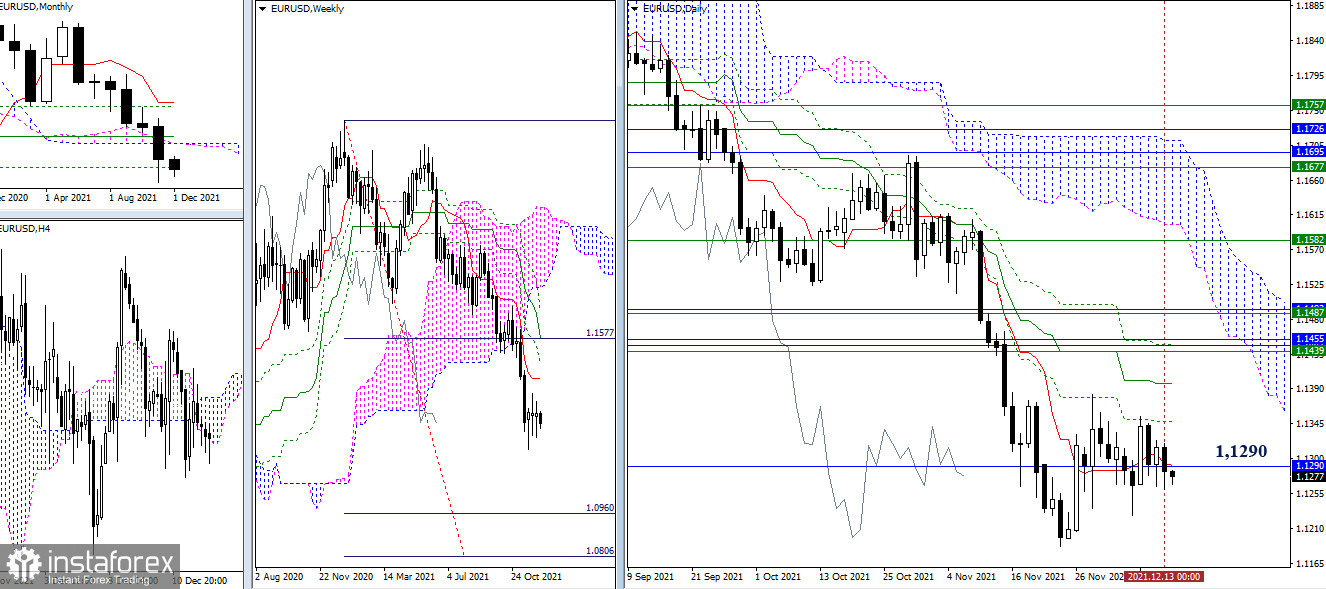

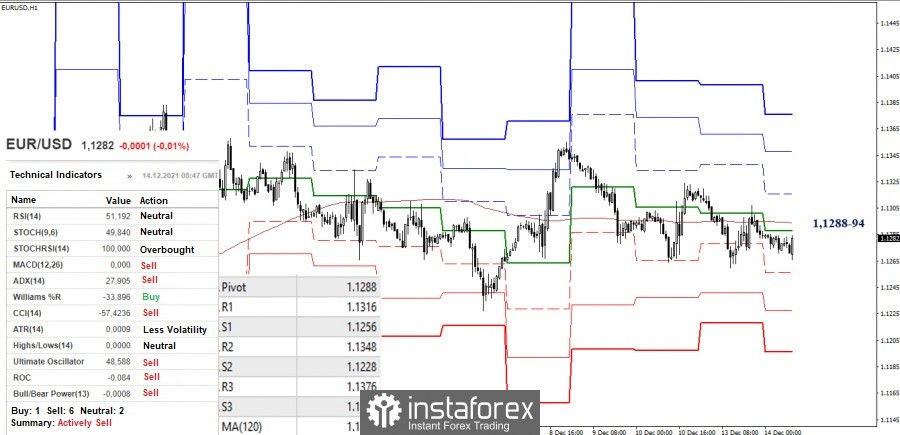

EUR/USD

A certain preponderance of forces was observed on the bearish side yesterday, but it was not possible to achieve results and possible changes. The pair remained in the attraction and influence zone of the monthly level of 1.1290. As a result, all conclusions and expectations retain their significance. The previously announced pivot points have not changed their location either. The nearest bearish reference is 1.1186 (minimum extreme). The first resistances of the bulls are the daily levels of 1.1348 and 1.1398.

