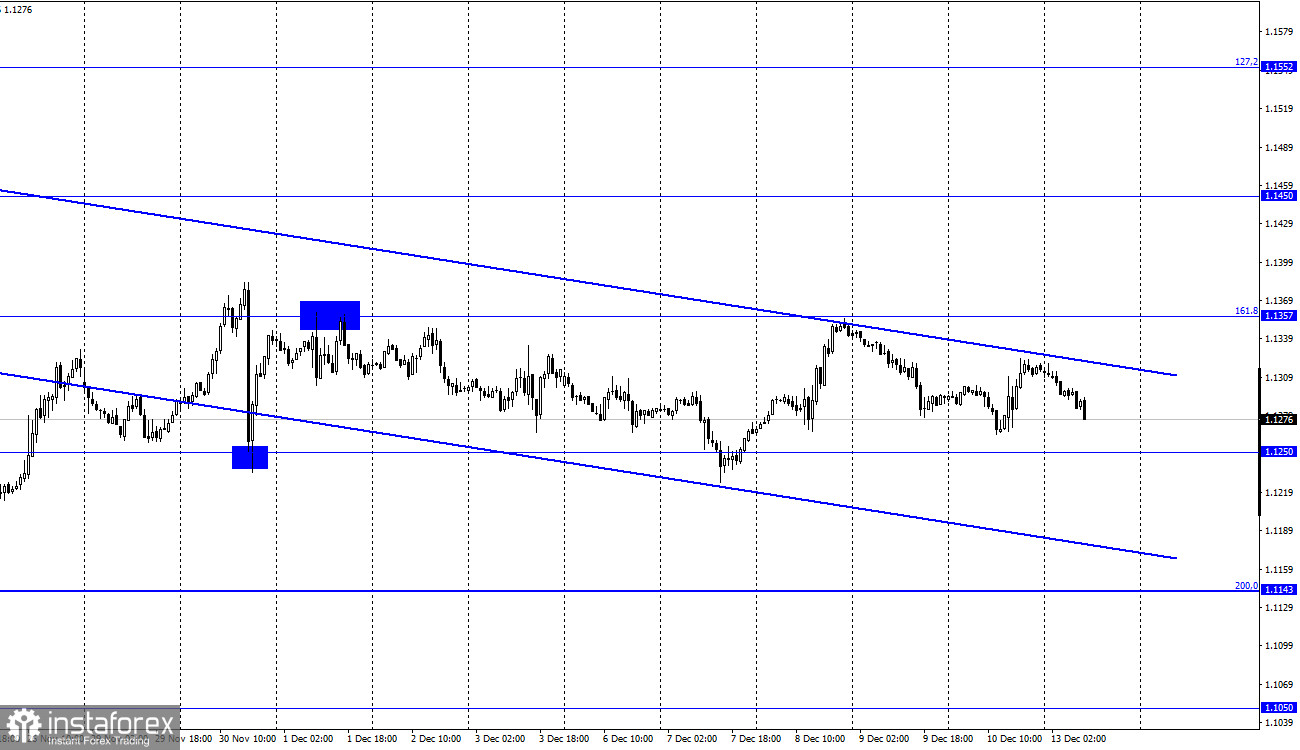

EUR/USD – 1H.

On Friday, the EUR/USD pair made a new rally to the upper boundary of the downtrend corridor. Around this level, there was a reversal in favour of the US currency and a renewed fall towards 1.1250. Therefore, traders' sentiment remains bearish at the moment. A consolidation of the pair above the range will allow traders to expect a stronger rally of the European currency towards the correction levels of 1.1357 and 1.1450. There was no interesting news in the EU on Friday. In the US, however, there were two reports which determined the pair's movement. The consumer price index rose to 6.8% year on year in November and core inflation rose to 4.9%. This was roughly what traders expected, but that does not negate the fact that both indicators are significantly higher compared to October. Thus, I believe that the pair could have moved stronger after the report. It should have been the dollar, not the euro currency, that rose.

