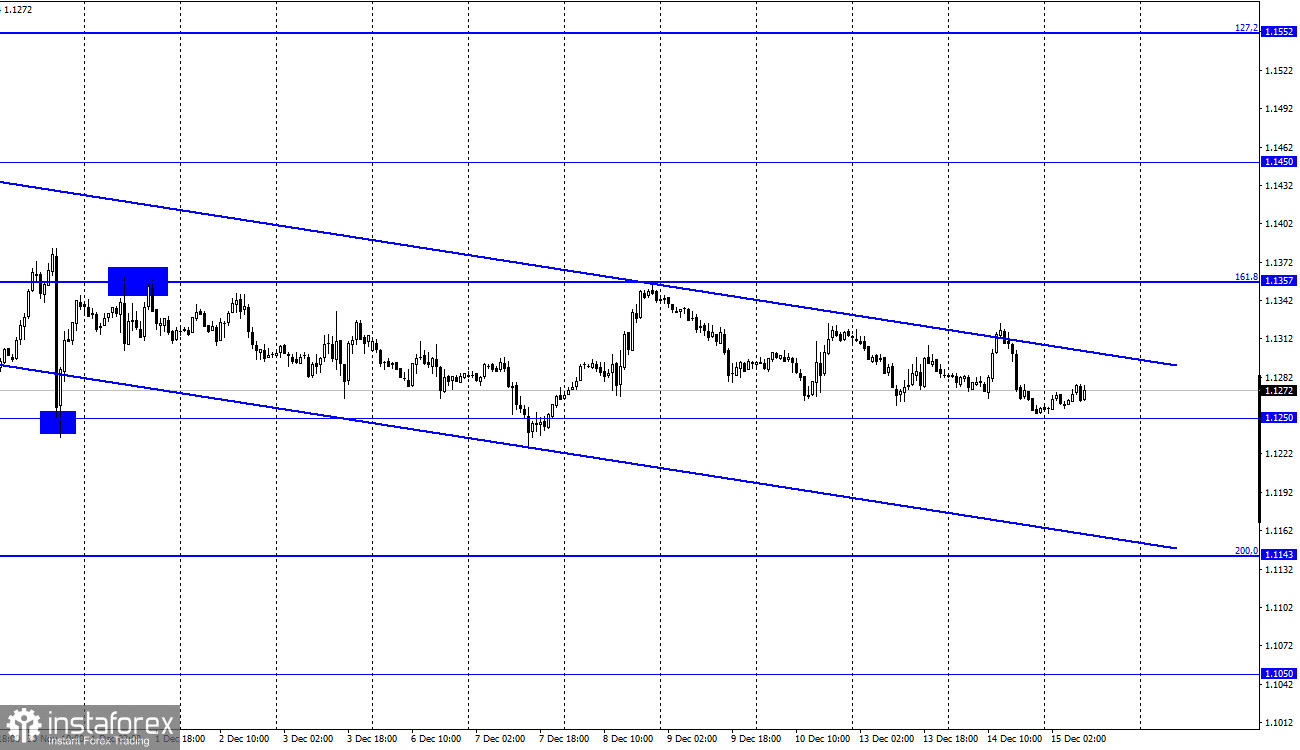

EUR/USD – 1H.

Hi, dear traders!

On Tuesday, EUR/USD failed to close above the descending channel and reversed downwards towards 1.1250, stopping 4 pips above it. If the pair consolidates below 1.1250, it could decline further towards the next retracement level of 200.0% (1.1143). There is currently a bearish trend, but trader sentiment could change under the influence of the upcoming Fed meeting. The Federal Reserve is expected to accelerate the wind down of its bond-buying program, which should give support to USD and push the pair down.

However, market reaction to the Fed's policy decisions is sometimes counterintuitive. The Fed is also due to release economic projections for 2022-2023, as well as the dot plot mapping out each FOMC members' outlook for the interest rate. At the press conference after the meeting, Jerome Powell is expected to reveal the Fed's position on high inflation, as well as the regulator's plans regarding QE tapering and the rate hike. In this situation, no matter what the results of the FOMC meeting are, it is impossible to say with absolute certainty that USD would rise. A dovish speech by Powell could nullify the effect of a hawkish policy shift by the Fed.

