After an impulse decline, Bitcoin has begun a consolidation phase and has been trading in the $45k-$50k range for more than a week. At the same time, there are no clear signals on the further price movement on the charts, however, the analysis of the futures and derivatives markets indicates an imminent exit from the current range. The situation remains precarious, as the market is in a state of fear, and a further decline in prices could provoke a local sell-off.

Overheating of the futures market

The analysis of the futures market indicates that the cryptocurrency is ready to exit the current range and start full-fledged growth. However, it sounds easier in words than it actually is. Before starting to move to new highs, Bitcoin needs to form a local bottom. The coin is ready for this procedure, as indicated by the stabilization of the OI indicator, which displays open interest in BTC in the futures market.

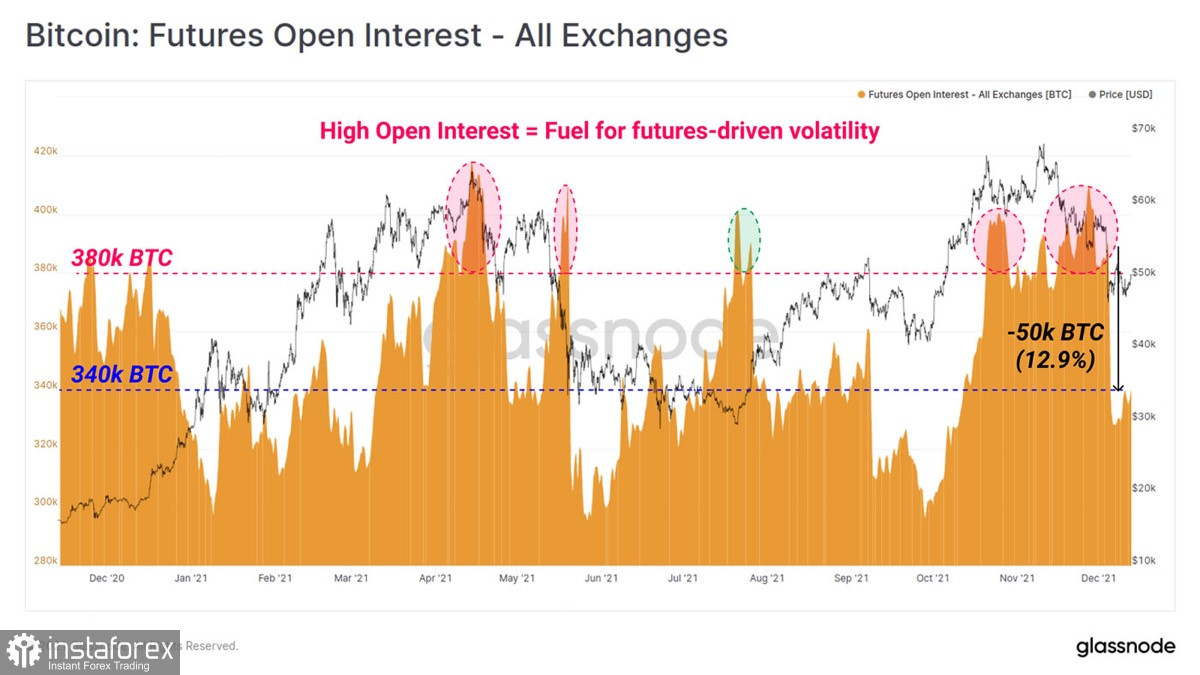

According to Glassnode, the overheating of the futures market contributed to the growth of volatility and the collapse of the cryptocurrency. Given the launch of the ETF in November, this does not seem like a revelation. As of December 15, open interest in BTC futures has decreased by $2.5 billion over the past week.

This suggests that the market situation has stabilized over the past week. Glassnode experts believe that the influence of the futures market on the fluctuations of the BTC exchange rate increases when the OI indicator exceeds the $380k mark. This is exactly what happened two weeks ago, before a massive collapse. Subsequently, the derivatives market also underwent a "purge" of long positions with excessive leverage, but the futures market became the main reason for the market decline.

What is happening in the market now?

