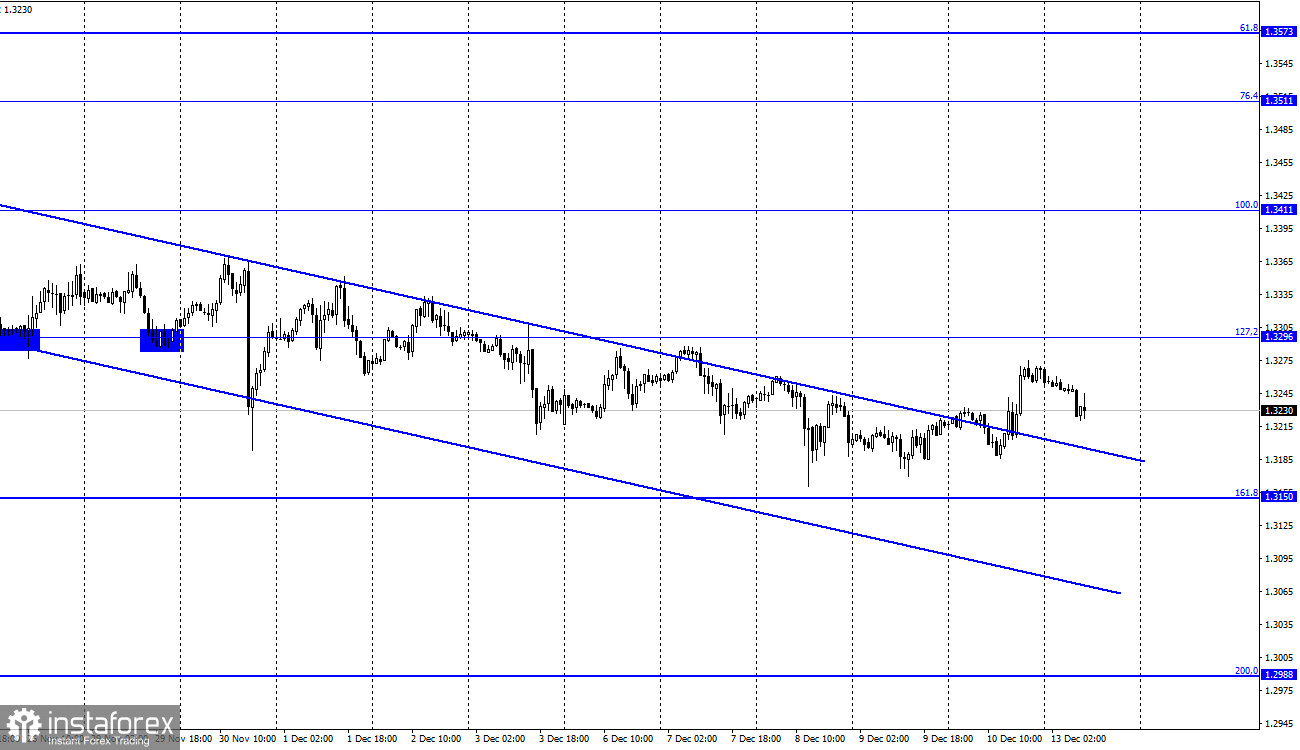

GBP/USD – 1H.

Hi, dear traders!

According to the 1H chart, on Friday GBP/USD reversed upward and closed above the descending channel, indicating a bullish trend. The pair could continue to rise towards the Fibonacci level of 127.2% (1.3296). Currently it is retracing back, as can be seen in this chart. GBP/USD slowed down its descent at one point, but the descending channel cannot react to these changes. Friday's economic data from the UK was unfavorable - in October, the GDP increased by 0.1% MoM and 4.6% YoY. Economists forecasted a rise by 0.4% MoM and 4.9% YoY. The industrial production report also did not meet expectations.

It is unclear what pushed the pair up on Friday. Neither the UK macroeconomic data nor the soaring inflation in the US could give GBP/USD support. Traders are likely to close long positions today - there is no reason to be bullish on the pair at the moment. While the pound sterling had chances for an uptrend in the second half of December a couple of weeks ago, right now the situation is not great for the British currency. The Bank of England could raise the key interest rate by 0.15% at its next meeting, but it is unlikely - several BoE officials have stated that it is too early to hike the rate at this point. Weak economic data and uncertainty over Omicron suggest the regulator is unlikely to tighten its policy, aside from some extra support in favor of reducing stimulus. While the pair could find some support this week, the Fed's meeting on Wednesday, which is likely to have a hawkish tilt, would boost the US dollar and push GBP/USD down.

