The gold market suffered from sluggish demand despite having a positive price environment, thanks to historically negative interest rates. This suggests that investors focused more on the Fed's tightening of policy, which began when they reduced monthly bond purchases in November.

Now, expectations have risen that the Federal Reserve will accelerate policy tapering and raise interest rates before the second half of next year. Many believe that rates will increase in June next year and rise four times all throughout the year.

Invesco CIO Kristina Hooper has suggested that once the Fed starts raising rates, the focus will be on how high those rates can go. "The 10-year yield will probably go up next year, but we don't see a dramatic rise," she said.

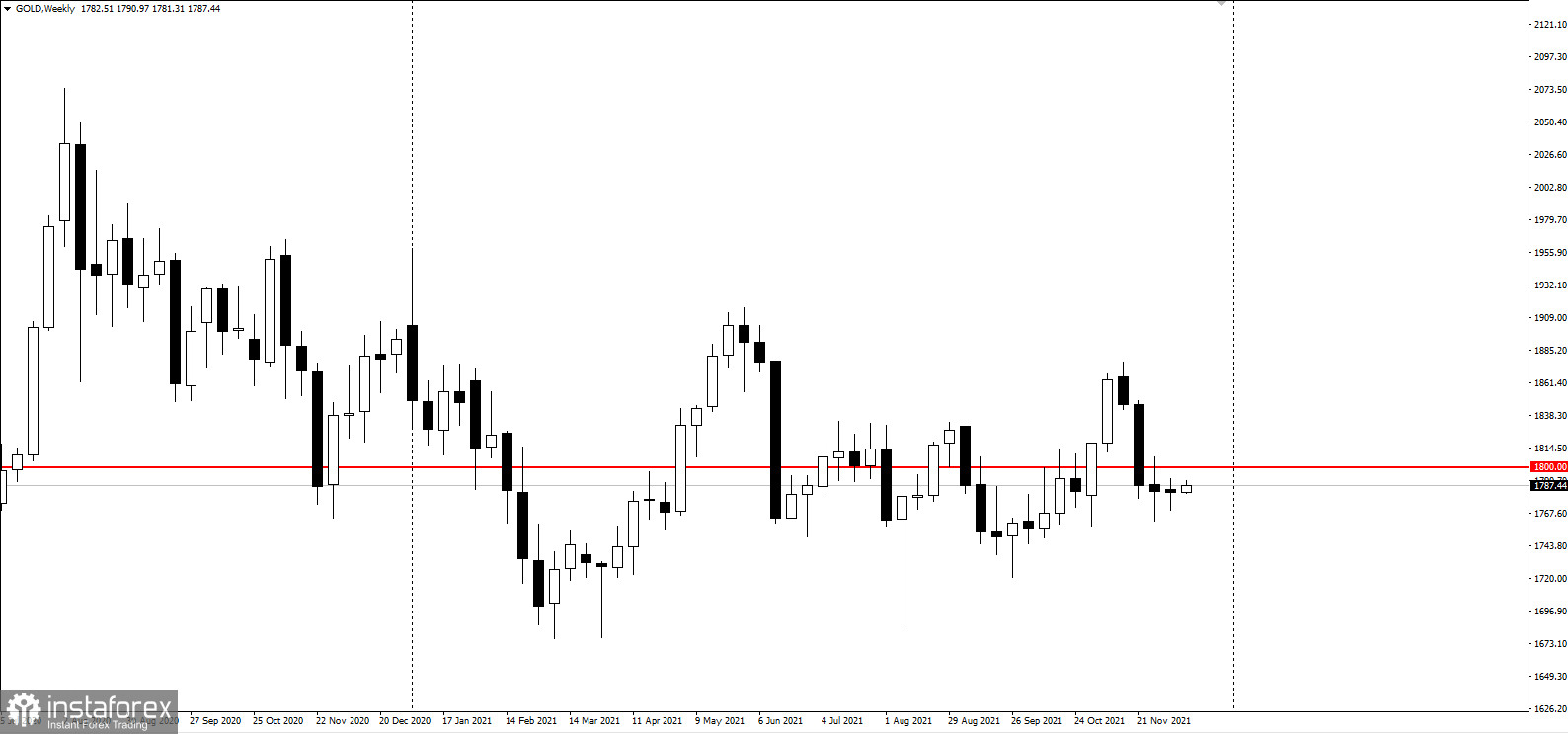

Hopper also noted that gold will remain flat next year, hovering around $ 1,800 per ounce.

Gold will also remain as an attractive inflation hedge and a safe-haven asset in a world facing growing geopolitical uncertainty. But Hopper added that US economic growth is supporting risky assets even if growth slows next year.

Meanwhile, Ole Hansen of Saxo Bank is more optimistic about the yellow metal next year. Although many investors were disappointed with gold's performance this year, Hansen said the market is holding up relatively well. The current price movement is some consolidation compared to the nearly 25% growth seen in 2020. He added that while the Federal Reserve's interest rate hike would push bond yields higher, real interest rates would remain negative.

Most economists believe that no matter how many times the Federal Reserve raises interest rates next year, they are unlikely to outpace the inflation curve.