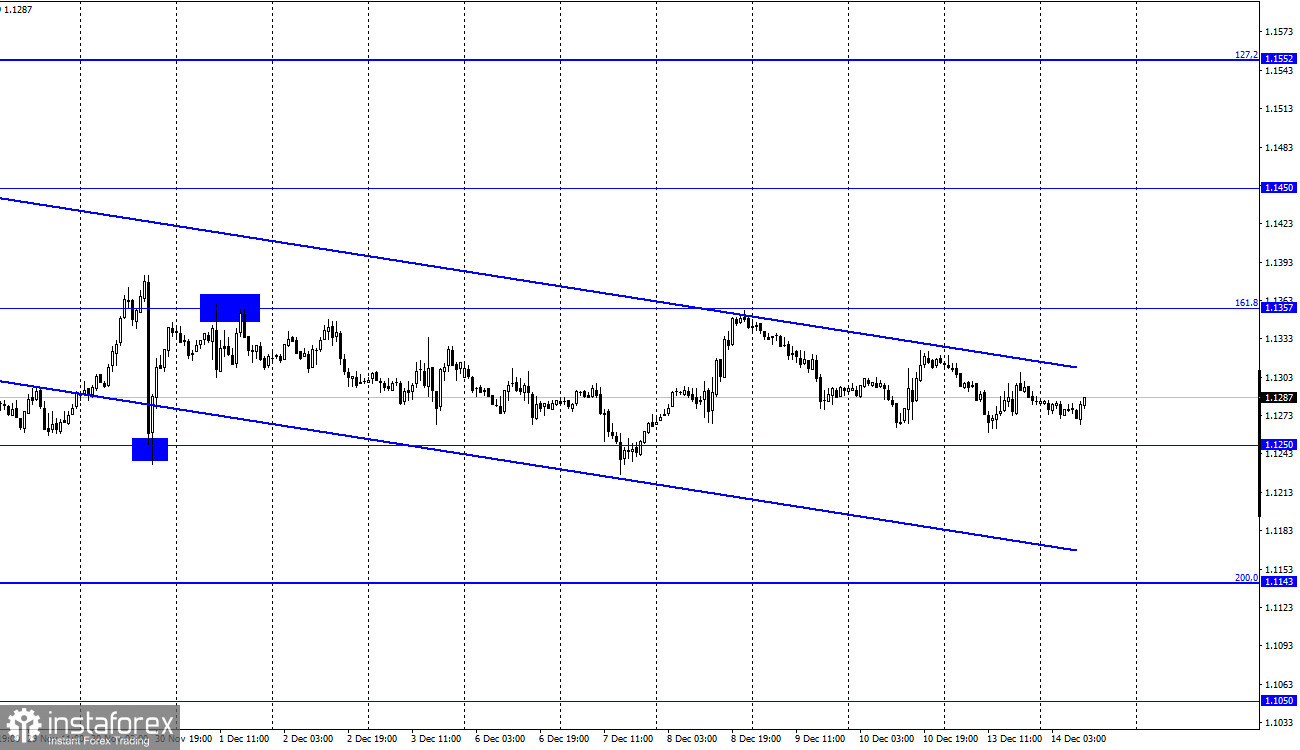

EUR/USD – 1H.

The EUR/USD pair completed a new drop towards 1.1250 on Monday, followed by a new rise towards the Fibonacci level of 161.8% (1.1357). Neither the first nor the second level was conquered by traders on December 13 and their activity left much to be desired. The downtrend corridor is still characterizing the sentiment of traders as bearish. There is no way the pair can perform a consolidation above it. On Monday, there was no information backdrop for the euro and the dollar. Thus, the activity may not have been very weak, but the trending movement of the pair was definitely absent. The situation will not be much better today. There is no information backdrop today. I expect the same uncertainty in Tuesday's trading. Traders are clearly waiting for the Fed meeting and its results, which are due tomorrow evening. I think that the pair is unlikely to make any strong moves before Wednesday evening. Traders say that the QE program will be cut by another $15bn. Some of them believe that the cut will be bigger. In either case, the US currency could experience an influx of new traders and rise. However, in addition to the decision on the QE program, the traditional press conference with Fed President Jerome Powell is due to take place as well as a dot-plot chart that shows the sentiment of Committee members regarding the interest rate. Notably, last time this chart was published, half of the Fed members thought there would be a rate hike next year. If the number increases this time, it will mean that the probability of a rate hike has increased. And with that, the US currency could continue its rise. Against this backdrop, there is not even a good reason to discuss the ECB and its monetary policy. I see enough reasons for the Fed to tighten its monetary policy and for the dollar to rise. I also see almost no reason for the Euro to rally and it is difficult to expect hawkish rhetoric and action from the ECB at the moment.

