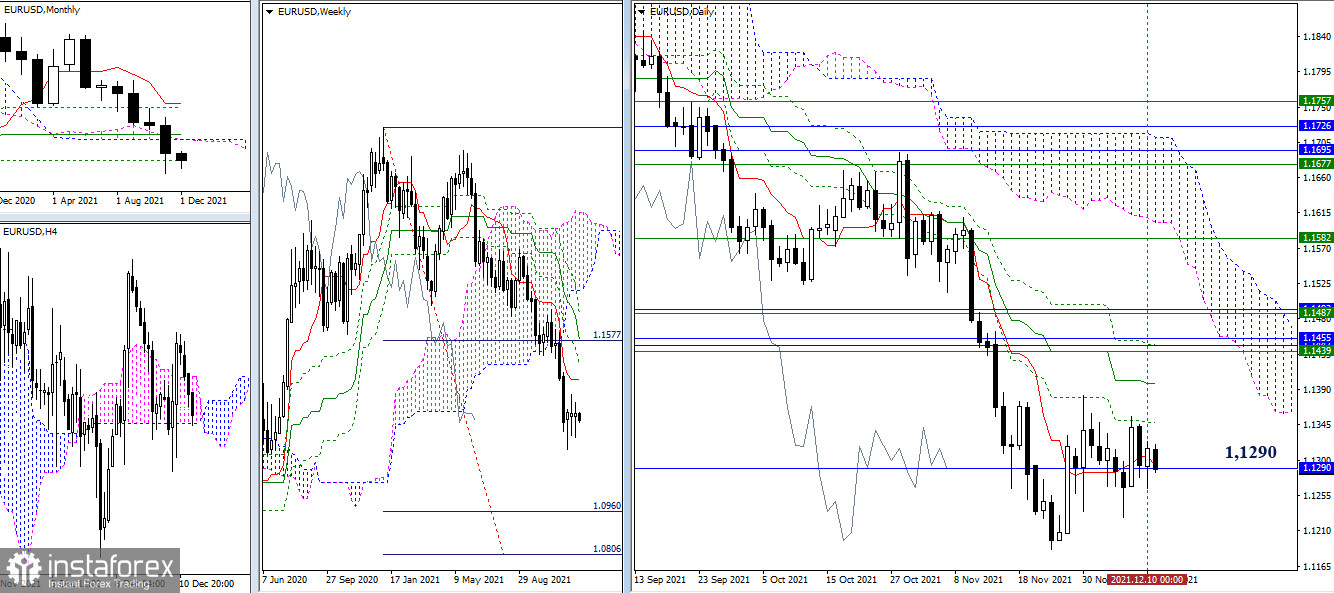

EUR/USD

The previous week closed with a candle of uncertainty again. As a result, the euro remains consolidating in the attraction and influence zone of the monthly level of 1.1290. To change the situation, the bulls should break through the nearest resistances of the daily cross (1.1348 - 1.1398) and overcome the accumulation of many strong levels of the week and month, united within 1.1439 - 1.1487. As for the bears, it is still most important for them to restore the daily and weekly downward trend, going beyond the minimum extreme of 1.1186. Further, the relevance will return to the downward targets for the breakdown of the weekly cloud (1.0960 - 1.0806).

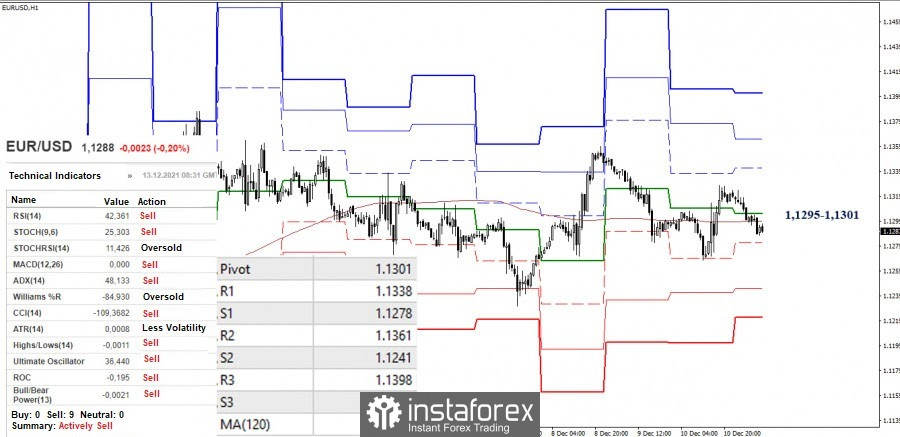

The uncertainty in the higher timeframes does not allow directional movement to form even at the smaller ones. The pair is moving around the key levels in the lower timeframes, which are set in the area of 1.1295 - 1.1301 (central pivot level + weekly long-term trend), interacting with the levels every day and remaining in their attraction zone. The classic pivot levels serve as additional intraday pivot points. The support levels of 1.1278 - 1.1241 - 1.1218 are important for the bears, while the resistances of 1.1338 - 1.1361 - 1.1398 are important for the bulls.

