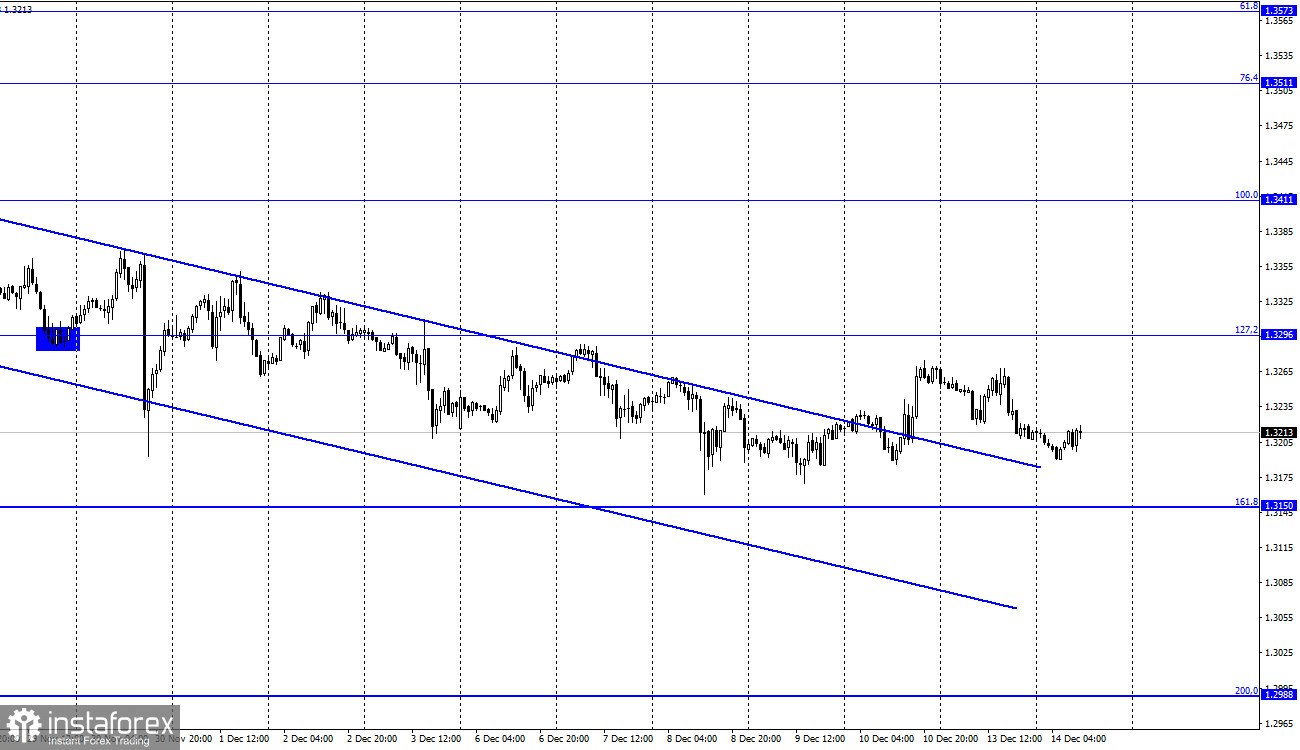

GBP/USD on H1

Hello, dear traders! On Monday, the GBP/USD pair reversed downwards on the hourly chart and headed towards 1.3150, the 161.8% Fibonacci level. At the same time, a day earlier, the pair closed above the downtrend corridor, which should have changed traders' sentiment to bullish. It seems that the closure above the corridor has been false and the British currency is about to collapse again. By the way, this is the most likely scenario. The Fed meeting will end tomorrow and its outcome will be announced. As I have already mentioned, there are many reasons for the US dollar to start gaining value again after the Fed's meeting. The regulator is highly likely to tighten monetary policy and make it clear that interest rates will be raised next year. As for the meeting of the Bank of England to be held on Thursday, it will hardly provide traders with hawkish comments that would allow them to buy the pound sterling. Moreover, the latest statements by Andrew Bailey and Michael Saunders indicate that the Bank of England will not make any important decisions in December. Thus, there is a 99% chance of the Fed tightening its policy and the Bank of England sticking to its existing policy. So, which pair of the two is expected to advance? Please remember that market participants may perceive information in a different way. However, in order for the British pound to gain value and the US dollar to fall, the Fed or the Bank of England's comments should come as a surprise to investors. Alternatively, traders may react to the outcome of the meetings in an opposite way. Today, Great Britain has already released data on unemployment and jobless claims. Both indicators turned out to be better than market expectations. Amid this news, the British pound could have gained upside momentum but failed again. I think that bulls will most likely return to the market only if some important information from the Fed or the Bank of England supports the pound sterling.

