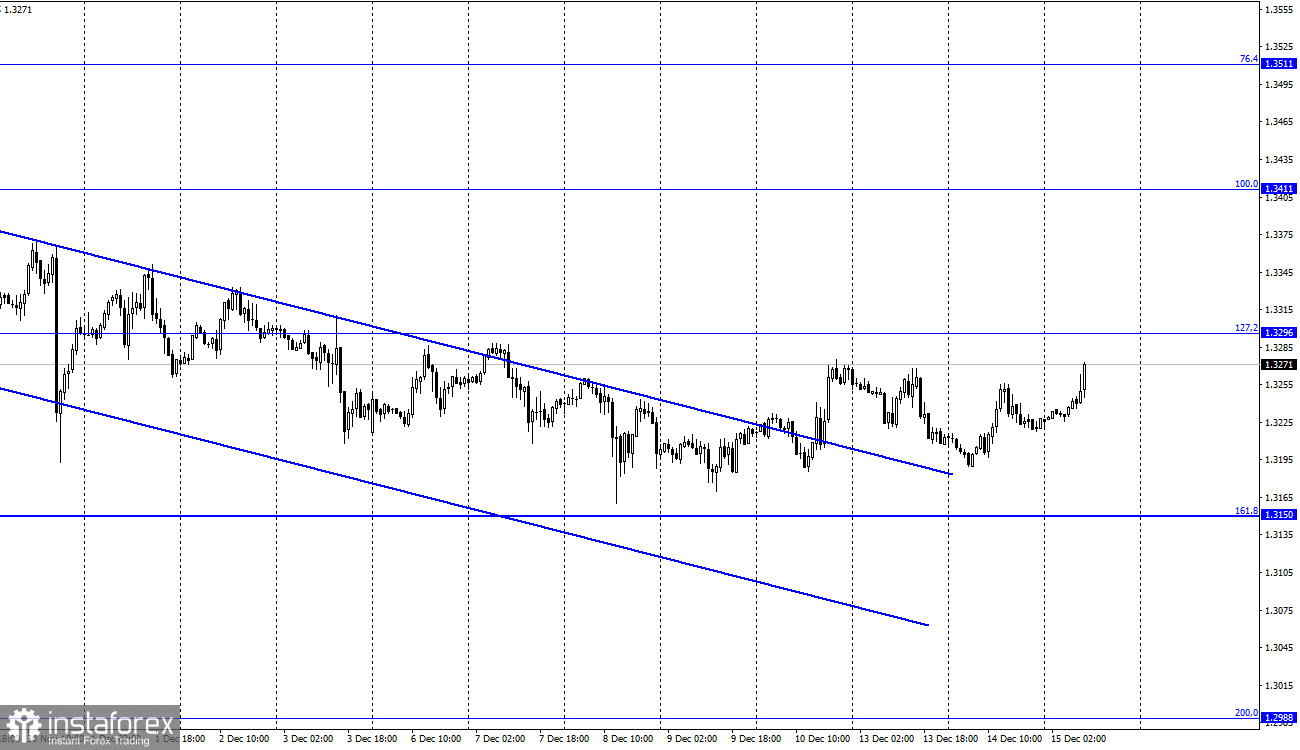

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the British on Tuesday and a new attempt to start a new bullish trend. The process of growth of quotes continues at the moment in the direction of the corrective level of 127.2% (1.3296). The rebound of the pair's exchange rate from this level will allow us to count on a reversal in favor of the US currency and a slight drop in the direction of the corrective level of 161.8% (1.3150). Closing above the level of 1.3296 will increase the chances of further growth in the direction of the Fibo level of 100.0% (1.3411). Meanwhile, traders continue to expect not only the results of the FOMC meeting, which will be announced tonight but also the denouement of many other topics and events. For example, tomorrow the results of the meeting of the Bank of England will be summed up. In addition, negotiations between Brussels and London on the customs regime on the border of Northern Ireland are continuing. In addition to this, the Anglo-French conflict based on illegal migration and the fish issue persists.

But the most important thing today will be the outcome of the FOMC meeting and all related events. I have already said that the probability of the growth of the US currency after the meeting is high, but not one hundred percent. And while traders are waiting for the end of the meetings of the Fed and the Bank of England, the IMF has published its economic forecast, which says that UK GDP may grow by 6.8% by the end of 2021, and by 5% in 2022. The IMF also believes that inflation will continue to accelerate and reach its peak of 5.5% in the spring of 2022. The Fund also believes that economic growth will slow down slightly in the coming months, which is due to the introduction of small restrictions due to omicron. The IMF also warned that to reduce inflation, the British regulator will have to raise interest rates. However, as we know from the Governor of the Bank of England, Andrew Bailey, the probability of a rate hike at the December meeting is extremely low. In Britain, they are afraid of the serious consequences of omicron and prefer to wait for these very consequences first, and only then make adjustments to monetary policy.

GBP/USD – 4H.