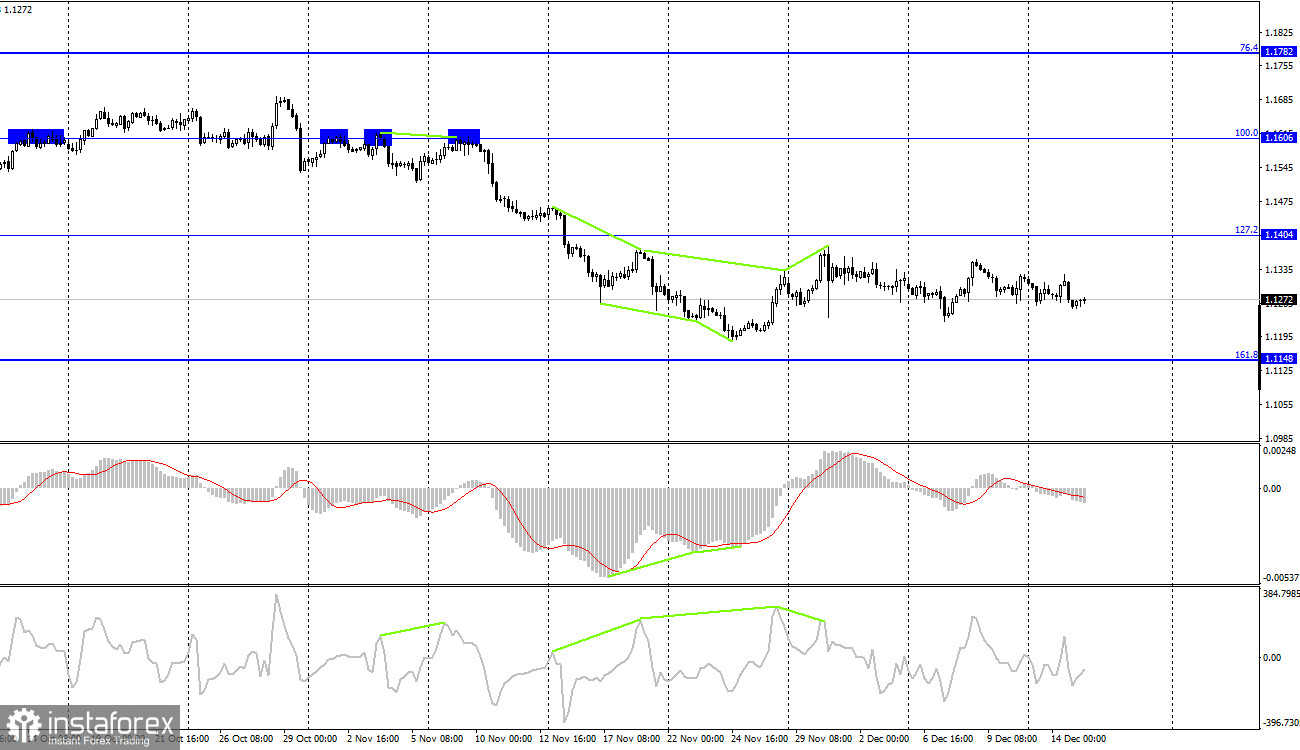

EUR/USD – 4H

According to the 4H chart, EUR/USD reversed downwards, moving towards the retracement level of 161.8% (1.1148). The pair is currently trading in the 1.1148-1.1404 range, without testing either level. The 1H chart offers more precise information on the pair's dynamics at the moment. There are no emerging divergences at this point.

US and EU economic calendar:

US - Retail sales data (13-30 UTC).

US - FOMC rate decision (19-00 UTC).

US - FOMC economic projections (19-00 UTC).

US - FOMC statement (19-00 UTC).

US - FOMC press conference (19-30 UTC).

There are no important events in the EU today. The FOMC meeting and the US retail sales data could significantly influence traders late in the afternoon.

