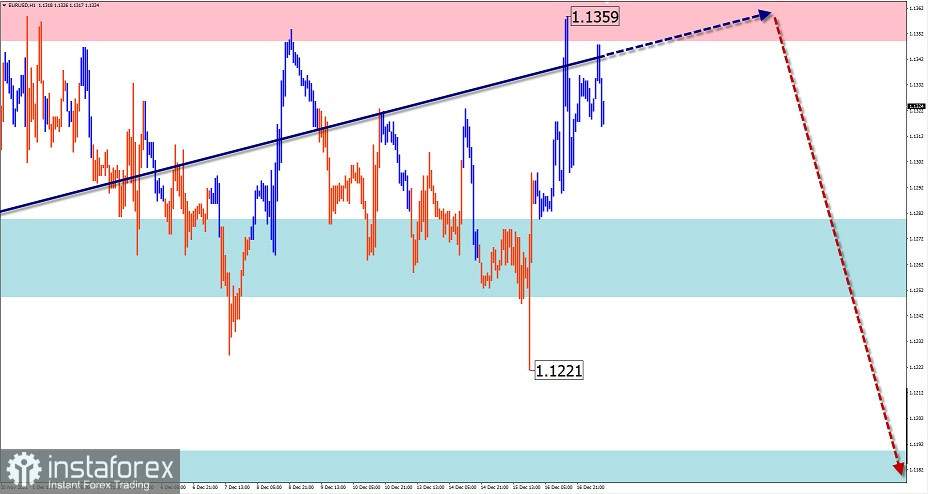

EUR/USD

Analysis:

The descending wave from January 6 continues to set the main direction of the European currency on the price chart of the major pair. Since the end of last month, along the upper boundary of the potential reversal zone, quotations have been forming an intermediate price pullback in the form of a horizontal plane. The structure of the wave is close to completion. There are no immediate reversal signals on the chart.

Outlook:

In the coming trading sessions, after the probable pressure on the resistance zone, a change of course and the beginning of the decline is expected. In case the lower boundary of the nearest support is breached, the move downwards will continue to the next zone.

Potential reversal zones

Resistance:

- 1.1350/1.1380

Support:

- 1.1280/1.1250

- 1.1190/1.1160

Recommendations:

There are no conditions for purchases in the euro market today. In the area of the calculated resistance, it is recommended to monitor emerging signals to sell the instrument.

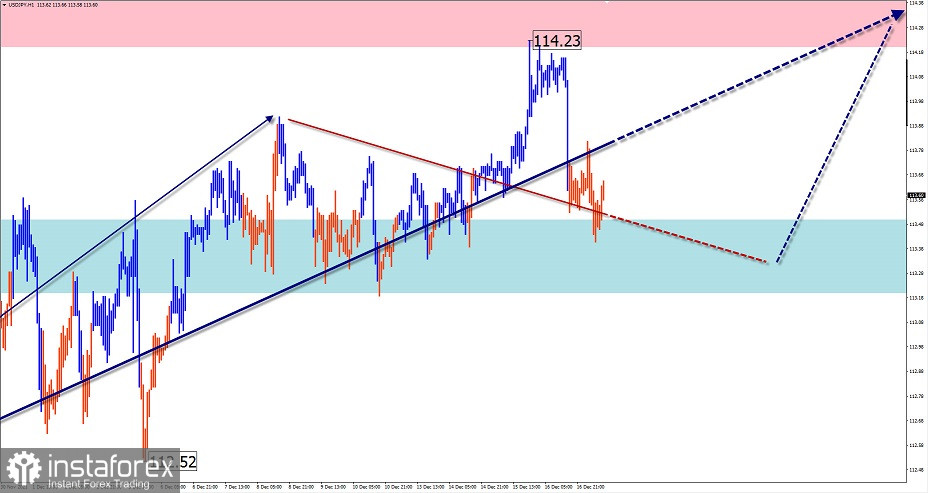

USD/JPY

Analysis:

On the chart of the main Japanese Yen pair, the main trend direction since the beginning of the year is set by an ascending wave. The incomplete ascending wave from November 30 is of particular interest on the small scale of the chart. Its wave level is not yet sufficient to start the next part of the main trend. All last week in the horizontal corridor the price formed correction (B) for the first part of the movement (A).

Outlook:

In the coming trading sessions, we expect the end of the downward movement, the formation of a reversal, and the beginning of the growth of the instrument.

Potential reversal zones

Resistance:

- 114.20/114.50

Support:

- 113.50/113.20

Recommendations:

Short-term purchases from the support zone are possible in the Japanese Yen market today. It is safer to reduce the lot size.

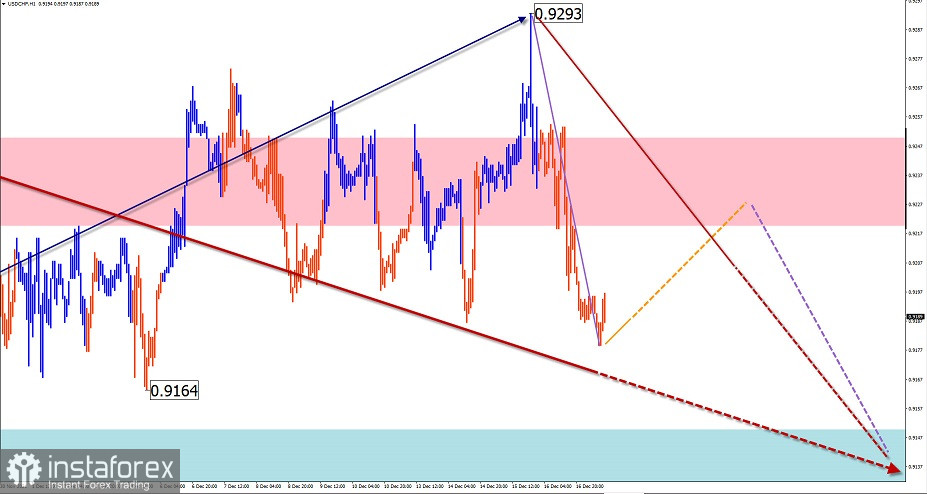

USD/CHF

Analysis:

On the Swiss franc chart, the current downtrend since mid-June has reached its final phase. The incomplete upward section of the chart from November 30 has no reversal potential, correcting the last part of the wave. In terms of its structure, the correction is closest to a stretched plane.

Outlook:

During the coming sessions, the price is expected to move towards the nearest support levels. A short-term pullback to the upper boundary of the price corridor is possible in the first half of the day.

Potential reversal zones

Resistance:

- 0.9220/0.9250

Support:

- 0.9150/0.9120

Recommendations:

Trading in the franc market today is only possible with small lots, within individual trading sessions. Selling the pair is more promising.

USD/CAD

Analysis:

Price swings in recent weeks have changed the wave pattern of the Canadian dollar chart. The incomplete uptrend from December 8 today fits into the algorithm of the ongoing bullish correction from May 18. After the current pullback down the rate will continue to rise.

Outlook:

In the first half of the day, we can expect a flat movement along the support zone. At the end of the day, volatility is expected to increase and a new round of price growth is expected, up to the calculated resistance zone.

Potential reversal zones

Resistance:

- 1.2850/1.2880

Support:

- 1.2760/1.2730

Recommendations:

Trading in the Canadian dollar market today is possible after the appearance of clear buy signals around the support area. There are no conditions for sale today.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analysed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!