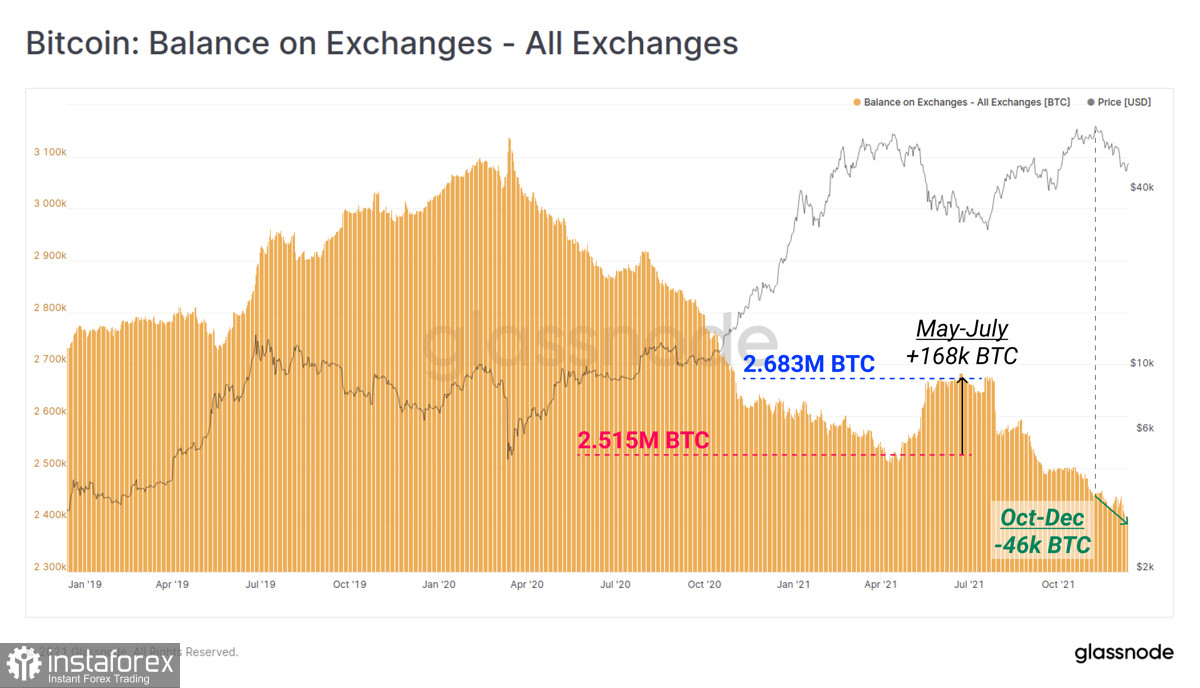

Stabilization in the futures market indicates a gradual decrease in Bitcoin volatility. At the same time, coin balances on exchanges have decreased by 46k BTC over the past three weeks, which indicates the start of the accumulation period. In other words, the market recovered from the correction and the main audience of Bitcoin began to actively absorb free volumes. Now the main task of Bitcoin is to form a local bottom, which will become a key support zone and the starting point of a new upward trend.

Where is the local bottom?

I assume that the local bottom can be formed much higher than the $42k mark, but it takes time to test the theory. Despite the fundamental prerequisites for the beginning of growth, institutional investors do not show direct activity in relation to cryptocurrency. This indicates the continuation of the accumulation period, which is confirmed by technical indicators on the daily horizontal chart of the cryptocurrency.

The price fluctuates within the Fibonacci levels of 0.382-0.5, and the MACD maintains a flat movement below the zero mark. This is a clear sign of buyers' weakness. At the same time, it is possible to notice impulsive attempts of bulls to start moving to the upper boundary of the oscillation zone at $51.2k on the stochastic oscillator. In general, the market is approaching the final stage of correction and subsequent uncertainty.

The coin found strong support in the area of the 200-day moving average, the retention of which indicates the strength of the long-term upward trend. At the same time, sellers have tried to break through the $46.6k zone twice in the last three days, but failed. With this in mind, I assume that the range of $46k-$48.7k can become a support for the impending upward trend.