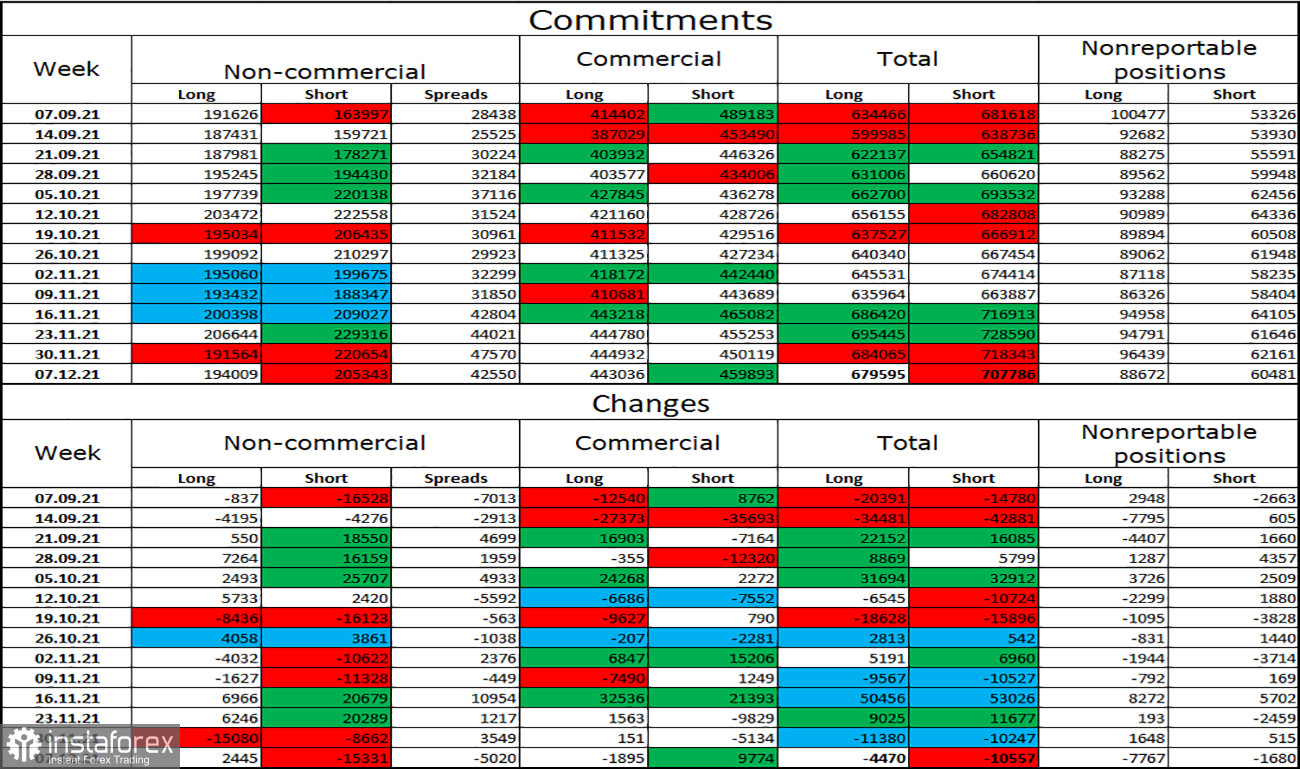

COT (Commitments of traders) report:

The latest COT report indicates an increasingly bullish sentiment among Non-commercial traders. Market players opened 2,445 Long positions and closed 15,331 Short positions. The total amount of Long positions rose to 193,000, while the number of Short positions declined to 205,000. The dominantly bearish mood among investors continues, indicating that EUR/USD could continue its downward movement. However, the downtrend weakened during the week.

EUR/USD outlook:

Traders were advised to close short positions near 1.1250. Opening new short positions could be possible if the pair closes below 1.1250 targeting 1.1143. Long positions could be opened if EUR/USD closes above the trend channel at the 1H chart targeting 1.1357 and 1.1450, or if it bounces off 1.1250 targeting 1.1357.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.