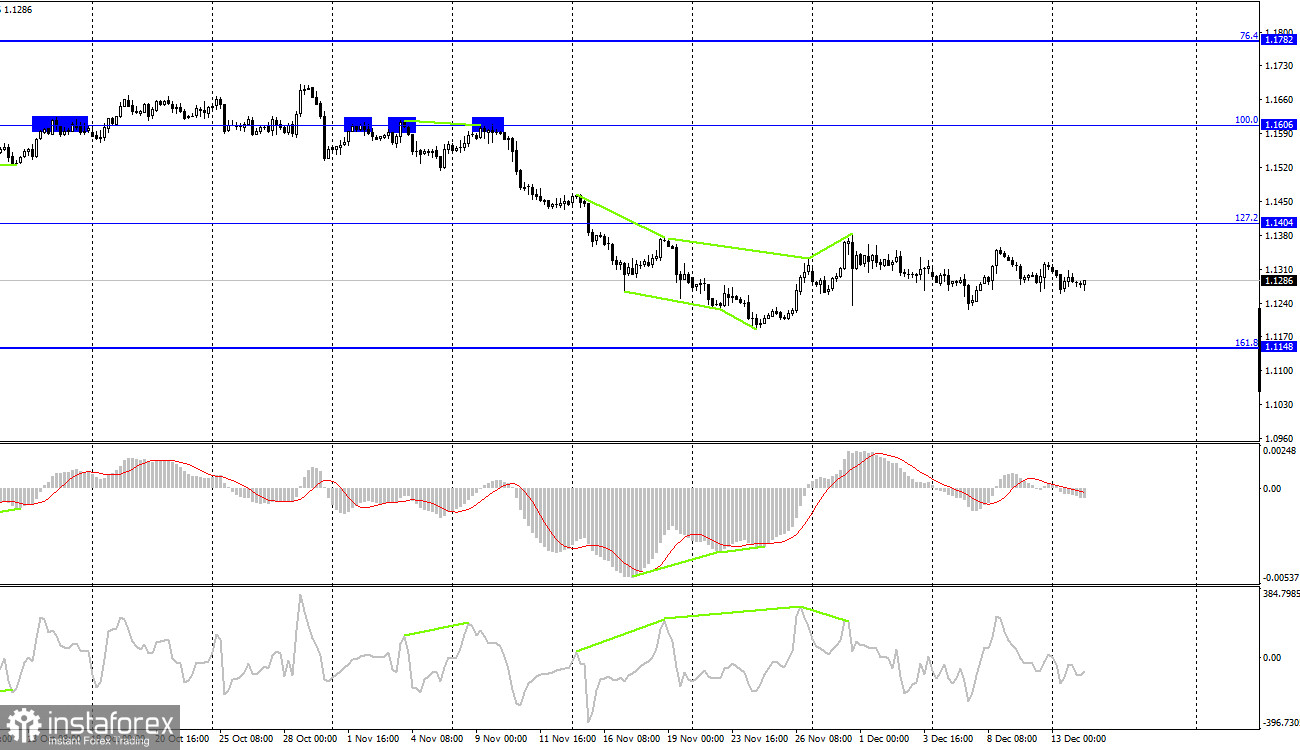

EUR/USD – 4H

On the 4-hour chart, the pair made a new reversal in favor of the US currency and started the process of falling towards the correction level of 161.8% (1.1148). However, it is better to pay more attention to the hourly chart now, as the graphical pattern is more accurate there. On the 4-hour chart, the pair is traded between 1.1148 and 1.1404 and it is not trying to break any of the levels.

News calendar for US and EU:

EU - Industrial Production Change (10-00 UTC).

US - Producer Price Index (13-30 UTC).