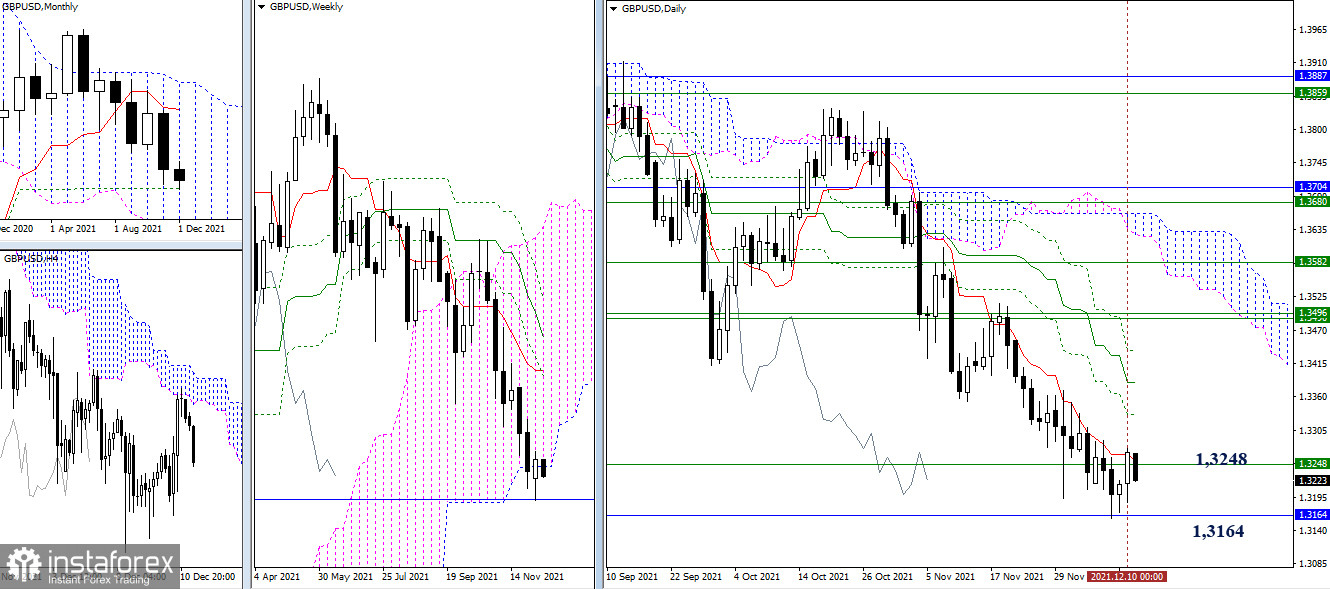

GBP/USD

The slowdown that emerged after testing the monthly level (1.3164) was able to be implemented in a weekly rebound, due to which the pound returned to the bullish cloud at the close of the week. The main task of the bulls now is to consolidate above 1.3248 (the lower limit of the weekly cloud + the daily short-term trend) and develop growth. The resistance on this path can be provided by the levels of the daily Ichimoku cross (1.3330 - 1.3383 - 1.3436 ). For the bears, the emergence of new prospects is still now associated with the breakdown of the monthly support of 1.3164.

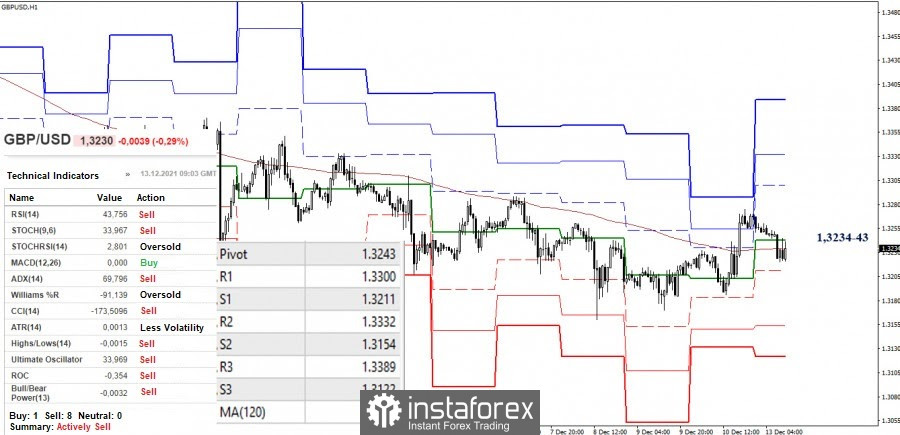

The interaction with key levels, which combine their efforts in the area of 1.3234-43 (central pivot level + weekly long-term trend) today, continues in the smaller timeframes. The result of the confrontation will form advantages. Trading above the levels will give preference to the upward traders, whose pivot points are located today at 1.3300 - 1.3332 - 1.3389. On the contrary, trading below the levels will strengthen the bearish mood. With the decline, stops can occur at the borders of 1.3211 - 1.3154 - 1.3122 (classic pivot levels).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.