On the 4-hour chart, the pair performed a return to the corrective level of 61.8% (1.3274). A new rebound of quotes from this level will again allow us to count on a reversal in favor of the US currency and a slight drop in the direction of the Fibo level of 76.4% (1.3044). Fixing the pair's rate above the level of 61.8% will work in favor of continuing growth towards the next Fibo level of 50.0% (1.3457). There are no brewing divergences today.

News calendar for the USA and the UK:

UK - consumer price index (07:00 UTC).

US - change in retail trade volume (13:30 UTC).

US - FOMC decision on the main interest rate (19:00 UTC).

US - economic forecast from FOMC (19:00 UTC).

US - accompanying FOMC statement (19:00 UTC).

US - FOMC press conference (19:30 UTC).

On Wednesday, the UK has already released a report on inflation, which rose to 5.1% y/y. The morning growth of the British is associated with this report. All the most interesting things are planned for Wednesday evening. The information background will have a strong influence on the mood of traders today.

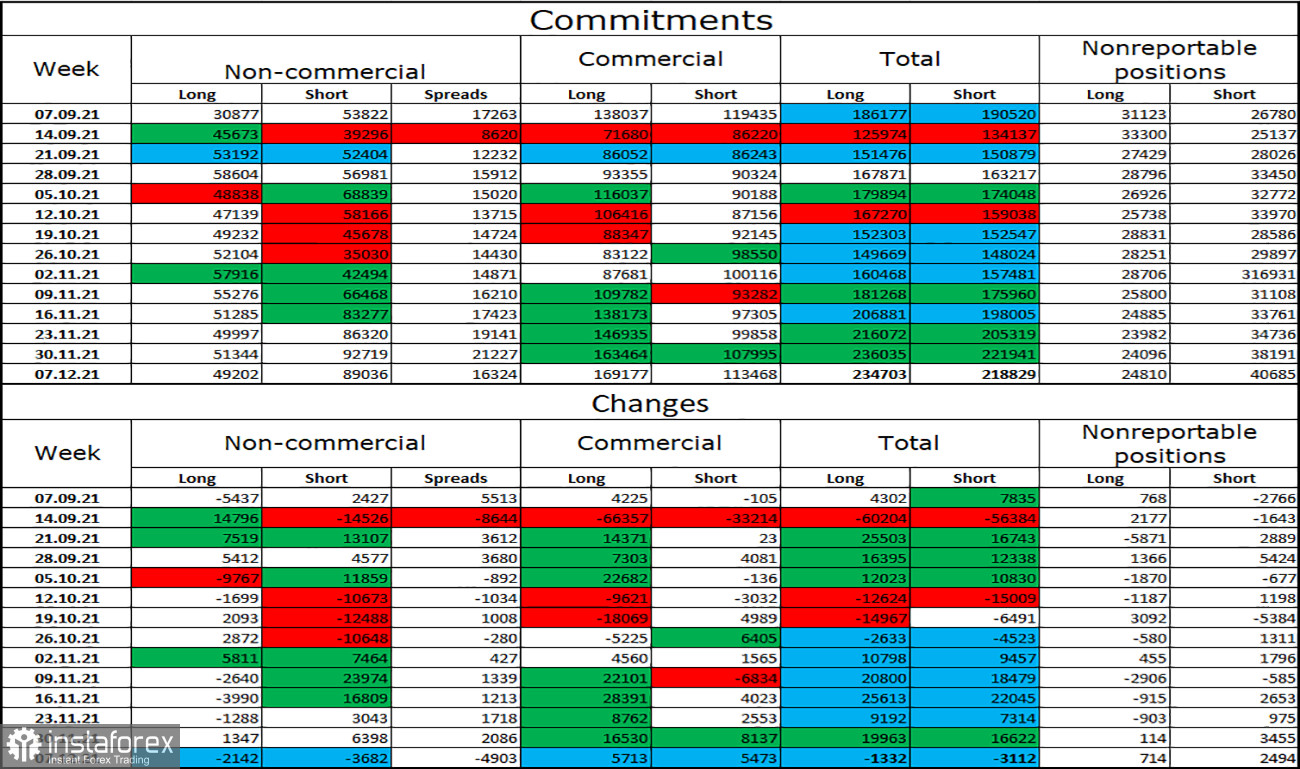

COT (Commitments of Traders) report:

The latest COT report from December 7 on the British showed that the mood of the major players has not changed much. The trend of strengthening the "bearish" mood has been observed for five weeks in a row, and now it persists. In the reporting week, speculators closed 2,142 long contracts and 3,682 short contracts. However, the total number of short contracts in the "Non-commercial" category of traders is now almost twice as high as the number of long contracts. Thus, based on the results of the next week and the next COT report, I cannot conclude that the situation for the Briton has improved at least a little. He can continue the process of falling.

Forecast for GBP/USD and recommendations to traders:

I recommend new purchases of the British if the 4-hour chart closes above the level of 1.3274 with targets of 1.3296 and 1.3411. I recommended selling the pair when closing below the level of 1.3274 with a target of 1.3150, but the "bullish" divergence canceled this signal. I do not recommend rushing with new sales.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.