However, traders can already change their minds today. And as we can see, since this morning the euro currency is already falling, while the dollar is rising. If we see the pair falling all day today towards 1.1250 and below, I think that will be fair. On Friday, the US Consumer Confidence Index came out. It was 70.4, showing an increase compared to the previous month. So, in this case, too, the dollar should have risen, not fallen. There will be at least two important events this week for the euro-dollar pair. Notably, the worst phase of the pandemic crisis is over, so central banks are now thinking hard about tightening monetary policy. And the Fed has already started tapering its stimulus programme. Thus, every next meeting could be another step towards policy normalisation. And every such step can and should support that bank's currency. Traders are not expecting much from the ECB right now, so there is more chance of a new rise in the dollar as the Fed is likely to continue cutting the QE programme.

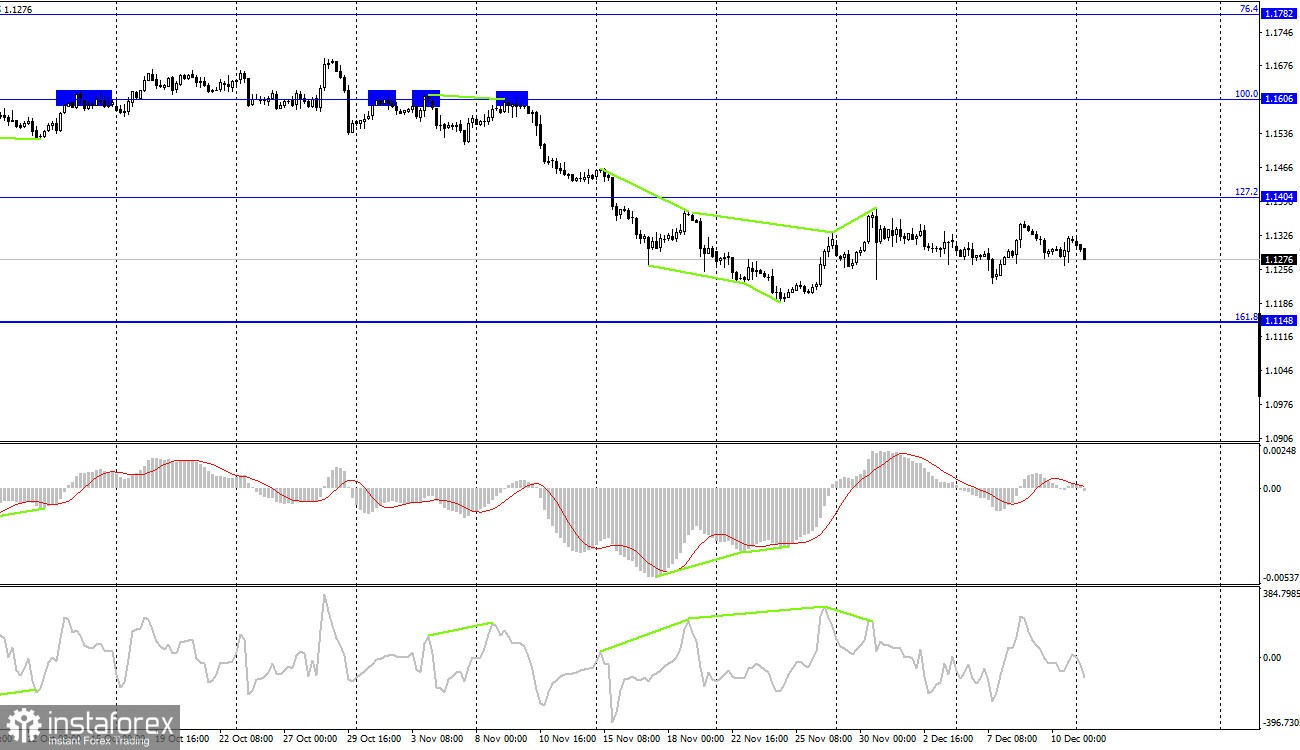

EUR/USD – 4H

On the 4-hour chart, the pair made a new reversal in favor of the US currency and started the process of falling towards the correction level of 161.8% (1.1148). However, it is better to pay more attention to the hourly chart now, as the graphical pattern is more accurate there. On the 4-hour chart the pair is traded between 1.1148 and 1.1404 and it is not trying to break any of the levels. Divergences could be guided by, but there are not any of them.