On December 14 news calendars in the US and the EU contain one entry event that can hardly be called important. The information backdrop will be very weak today.

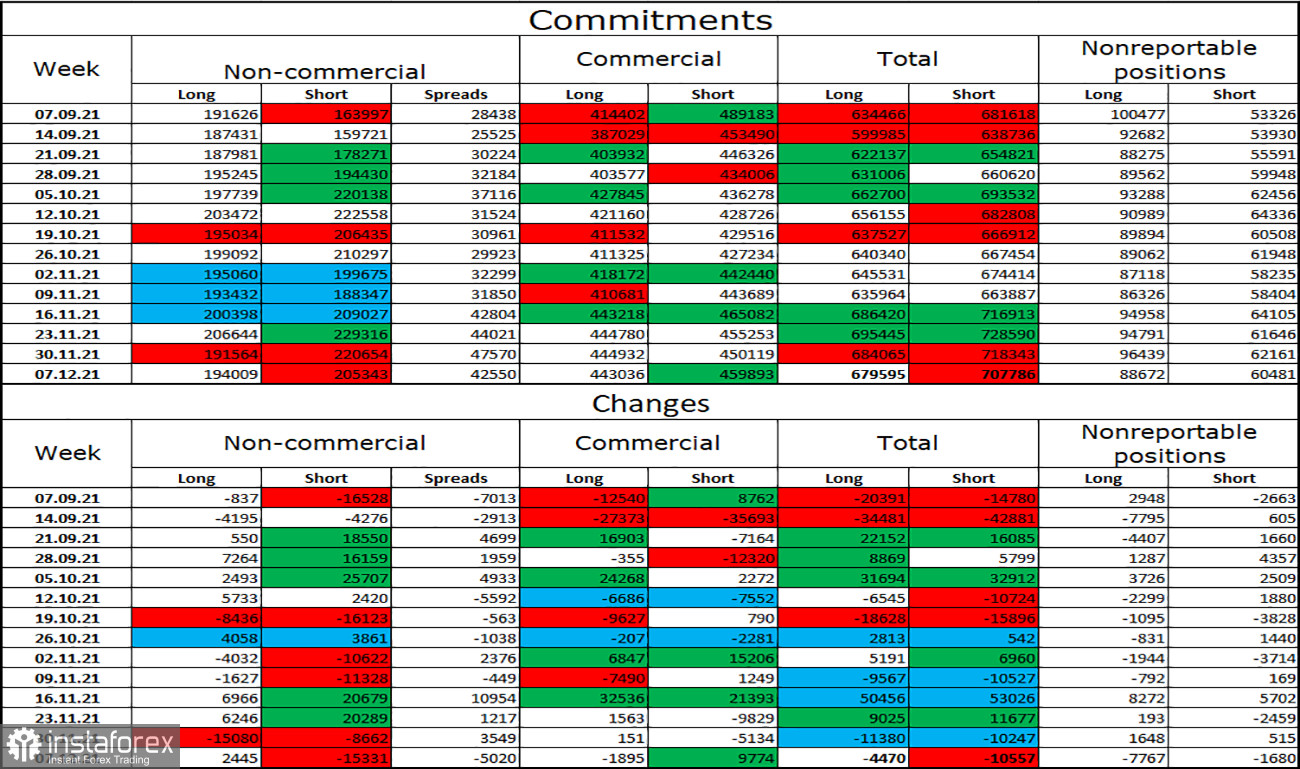

COT (Commitments of Traders) report:

The new COT report showed that the sentiment of the Non-commercial category traders became more bullish during the reporting week. Speculators increased Longs and also closed Short positions. In total, 2,445 long contracts on the euro currency were opened and 15,331 short contracts were closed. Thus, the total number of long contracts in the hands of speculators increased to 193,000, while the total number of short contracts decreased to 205,000. "The bearish mood among the most important category of traders remains but has weakened during the reporting week. Since it is still bearish, the euro is likely to fall further.

EUR/USD outlook and tips for traders:

Sales of the pair could be opened on a rebound from the level of 1.1357 on the hourly chart with a target of 1.1250. They can now be kept open. I recommend buying the euro at a close above the range on the hourly chart, with a target of 1.1450, or on a rebound from 1.1250 with a target of 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.