The pound/dollar pair continued its downward movement last week. And the fundamental background for the British currency remains very unimportant. We have already said earlier that there are now quite a large number from both the UK and the USA, which theoretically can have an impact on the mood of traders and the exchange rate of the British or American currency. But at the same time, it is very difficult to say which factors are perceived by the markets and which are not. Thus, we have to pay attention to all the available information and it seems that it is perceived by the market at 100%. The fact is that the pound/dollar pair has continued to fall in recent weeks, although the euro/dollar pair at the same time showed at least some signs of correction. This means that the fundamental background for the British currency is currently more negative than for the European one. Therefore, we should also pay attention to the data from the UK, which, most likely, are the reason for the stronger fall of the pound in recent weeks. Thus, the "gasoline" crisis, the "logistical" crisis, the conflict between the European Union and Britain over the "Northern Ireland protocol", the conflicts between London and Paris over fishing and illegal migrants, as well as the scandals with Boris Johnson, which he regularly gets into, are immediately recalled.

Thus, the British currency now needs very strong fundamental factors that will be able to support it. Of course, on the same factors, the pair cannot constantly move in one direction. For example, the last round of the downward movement is already 660 points. Therefore, at least, the correction is already overdue. Therefore, no matter how weak the fundamental background is, the pound can still count on an upward movement. And next week, it will have a certain chance of that. In addition to the Fed meeting, with which everything is more or less clear and understandable, there will also be a meeting of the Bank of England. However, everything is not so simple here. Not so easy for the pound. At the last meeting, members of the monetary committee unexpectedly showed their willingness to vote for tightening policy. At the same time, this even concerned the key rate, since two members of the monetary committee voted "for" its increase. However, already this month, instead of the number of hawkish-minded members of the committee increasing (to make it logical), it may decrease. And this will happen because the UK is again faced with an increase in the number of coronavirus diseases, as well as a high probability of rapid spread of the omicron strain. Therefore, the Bank of England, most likely, will not take risks and tighten monetary policy when it is completely unclear how everything will end with a new strain and how the current fourth "wave" of the pandemic will end. Forecasts already indicate that the number of members supporting the rate increase will be equal to 1. Thus, the British pound can only hope that more than 3 board members will vote "for" curtailing the quantitative stimulus program. This will be a bullish factor, and it can support the pound sterling.

As for other fundamental and macroeconomic events, a speech by the Chairman of the Bank of England, Andrew Bailey, is due on Monday, and quite important data on unemployment and average earnings will be published on Tuesday. Bailey's speech before the Bank of England meeting is unlikely to provide new information, and the report is unlikely to find a market reaction. But on Wednesday, the consumer price index for November will be published in the UK, which, according to experts, may rise to 4.7-5.0% y/y. Again, it is difficult to say exactly how traders will react to this report and what the actual value of inflation will be. But there is no doubt that the reaction will follow. The most interesting thing, as already mentioned, will happen on Thursday, when the results of the Bank of England meeting will be announced, and on Friday the retail sales report for November will be released. In general, all the most important events are scheduled for Wednesday and Thursday: two important meetings and a report on British inflation.

Unfortunately, it will be really hard for the pound to get market support this week. If both meetings are held as we expect, then a new growth of the dollar is much more likely. Even the inflation report, which, in theory, should have increased the likelihood of tightening monetary policy in Britain, is unlikely to save the pound, since forecasts already boil down to the fact that the "hawkish" mood will weaken at the Bank of England. Thus, the probability of the British pound rising next week is unlikely to exceed 20%. However, it should still be remembered that this is a market and it is impossible to predict its behavior with one hundred percent probability.

Recommendations for the GBP/USD pair:

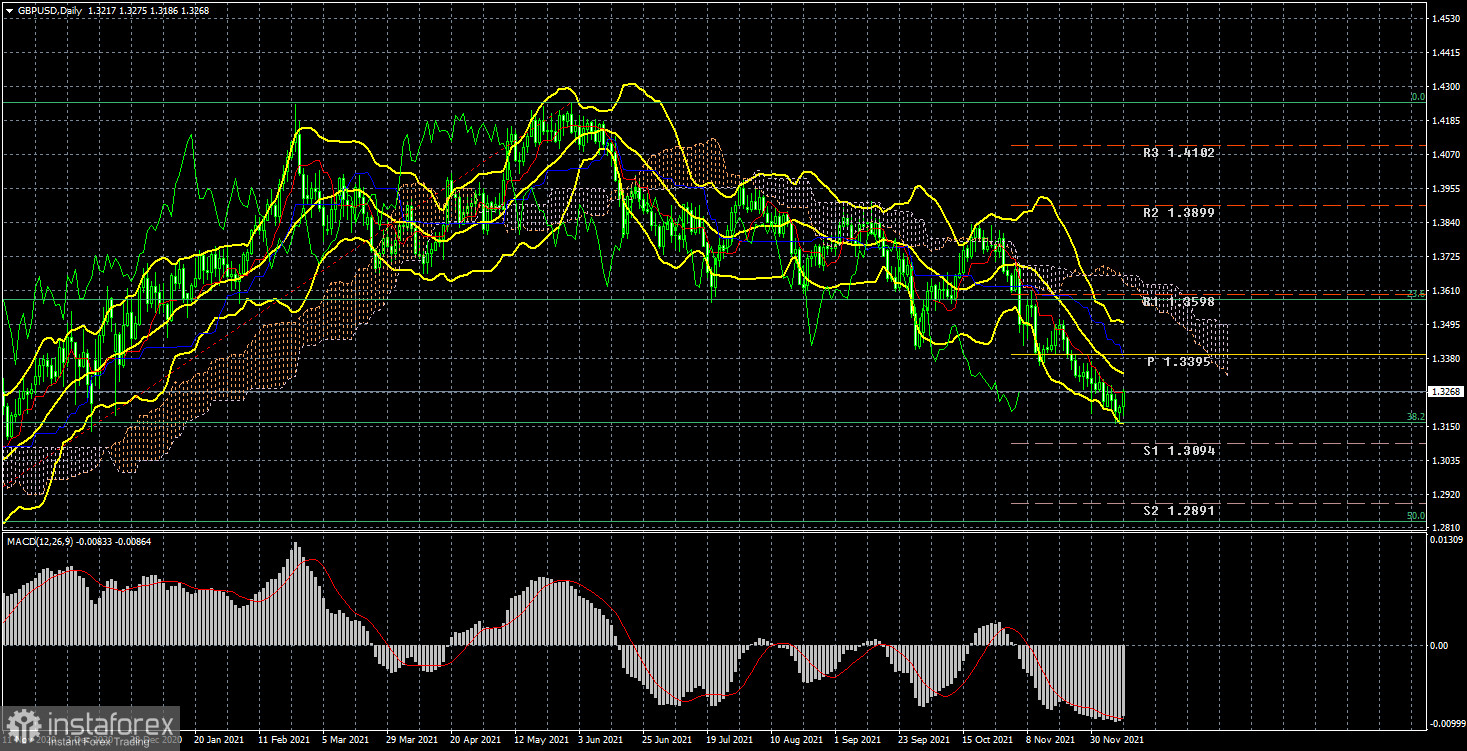

The pound/dollar pair on the 4-hour timeframe on Friday began an upward correction, but at the moment it rested on the Ichimoku cloud. Thus, if the cloud is overcome, the probability of further growth of the British currency will increase, but it should be remembered that on Wednesday and Thursday the pair may "fly" from side to side and the technical picture may change greatly after these two days. Thus, a "storm" is quite likely next week, and making forecasts in such conditions is a thankless task. We will have to act according to the situation.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target level when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).