The main Wall Street indices ended yesterday's trading with a decline for the second consecutive session. In particular, the S&P 500 lost 0.75%, dropping to 4634.09 points. However, the broad market index is already trying to get into the positive today.

"The background for the stock market at the moment is very difficult. Traders are still finding it difficult to choose a direction. They want to know what the US central bank intends to do," PineBridge Investments analysts said.

A similar pattern is observed in the foreign exchange market, where the EUR/USD pair remains in the range formed at the end of November.

The day before, the single currency fell in price against the US dollar by more than 0.2%, to 1.1260. During yesterday's trading, the EUR/USD pair rose above 1.1320, but then went down after the IFO Institute revised the estimate of German GDP growth for next year and the release of the November report on industrial inflation in the United States.

The IFO Institute has worsened the forecast of German GDP growth for 2022 by 1.4 percentage points at once – from 5.1% to 3.7%. Experts cited a slowdown in the pace of economic recovery due to disruptions in supply chains and the fourth wave of coronavirus as the reasons for the revision of the forecast.

Meanwhile, the US Department of Labor reported that in November, the producer price index in the country increased by 0.8% on a monthly basis. In annual terms, the indicator jumped by 9.6%. The indicator value has become the highest since November 2010.

These data reinforced expectations that the Federal Reserve will tighten monetary policy next year.

The EUR/USD pair has been declining in the previous two days, and on Wednesday it consolidated its recent losses near 1.1270 amid the fact that players are waiting for the results of the December FOMC meeting.

The economic calendar for the eurozone is empty today.

Data on retail sales in the United States were released before the Fed announces its verdict on monetary policy.

According to the US Department of Commerce, the volume of retail sales in the country in November expanded by 0.3% compared to October. Experts predicted the growth of the indicator at the level of 0.8% in monthly terms.

Consumer spending plays an important role in determining the policy of the US central bank, and the slowdown in the indicator as the "Omicron" spreads in the country may weaken expectations for an accelerated tightening of the monetary policy of the central bank next year.

So far, the divergence in the rates of the Fed and the European Central Bank remains the main driving force for the EUR/USD pair.

Central banks on both sides of the Atlantic are currently facing one version or another of the same dilemma – whether the need to protect against inflation and end the current era of low interest rates and asset purchases is more urgent than the economic threat posed by the new COVID-19 variant. However, their different approaches may lead to a turbulent 2022, which will be marked by a strengthening of the dollar against the single currency, due to higher interest rates in the United States than in the eurozone.

At the same time, in the long term, a cheap euro will certainly have a positive impact on the demand for European industrial products, which should be very attractive from a price point of view.

The Fed is likely to intensify the policy shift, which could become even more abrupt over the next year, and this probably poses the greatest risk of a devastating surprise for the markets.

As for the ECB, the central bank should keep in mind the main differences within the currency bloc for which it determines policy. Any significant deviation from anti-crisis support may lead to undesirable consequences, for example, for the sustainability of high debt loads in economies such as Italy.

Inflation, labor markets and the link between the virus and economic indicators behave differently in the largest economies, creating a potentially dramatic difference in how leading central banks will cope with the upcoming stage of the pandemic. This contrasts with the synchronized and large-scale wave of support approved at the beginning of the health crisis in the spring of 2020.

At the same time, Fed officials face the same unknowns as their European counterparts: will the new COVID-19 variant contribute to the further expansion of global supply chains and the growth of inflation? Is it capable of destroying consumer spending and jobs in the face of a new economic downturn? All of the above? Or will it have virtually no economic impact?

Given that the Fed is expected to take measures to combat inflation soon, at first glance it may seem that the central bank will have to abandon its goal of ensuring broad and comprehensive employment.

Reality, however, is more subtle than a simple "either-or" choice: curb uncomfortably high inflation by raising the base interest rate or promote a return to full employment.

The first step in the US central bank's turnaround is expected at the end of its two-day monetary policy meeting on Wednesday with a widely expected acceleration in the reduction of bond purchases, which would clear the way for an interest rate hike next year.

