As they say, everything in life is not easy, and then the topic of Omicron surfaced, which caused another wave of panic in the currency markets. Earlier, the decision of British Prime Minister B. Johnson to impose restrictions due to the spread of COVID-19 in the country did not raise concerns, but after the death of a person with the Omicron strain was reported, financial markets experienced a strong shock.

European trading platforms, as well as the US stock market, closed in the negative zone. Stock indices in the Asia-Pacific region are also falling today. All this is happening against the background of waiting for important news for investors – the results of the meeting of the Fed, the ECB, the Bank of England, and the Central Bank of Japan.

Investors are actually ready for the fact that the US regulator will not only actively reduce stimulus measures but will raise interest rates next year. In addition, the European Central Bank will most likely begin to do the same. It's hard to expect anything from Japan yet.

How will investors react today after the opening of trading in Europe?

It seems that the shock of the Omicron news is fading into the background. Futures on European and American stock indices are traded in the "green" zone and show a positive opening in trading both in Europe and in the United States.

We believe that after yesterday's local failure, market sentiment will improve today, which will lead to an increase in demand for risky assets. This also confirms the cessation of purchases by market participants of government bonds of economically strong countries as protective assets. So today, the yield of the benchmark 10-year treasuries is growing by 0.48%, to 1.431% after yesterday's collapse.

From the important economic data published today, we will highlight the publication of the value of industrial inflation in America. It is expected that the producer price index will surge from 8.6% to 9.2% in annual terms, but for the month in November, the indicator may slightly adjust in downward growth – up to 0.5% from 0.6%. If the figures presented turn out to be at least in line with expectations, and this is likely to be the case, then this will be another reason for J.P.'s tougher rhetoric. Powell will decide about an earlier increase in interest rates based on the results of the Fed meeting tomorrow.

Considering everything that is happening in the markets, we believe that we should expect an increase in positive sentiment in the stock and commodity markets today. But in the currency market, one should not expect any noticeable changes before the meetings of the Central Bank mentioned above.

Forecast:

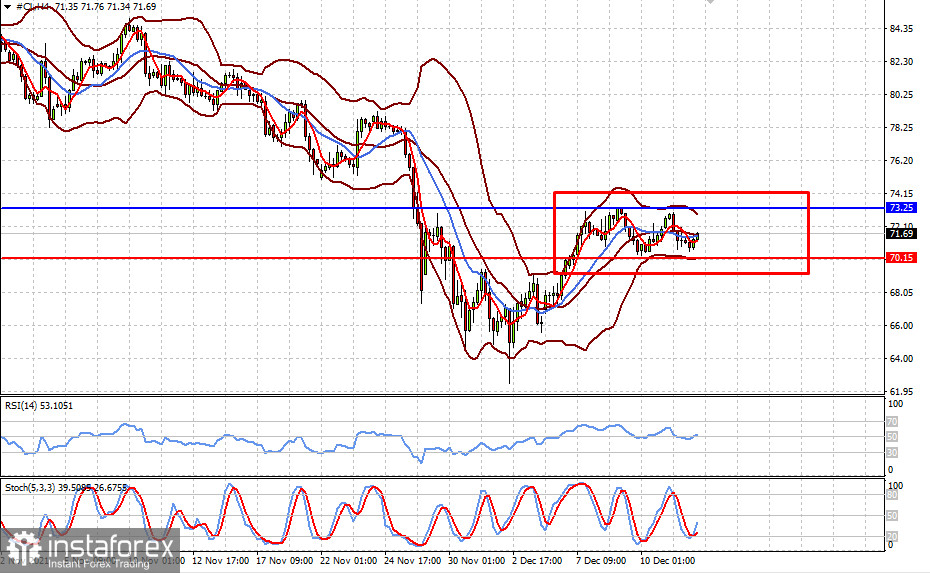

WTI crude oil is consolidating in anticipation of two important events – the outcome of the Fed's monetary policy meeting and the publication of updated data on oil and petroleum reserves in America. Taking this into account, we believe that the price will continue to consolidate in the range of 70.15-73.25.

Spot gold will also remain in the range of 1762.00-1793.00 until the result of the Federal Reserve meeting. Only a clear picture with the prospects for the timing of a rate hike in the US will set gold quotes in motion.