GBP/USD on H4

On the 4-hour chart, the pair bounced off 1.3274, the 61.8% Fibonacci level, and formed a bearish divergence according to the CCI indicator. Therefore, we can count on a resumed downward movement towards 1.3044, the 76.4% Fibo level. If the price consolidates above the level of 1.3274, the British currency will have a chance of rising to the 50% Fibonacci level, 1.3457. Market sentiment is the same as on the hourly chart. It remains bearish.

Macroeconomic calendar:

Britain - Claimant count change

Britain - Claimant count rate

Britain - Average earnings index

The US - Producer price index

All the reports from Britain scheduled for today have already been released. Later, the US will publish data on producer prices, but this report will hardly have an impact on market sentiment.

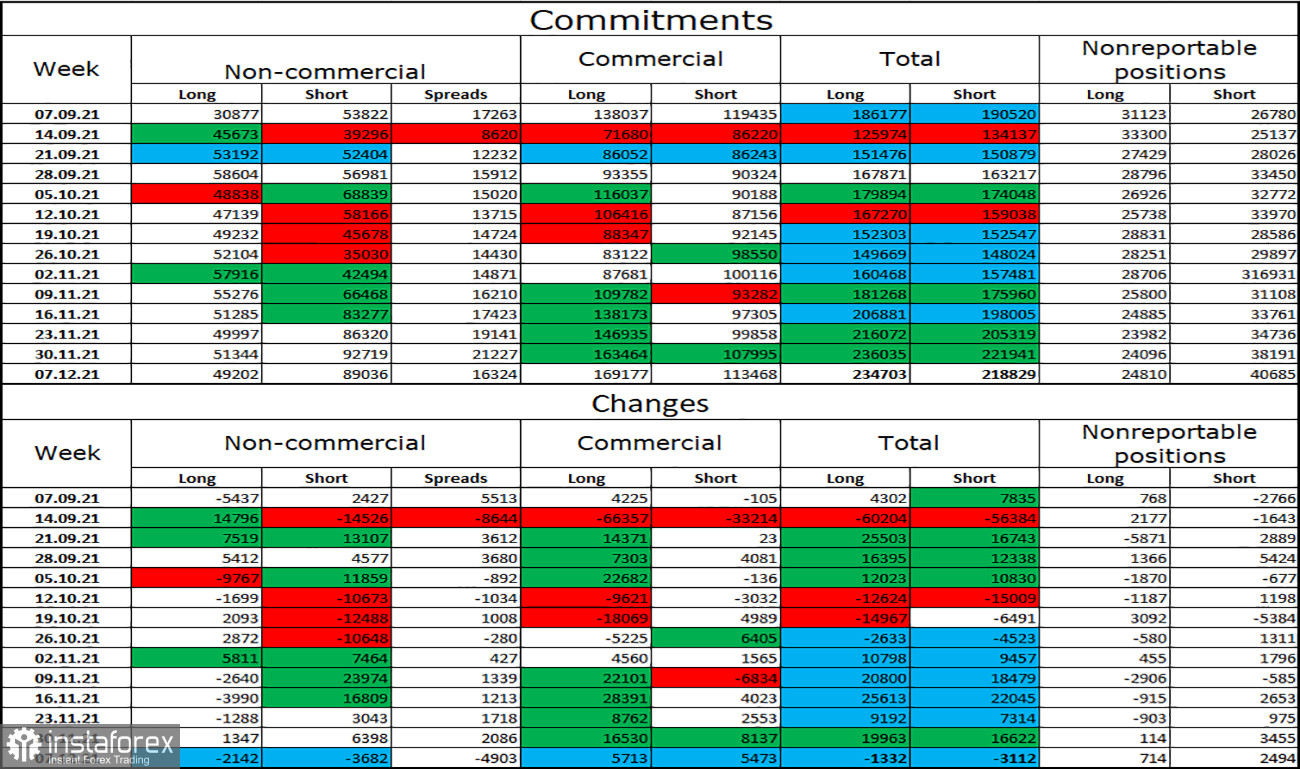

COT (Commitments of traders) report:

The latest COT report released on December 7 showed that sentiment of major market players remained largely unchanged. The quotes have been trading in a bearish trend for five weeks in a row. During the reporting week, speculators closed 2,142 long contracts and 3,682 short contracts. However, the total number of short contracts in the "Non-commercial" category is now almost twice as high as the number of long contracts. Thus, it can be concluded that the situation has not changed. The pound sterling continues to trade downwards.

GBP/USD forecast and recommendations for traders:

New long positions on the British pound can be considered if the price closes above 1.3274 on the 4-hour chart. In this case, the levels of 1.3296 and 1.3411 can be seen as targets. Earlier, I recommended opening short positions with a view to reaching the target level of 1.3150 in case the price closed below 1.3274, but the bullish divergence canceled that signal. So I think it would be a wise decision to hold off going short.

TERMS:

"Non-commercial" - major market players such as banks, hedge funds, investment funds, private, and large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.