Against the backdrop of a sharp rise in inflation, some experts argue that the Fed needs to quickly take its foot off the gas pedal and start pressing the brakes to slow down economic activity and job growth before the rapid rise in prices completely kills both.

However, in this case, the Fed risks breaking the promise, first made in September 2020, to leave rates close to zero until the US labor market fully recovers. However, refusing to increase the number of jobs to control inflation is a compromise that Fed Chairman Jerome Powell simply has to make.

He seemed to accept this possibility last month when he said during his speech to Congress that the central bank needed to balance its inflation target with the maximum employment target when they are under stress, as they are now.

According to some analysts, sacrificing the Fed's goal of ensuring full employment may be the price of fighting inflation and preventing an even worse employment situation in the future.

"Inflation is like a tax. Too high inflation can also affect the development of the labor market. Now that inflation has shown up again, there is a price, the real price of the Fed keeping rates low," ADP economists said.

If the labor market continues to strengthen, there is a possibility that the Fed may avoid having to make a painful choice between its goals.

Employee America analysts believe that the US labor market will return to the pre-pandemic level sometime between April and June 2022.

"At this point, if inflation is still high, we don't think it would be a violation of the commitment to maximum employment if the Fed raises interest rates," they noted.

"It is obvious that Omicron introduces some uncertainty into the calculations of the Federal Reserve," Wells Fargo strategists said.

They believe that inflation in the US will decrease in mid-2022, which will allow the Fed to wait until the second half of next year to raise the base interest rate and end the year with just two rate hikes of 0.25%.

"But if we are wrong, the Fed will have to step it up. And if they act really quickly, that's when you will have a political mistake," Wells Fargo added.

However, many questions arise here too. One of them is whether high rates will then be able to withstand the inflation created by the shock from the shortage of supply, while high demand spurs a jump in prices.

The FOMC's monetary policy decision will be announced. A "dot chart" and updated economic forecasts of the US central bank will also be published, followed by Powell's press conference.

There are three ways to trade on the FOMC solution.

1. Probably the most risky is preparing positions with an eye to a faster tightening of the Fed's monetary policy next year and closing them shortly after the announcement of the central bank's decision. Rapid pullbacks after initial movements are often explained precisely by profit-taking by investors who have opened positions in advance.

2. Wait 30-45 minutes after Powell's speech, let the market "digest" his words and buy or sell at the breakdown of the channel.

3. Stay on the sidelines and wait until the dust settles after the FOMC meeting, and trade at the beginning of Thursday's Asian session.

Traders are waiting for answers from the Fed to the following questions: how fast is the central bank going to reduce QE, how many rounds of rate hikes will take place next year, what are the estimates of further economic growth and price pressure.

Now the US central bank is reducing the volume of redeemable assets by $15 billion monthly.

There is a possibility that the Fed will increase the pace of curtailing QE to $25-30 billion. Less aggressive steps may lead to a weakening of the dollar. The higher the pace of curtailing asset purchases, the more support they will provide to the US currency and the stronger the pressure on the US stock market will be.

The last FOMC dot chart was published in September. Then it meant only one increase in the federal funds rate next year. Nine out of eighteen members of the Committee expressed their support for such a step. Given that inflation in the US has already reached an almost 40-year peak, there is reason to believe that this number has increased. It is possible that some participants of the meeting will advocate an increase in the rate by 50 basis points.

The greenback strengthened sharply on the news that more than half of the FOMC members expect two rounds of rate hikes next year.

At the same time, the inflation forecast is likely to be revised upward, but Omicron may become the basis for lowering estimates of US GDP growth, which in turn will put pressure on the dollar.

