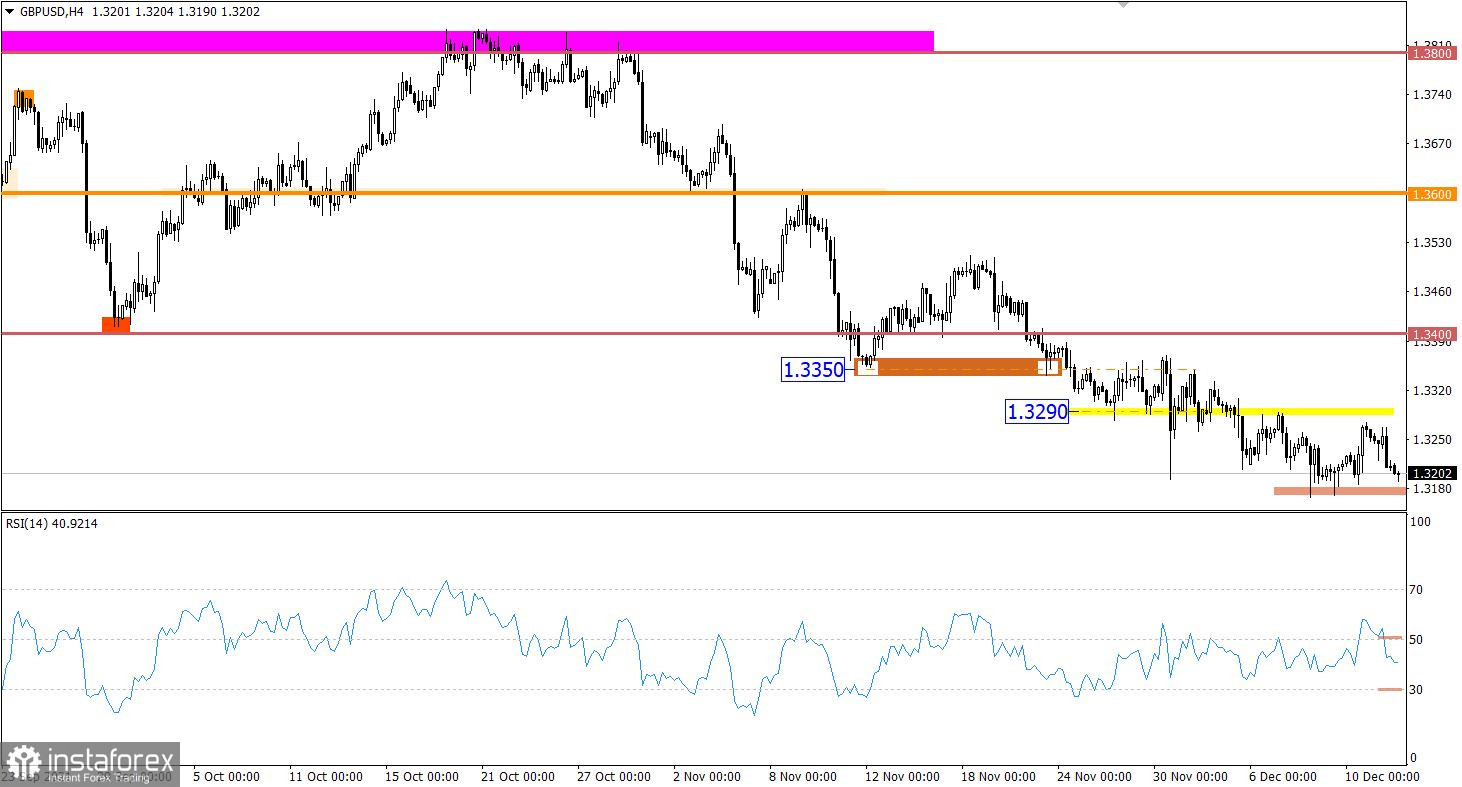

After the pound returned to the positions it was in before the US inflation report was released, the market essentially froze in place. Although some fluctuations were observed, not only are their scales incredibly modest, but there is no result either, since everything still returns to its original positions. Perhaps this is not surprising, because no one intends to take risks ahead of the meeting of the Federal Open Market Committee. Moreover, there is no complete certainty about its results.

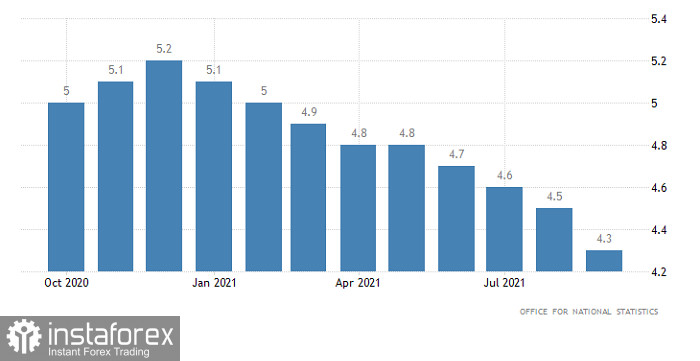

Nevertheless, the pound has good chances of growth in the first half of the day. It should be helped by data on unemployment, which in the United Kingdom may fall from 4.3% to 4.2%. And here the very fact of a decrease in unemployment is important, and not the scale of this process. However, one should not expect any serious growth. Due to the rather complete uncertainty about the outcome of tomorrow's meeting, and the associated fear of risk, growth will be rather symbolic.

Unemployment rate (UK):

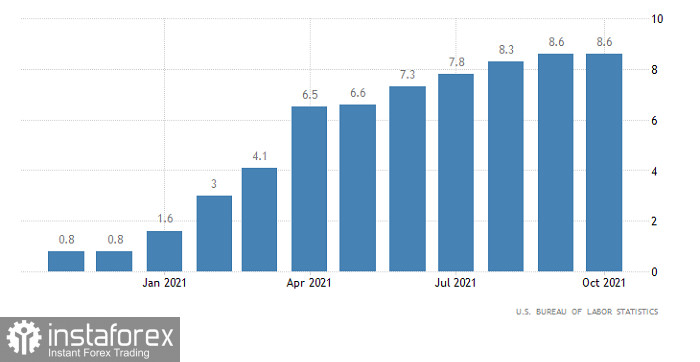

But the result will be exactly the same as yesterday. That is, the pound will then return to its original position. This will happen during the US trading session. The growth factor of the dollar may be the producer price index in the United States, which, by the way, should rise from 8.6% to 9.2%. This means that inflation, which has already reached a record level since the summer of 1982, is likely to continue to rise. In other words, the Federal Reserve is only adding more reasons for the earliest possible transition to a tighter monetary policy. And it is quite possible that this will be announced tomorrow.

Producer Price Index (United States):

The GBPUSD pair is moving within the bottom of the downward trend with a characteristic stagnation in the form of a short-term flat. This indicates a process of accumulation of trading forces, which, as a result, will lead to a natural acceleration in the market.

The technical instrument RSI in the four-hour period again moves in the lower area of the indicator 30/50. This may indicate an increase in the volume of short positions in the long term, which will lead to the prolongation of the downward trend.

On the chart of the daily period, there is a gradual change in the trend, where, on the basis of the downward cycle from the beginning of June, a path of 1000 points has been covered.

Expectations and prospects:

In order to receive a signal to sell the quotes, it is necessary to stay below the value of 1.3165 in a four-hour period. This will lead to an increase in the volume of short positions and, as a result, to the prolongation of the downward trend. Otherwise, a flat within 1.3200/1.3290 will remain on the market for some time.

Comprehensive indicator analysis gives a sell signal based on short-term, intraday and medium-term periods due to price movement within the trend base.