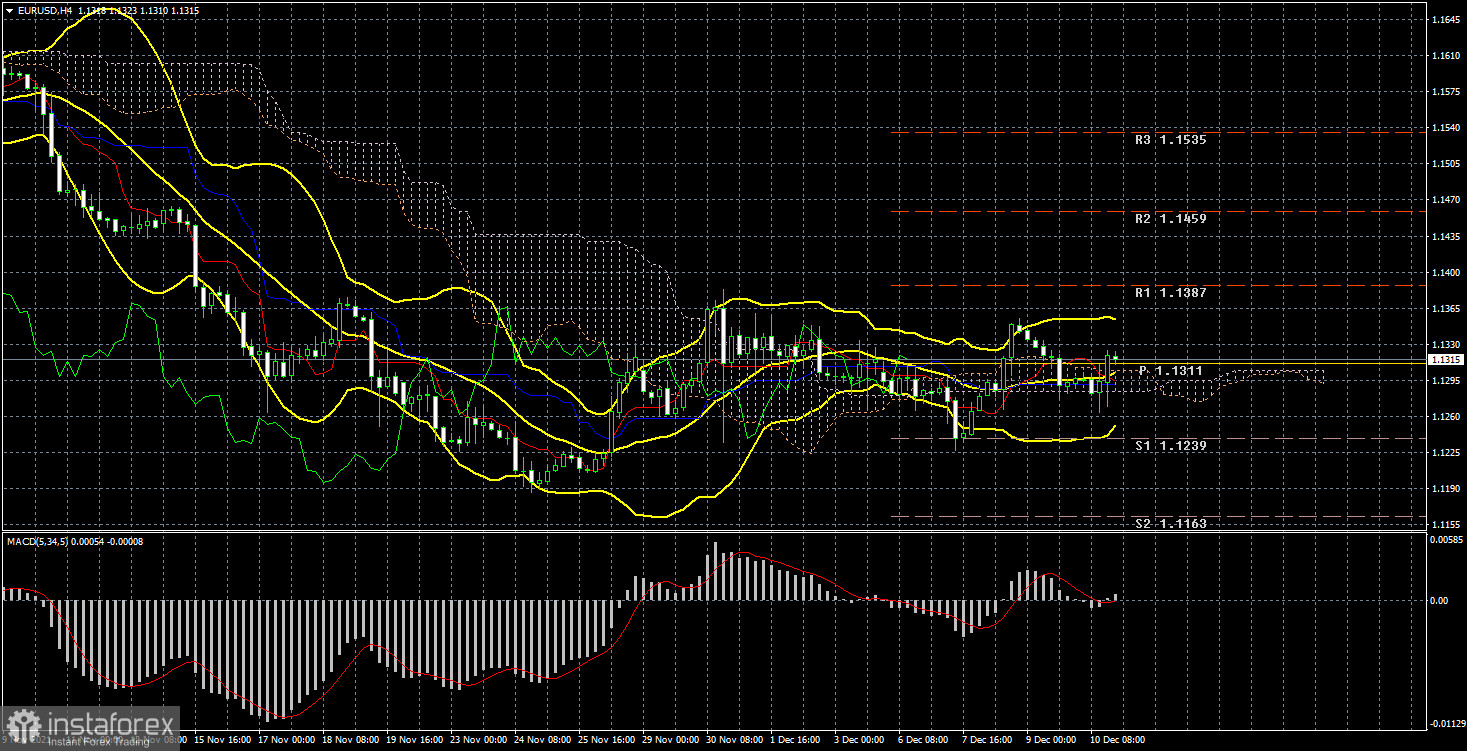

The technical picture of the EUR/USD pair on the 4-hour chart indicates that the correction continues. However, the illustration above clearly shows how strong this correction is, if the pair managed to grow by 130 points in more than two weeks. The Bollinger bands are directed sideways at all, which signals a flat, not a trend movement. And in the last 7-8 days, the pair has been trading directly "on" the lines of the Ichimoku indicator, which also indicates the absence of a trend. Thus, formally, the pair can resume growth, but the bulls are very weak now. It seems that everything is going to the fact that the bears will become more active and will continue to pull the European currency down. The first targets are 1.1239 and 1.1163. There will be practically no important macroeconomic publications in the European Union this week. The indices of business activity in the service and manufacturing sectors are unlikely to change much in December, and the consumer price index for November is already known to market participants.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).