Bitcoin is once again in demand among investors at $48,000. The data confirms the largest increase in purchases since March 2020.

In his tweet, last December 14, analyst Willy Woo highlighted a key trend that had previously been absent from the bitcoin market for over 18 months.

Retail investors are buying up bitcoins the same way they did in March 2020

After the collapse to $3,600 in March 2020, the main cryptocurrency was in demand among those who could and were willing to invest. Now the same trend has returned to the market. Changes in the balances of wallets containing 1 BTC or less, usually owned by small investors, peaked since March 2020.

Circumstances remain the same. Fears about the coronavirus and instability in the global market remain due to uncertainty around the tightening of monetary policies by central banks. However, the main difference between late 2021 and March 2020 is that bitcoin is worth $48,000, not $3,600.

However, if the retail savings conclusions are correct, the bullish breakout rates are higher.

"The last time retail bought the dip this hard was at the bottom of the COVID crash," Woo commented.

As Cointelegraph reported this week, existing larger holders continue to exhibit mixed behavior at current price levels. While some are selling, whales are more cautious of giving up BTC.

'Smart' and 'dumb' money at record levels

Meanwhile, the share of long-term investors has reached a record high compared to short-term market participants.

According to the so-called 'Smart Money Gap' indicator, which is composed of data from the analyst firm Glassnode, there has never been a greater gap between the amount of BTC held by 'smart' and 'dumb' money - long-term and short-term buyers.

Throughout bitcoin's history, local peaks in the metric have marked the beginning of a bullish rally, marking a local price bottom.

Can this be taken as a signal that the main cryptocurrency can start the next bullish round from the current local bottom?

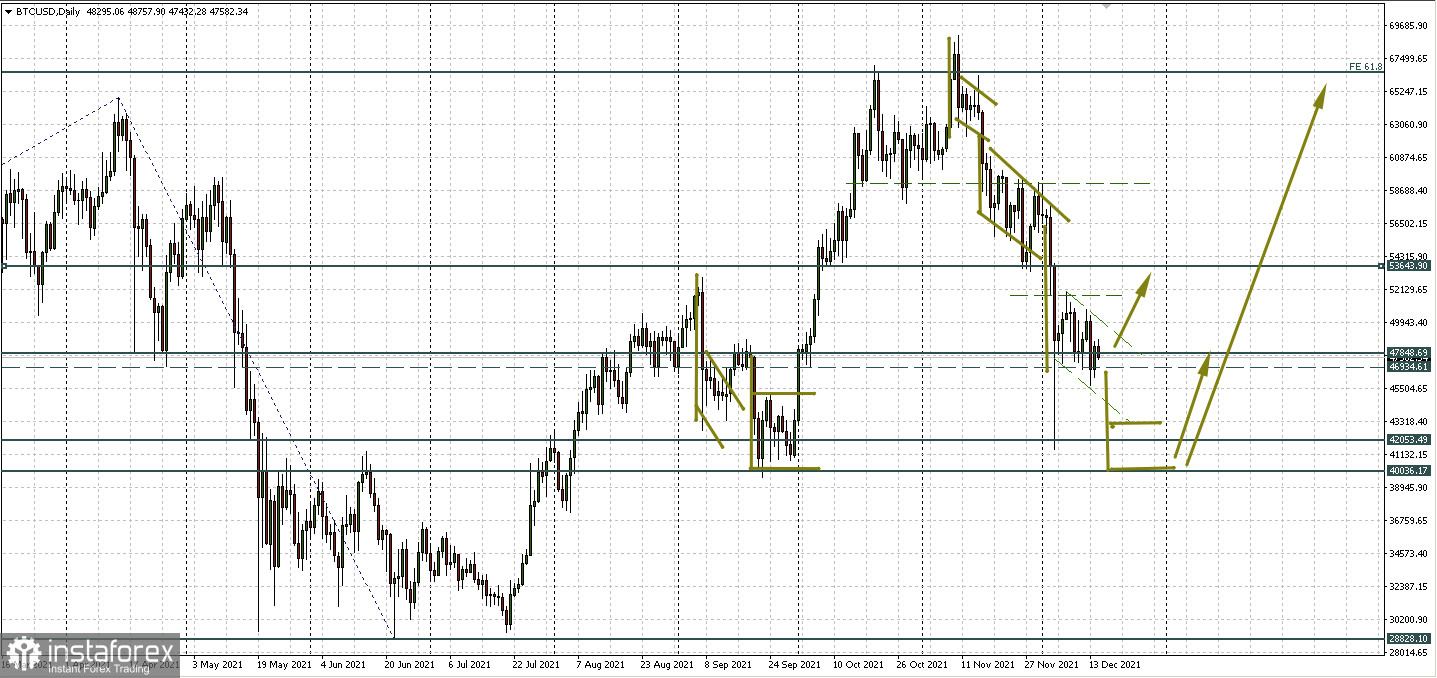

Flag, downward trend, and support at $40,000

On the daily chart, the sideways trend between the support zone 46,934.61 - 47,848.69 and resistance 51,697.58 is cautiously turning into a downward trend. After falling on December 3-4, this downward consolidation looks like a downward flag. But not quite canonical, with a long lower shadow on the handle.

If we assume that this flag really exists, then it should indicate the continuation of the fall. In our case, yes and no.

On the one hand, BTCUSD does have a power reserve of $40,000 - $42,000 per coin. On the other hand, the current "flag" is already the second in the fall from the historical maximum. And even the third, if we take into account the small figure immediately after the reversal. In the previous September fall, there were two such flags before the price turned up.

Focus on Fed, support at stake at 46,934.61

Against this background, there is a chance that the support at 46,934.61 for BTCUSD will survive. But today we are still waiting for the Fed's decision.

Bloomberg Intelligence Senior Commodity Strategist Mike McGlone warned that the decisions of the U.S. central bank could affect bitcoin and ether.

The anticipated cut in the Fed's bond-buying program and the rise in interest rates are likely to create a favorable macroeconomic environment for the first and second cryptocurrencies next year.

But today, the rhetoric and tone of statements of the U.S. Central Bank can determine the position of bitcoin relative to the support zone 46,934.61 - 47,848.69 and set the direction, perhaps even before the end of the year.