The key levels (1.1288 central pivot level + 1.1294 weekly long-term trend) in the smaller timeframes continue to combine their efforts while remaining in the influence zone of the monthly border of 1.1290. Trading below the key levels provides some preponderance of the bears. Today, their intraday pivot points are located at 1.1256 - 1.1228 - 1.196 (support for the classic pivot levels). The levels above are in favor of strengthening the bullish mood. The intraday upward targets are set at 1.1316 - 1.1348 - 1.1376 (resistance of the classic pivot levels).

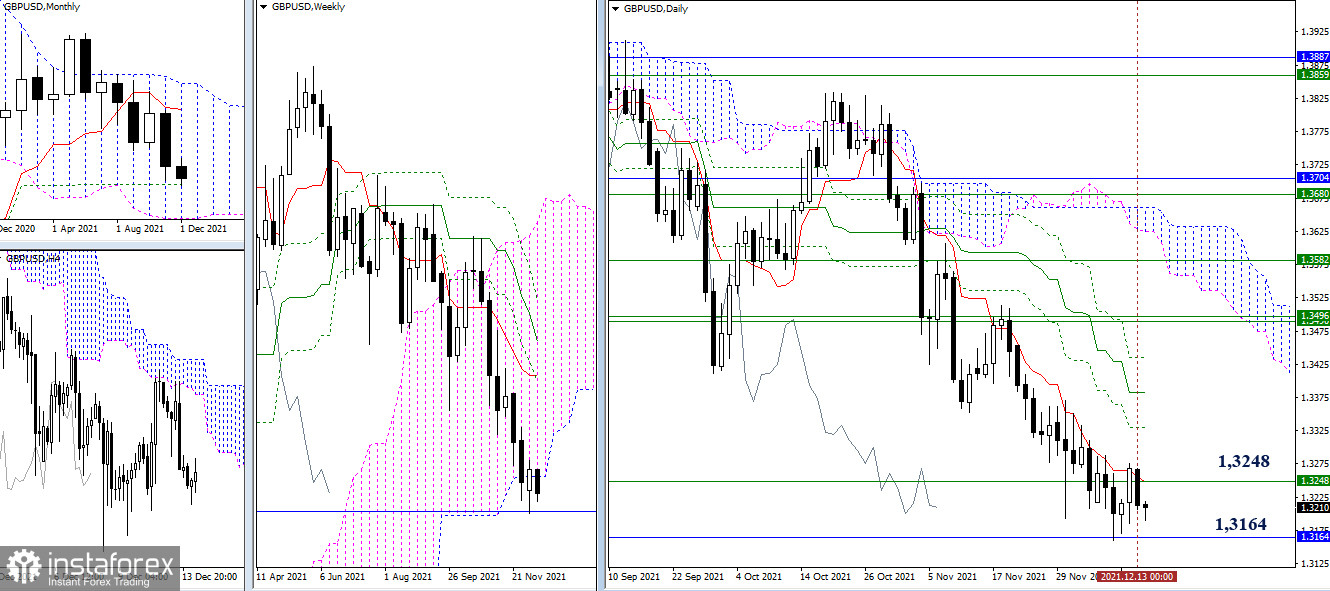

GBP/USD

On Monday, the bulls failed to confirm and develop the rebound outlined on Friday. The opponent used this to its advantage. However, it should be noted that the situation has not undergone significant changes. The two levels of 1.3248 (the lower limit of the weekly cloud) and 1.3164 (monthly Fibo Kijun) are still of primary importance. The result of the interaction, confirmed on the higher timeframes, will determine the subsequent prospects.

The key levels in the smaller timeframes are joining forces in the area of 1.3225-29 (central pivot level + weekly long-term trend) today. The situation with frequent changes in priorities persists, which allows uncertainties to dominate. The possession of levels gives some advantage to one of the parties. So at the time of analysis, the key levels are held by the bears. Further strengthening of bearish sentiment is breaking through the support of the classic pivot levels 1.3191 - 1.3168 - 1.3130. On the contrary, consolidation above 1.3225-29 will contribute to the return of possible activity of the bulls, whose pivot points can be noted at 1.3252 - 1.3290 - 1.3313.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.