A number of central banks held scheduled meetings on monetary policy at once, forming a general trend towards curtailing stimulus measures. Most of the forecasts were confirmed with minimal changes, but some were surprising.

The US Federal Reserve System was the first one to make a move, and it managed to carry out its generally quite tough decision without significant unrest in the financial markets, which is a good sign.

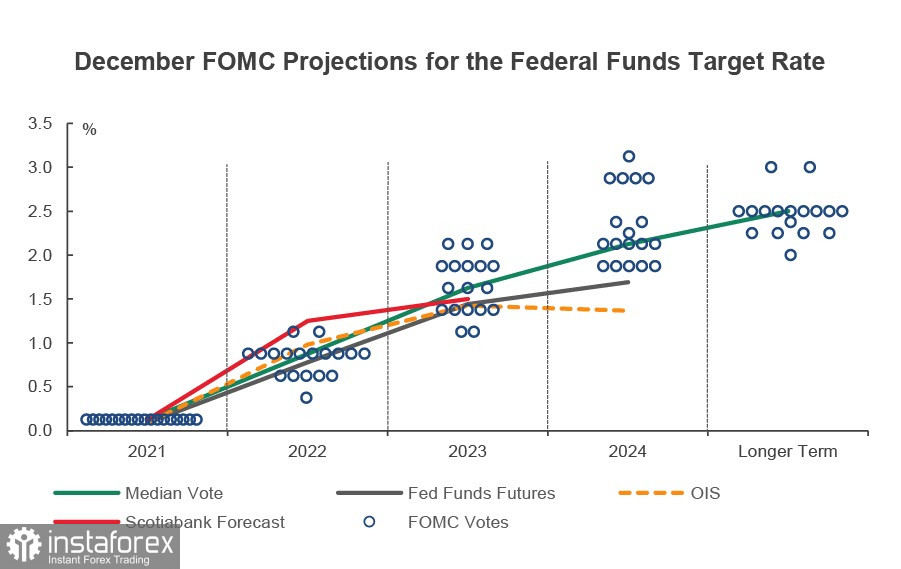

The average forecast assumes an increase of 75 points in 2022, with the forecast of the first increase shifted from June to May. There are at least 3 more increases expected in 2023, but the rate at the end of the cycle should be established at a neutral level. The dot graph looks quite hawkish.

As for the timing of the curtailment of bond purchases, there are no surprises here – as the Committee members hinted earlier, the Fed doubled the pace of completion of QE from $ 15 to $ 30 billion per month and will complete the program in March 2022.

There have been significant changes in the wording regarding inflation, confirming that the word "temporary" has left the text, and probably forever. This change in terminology adds an additional hawkish focus to the Fed's position. Forecasts for inflation and unemployment were slightly revised, unemployment is half a point downwards, and expectations for inflation are slightly higher. But in general, these changes will not affect the assessment of the US dollar's prospects.

These prospects are becoming confidently bullish, and the fact that the currency markets reacted rather sluggishly only indicates that changes were expected. Nevertheless, the Fed is ahead of other central banks, and the US dollar will win back its advantage in the long run.

What gave a surprise was the Bank of England, which raised the base rate by 0.15% to 0.25%. The probability of such a move before the meeting was about 33%, but the BoE was forced to hurry up, not looking at the risks associated with the Omicron. As BoE CEO Bailey said at a press conference, "the UK has a very tough labor market and more sustained inflationary pressures." Inflation should reach 6% next year, which is significantly higher than the previous forecast of 5%. Nevertheless, the unexpected decision did not help the pound, the growth against the US dollar was weak since only 2 increases are planned for 2022, that is, the Fed will presumably overtake the Bank of England in the rate of normalization. The pound did not receive any reasons for an upward reversal, remaining in the descending channel. The resistance of 1.3400 presumably in the middle of the channel is unlikely to be broken and represents a convenient level for resuming sales.

The ECB could find no reason to reassure traders, and the euro is turning into an outsider in the currency market. The ECB is expected to complete the PEPP in March, the forecast for reinvestment of the PEPP has been extended by a year "at least" until December 2024. As for the APP, the ECB left the issue open, committing to increase the pace of purchases (in order to compensate for the loss of PEPP) The inflation forecast has been significantly revised upward in 2022 and 2023. The market assessed the ECB's results as an attempt to retain the flexibility to react to changes in the situation, which will put pressure on the euro against the backdrop of the hawkish bias of other central banks. It can be assumed that the EUR/USD pair will continue to decline. The long-term target will shift to the lows of the beginning of the pandemic, namely at 1.06.

It should also be noted that meetings of other central banks were held, and they turned out to be quite hawkish. The Bank of Norway raised the rate by 0.25%, signaling the next increase in March 2022. The Central Bank of Mexico immediately raised the rate by 0.5%, reacting to an increase in inflation to almost 7.5%, and there is a possibility of another increase by 0.5%. The SNB left the rates unchanged, but significantly raised the inflation forecast, which hints at the possibility of a quick response in case of continued price growth.

In general, the following should be noted. The process of exiting the ultra-soft policy by the world central banks is accelerating. This will probably lead to a fall in stock indices and an increase in demand for protective assets. The US dollar leads this process and remains the main favorite of the market.