News calendar for US and EU:

On December 13 there will be no important economic events in the USA and the EU. Thus, the information background will have no influence on the traders' sentiment today.

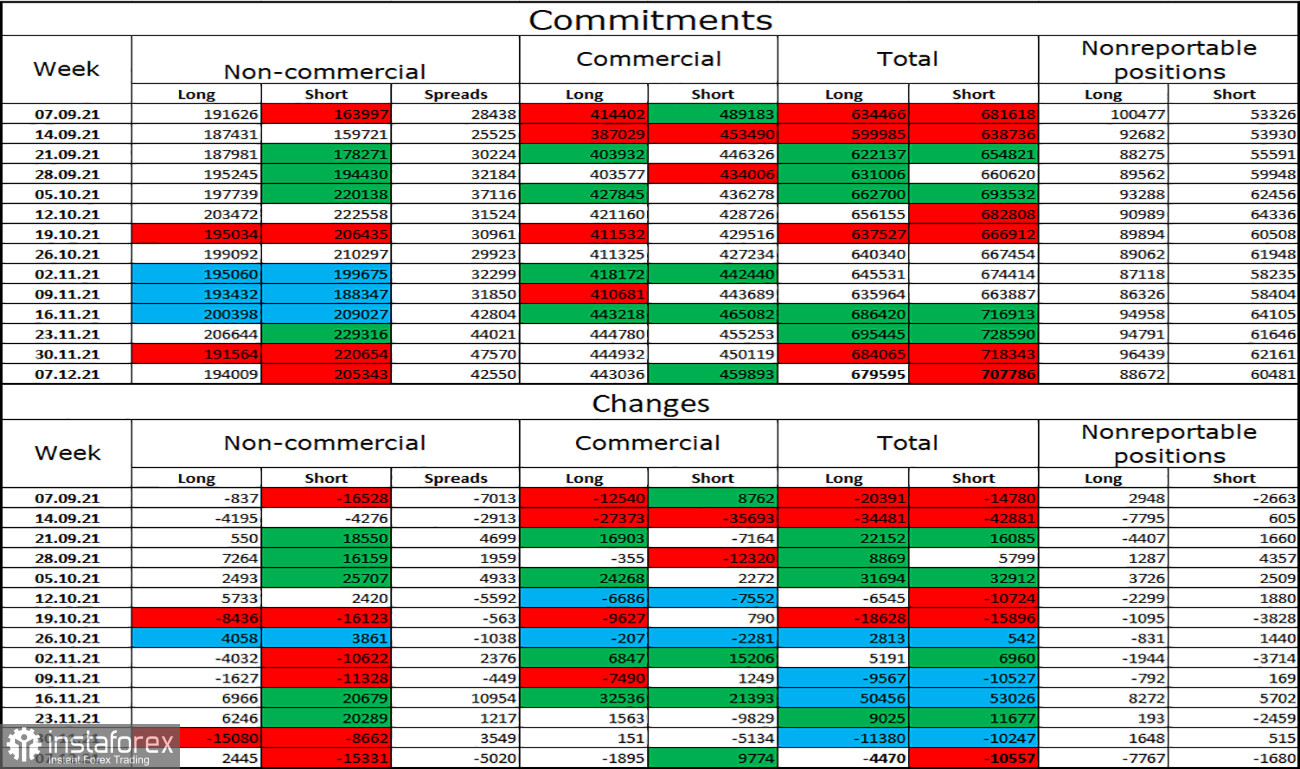

COT (Commitments of Traders) report:

The new COT report showed that the sentiment of the Non-commercial category traders became more bullish during the reporting week. Speculators increased Longs and also closed Short positions. In total, 2,445 long contracts on the euro currency were opened and 15,331 short contracts were closed. Thus, the total number of long contracts in the hands of speculators increased to 193,000, while the total number of short contracts decreased to 205,000. "The bearish mood among the most important category of traders remains but has weakened during the reporting week. Since it is still bearish, the euro is likely to fall further.

EUR/USD outlook and tips for traders:

Sales of the pair could be opened on a rebound from the level of 1.1357 on the hourly chart with a target of 1.1250. They can now be kept open. I recommend buying the euro at a close above the range on the hourly chart, with a target of 1.1450, or on a rebound from 1.1250 with a target of 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.