Trading dollar pairs is extremely risky today. By and large, no one in the market knows for sure which way the pendulum will swing - towards the dollar or vice versa, against it. There are many versions, scenarios and rumors, but all these assumptions (which are also contradictory in nature) are simply guesses. This is a shaky house of cards, ready to collapse at any moment. Moreover, we should not forget about the risks of false price movements, especially in the short period of time between the announcement of the final communique and the press conference of the head of the Federal Reserve Jerome Powell.

During such periods of emotional volatility, it is best to stay out of the market. Traders will not immediately crystallize their general opinion on the results of the December meeting, especially if the Fed voices contradictory and ambiguous messages. For example, if the dot chart reports the hawkish mood of the Fed, and Powell, despite everything, takes a cautious and wait-and-see attitude. In this case, traders will need to make a difficult choice that will determine the fate of the greenback.

Therefore, today it is possible (and necessary) to get away from the currency pairs of the major group by focusing on crosses. Many cross-pairs are almost unaffected by US events. They have their own "coordinate system" of fundamental factors, more closed. Among the numerous crosses today, one can single out the GBP/JPY pair, especially against the background of today's resonant release.

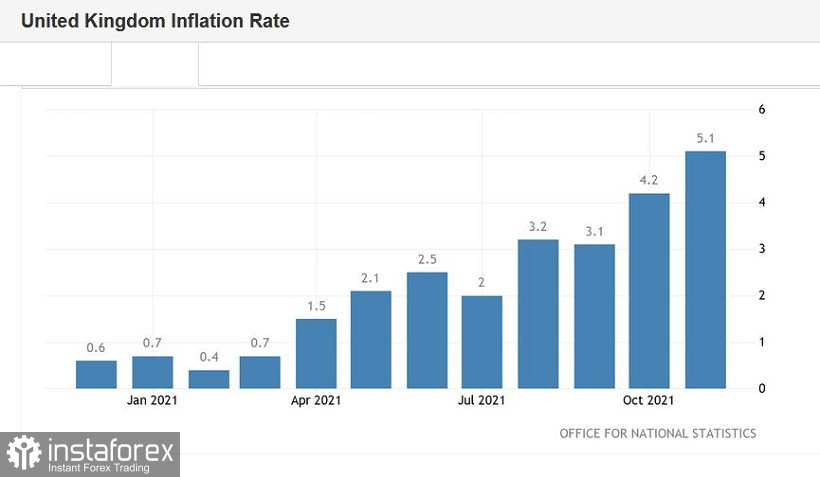

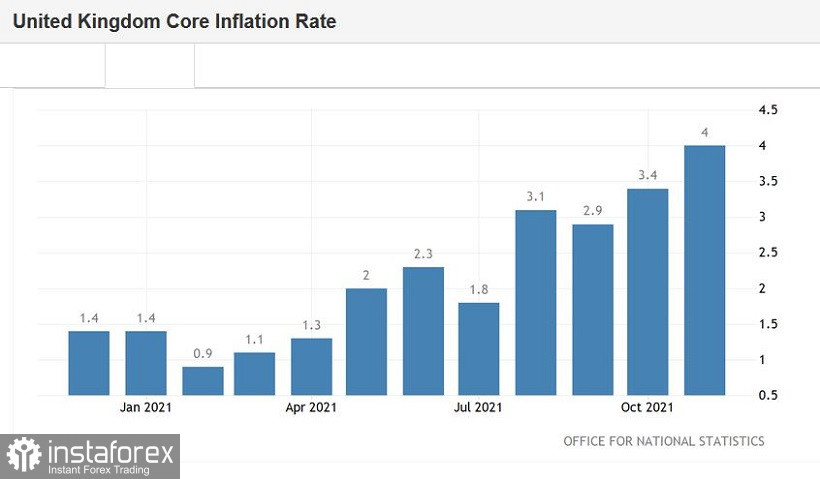

We are talking about the data on the growth of British inflation. The report was really surprising: against the background of bold forecasts, it came out in the green zone, reflecting long-term records. Thus, the general consumer price index on a monthly basis in November came out at the level of 0.7% (with a forecast of growth up to 0.4%). In annual terms, the indicator showed a jumpy growth, reaching 5.1%. Just like last month, here again we can talk about a multi-year record: this is the strongest growth rate since November 2011. Core inflation showed a similar trend. The core consumer price index jumped to 4.0%. In this case, we are talking about a 29-year record (the strongest growth rate since 1992). In addition, the retail price index was published today (0.7% mom, 7.1% y/y, with a forecast of growth up to 0.4% m/m, 6.7% y/y) and the price index of purchasing producers (1.0% mom, 14.3% y/y, with a forecast of growth up to 0.5% mom, 11.0% y/y). All components of the release were in the green zone.

In other words, British inflation has once again surprised with a breakthrough growth. This growth was mainly due to the prices of clothing, fuel and used cars. Inflation has more than doubled the target level of the Bank of England, forcing the members of the British central bank to respond to the current situation. In just four months (since August), the overall consumer price index in the country soared by 3.1% - this is a record growth rate in the entire history of observations. According to experts, today's release will be a kind of "challenge" for the BoE.

The data published today offset the negative from Friday's data. Let me remind you that at the end of last week it became known that the UK GDP increased by only 0.1% in October (with growth forecast to 0.4%), and industrial production decreased by 0.6%. It should also be noted that the key data on the growth of the British economy are somewhat late (for October), whereas this week we learned more operational figures (for November) - in the labor market and inflation.

The record increase in inflation suggests that the BoE will still decide to tighten its rhetoric at the December meeting, the results of which will be announced tomorrow. It is unlikely that the central bank will raise the rate on Thursday, but instead it may announce a tightening of monetary policy "in the foreseeable future." In this case, the probability of an interest rate increase in February 2022 will increase significantly.

According to a number of experts, the members of the BoE may be restrained by the so-called "Omicron factor". Indeed, the other day in Britain, the first patient with a new strain of coronavirus died. Indeed, according to the head of the British Ministry of Health, no Covid strain has spread as quickly as Omicron. Currently, the country has registered 4,713 cases of infection with the "new modification" of the virus. At the same time, scientists are increasingly saying that Omicron is less dangerous than Delta (although more infectious). According to the results of studies carried out in South Africa (in which 79,000 patients took part), the new strain, as a rule, does not "bring" people to the hospital. The total number of hospitalizations due to Omicron is 29% less than with the spread of the so-called "Wuhan strain", and 23% less than with Delta infection. It was also found that in those vaccinated and already ill with coronavirus, the disease proceeds in an even milder form.

All of the above factors suggest that tomorrow the BoE will voice a hawkish position, adequately responding to the record and spasmodic growth of inflation indicators.

Meanwhile, Bank of Japan Governor Haruhiko Kuroda just announced that the Japanese central bank will continue to pursue an ultra-soft policy in order to provide "accompaniment" to price increases with wage increases and the recovery of the national economy.

Divergence of positions of the BoE and BOJ will support the GBP/JPY cross. Therefore, any more or less large-scale downward pullbacks can now be used to open long positions. The first, and so far the main target of the upward movement is at around 151.40 - this is the middle line of the Bollinger Bands indicator on the daily chart.