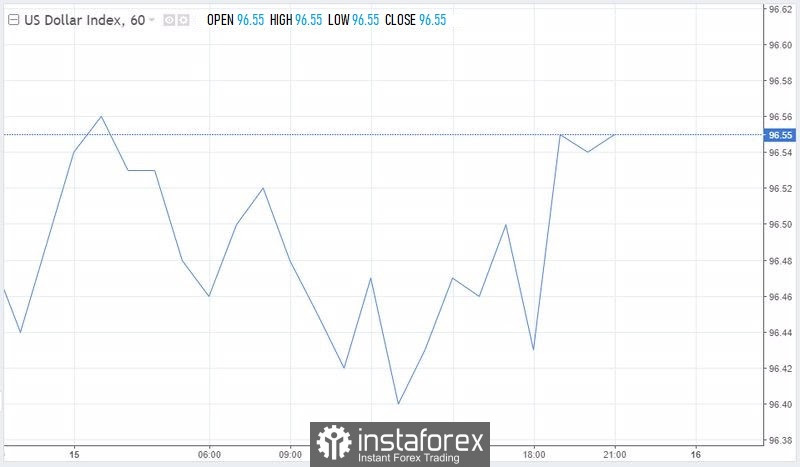

The USD index fluctuates between gains and losses on Wednesday, but stays above the 96.50 point mark ahead of the announcement of the results of the December Fed monetary policy meeting.

The greenback took a pause in growth, which stalled near the resistance of 97.00. Societe Generale analysts are waiting for the resumption of the growth of the US currency.

"Over the past three weeks, the USD index has been closing near the opening price and formed a Doji candle, which indicates that the index cannot determine the direction. The MACD of the daily chart dropped lower, but remained in the green zone, so the pause may be temporary. Last week's low of 95.85 is the initial support. Its breakdown will target the index at 95.10-94.50 (the multi-month trend line), and this area will determine the further direction of the dollar's movement," they noted.

The EUR/USD pair, which is changing hands on Wednesday, is also unable to determine the direction of movement.

In November, it fell from 1.1600 to 1.1200 and has been consolidating in a narrowing range ever since.

The euro may fall against the US dollar, as the Fed is expected to accelerate the reduction of bond purchases, while the ECB will show tolerance at its next meetings, according to ING.

The ECB's updated forecasts will show that inflation in the eurozone will be below the target of 2% in 2023-2024, which reduces the likelihood of an interest rate increase, Bloomberg reports.

"This should be the main topic of tomorrow's ECB meeting and offer the euro a little protection against a stronger dollar," ING strategists said.

"If the Fed is as aggressive tonight as we expect, the EUR/USD pair should touch the 1.1170-1.1180 area later today, and a close below will open the door to 1.1000," they added.

It is assumed that, unlike the Fed, the ECB is likely to refrain in the short term from any changes in its monetary policy aimed at tightening it.

On Thursday, the ECB is likely to confirm that the emergency Asset purchase Program (PEPP) will end in March.

The ECB may halve the volume of monthly assets it buys from April, analysts recently interviewed by Reuters predict.

Currently, the central bank buys bonds worth €80 billion per month under two programs: €60 billion under the emergency PEPP and €20 billion under the regular APP.

A survey of experts conducted by Reuters on December 8-10 showed that after April, the ECB may continue to buy bonds worth €40 billion per month until the end of 2022, and some analysts predict the continuation of asset purchases until mid-2023.

Although the risk of the spread of new variants of coronavirus is global, the reaction of ECB officials will differ from the actions of colleagues from the United States, which will almost certainly raise interest rates from near zero in 2022.

"We believe that by the end of 2023, the conditions for raising rates in the eurozone should be met. Given the tight sequence between the end of QE and the first rate hike, this may happen when the ECB announces the end of the APP," HSBC analysts said.

The divergence in the pace of curtailing monetary stimulus and raising interest rates by the Fed and the ECB creates prerequisites for further strengthening of the dollar and should put pressure on the EUR/USD pair.

The nearest resistance is at 1.1280, and then at 1.1300. Although the pair first managed to grow above these marks on Tuesday, it then turned 180 degrees from 1.1320. This suggests that short-term resistance is forming near this mark.

On the other hand, the initial support is located at 1.1240, followed by 1.1220 and 1.1200. Closing below the last mark, bears will aim for 1.1185, especially if the Fed shows a hawkish attitude.