GBP/USD – 4H.

According to the 4H chart, the pair closed above the descending channel, rising towards the retracement level of 61.8% (1.3274). A bounce off this level and the bearish divergence near the CCI indicator could lead to a downward reversal towards the retracement level of 76.4% (1.3044). If the pair closes above 1.3274, further growth towards the retracement level of 50.0% (1.3457) could be possible.

US and UK economic calendar:

UK - a speech by Andrew Bailey, Governor of the Bank of England (18-00 UTC)

There is only one event on the calendar in the UK, which could influence traders later on Monday. No events are scheduled in the US.

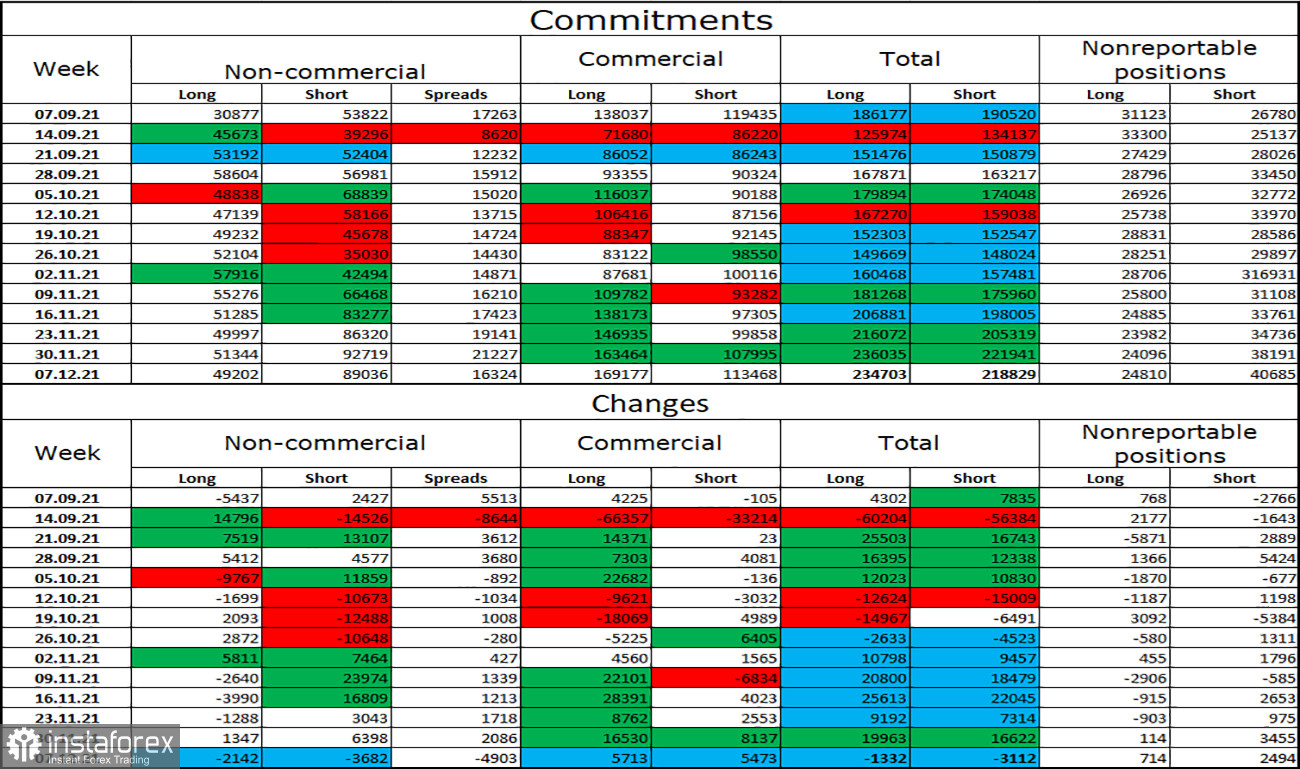

COT (Commitments of traders) report:

The latest COT report as of December 7 indicates no changes in the sentiment of traders, but the bearish trend of the past 5 weeks is still continuing. Market players closed 2,142 Long positions and 3,682 Short positions. The total number of Short positions is twofold higher than the amount of Long positions. The situation has not improved for the pair, which could resume its decline.

Outlook for GBP/USD:

Traders are recommended to open long positions if the pair closes above 1.3274 targeting 1.3296 and 1.3411. Earlier, traders were recommended to open short positions if GBP/USD closed below 1.3274 targeting 1.3150, however the bullish divergence has cancelled the sell signal. It is not recommended to open new short positions at the moment.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.