4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

On Wednesday, the EUR/USD currency pair continued to move inside the side channel between the Murray levels "0/8" - 1.1230 and "2/8" - 1.1353. It has been inside this channel for almost a month, although, judging by the illustration above, you can't say that. However, no, the pair first found themselves in it on November 26. In the last few days, the euro currency has not even tried to work out the upper or lower border of this channel, but moves strictly in the middle. That is, traders have already completely lost interest in what is happening and are preparing for Christmas and New Year with might and main. What is noteworthy is that such market behavior should not be misleading. It so happened that on holidays the pair did not stand in absolute flat, but on the contrary, moved very vividly. The fact is that now the market is very "thin". This means that there are fewer participants than usual, so for the pair to jump sharply and unexpectedly in any direction, less effort is required by traders. By and large, even one major market participant can now move the pair in any direction. Therefore, one should not relax and think that the pair will now be between the levels of 1.1230 and 1.1353 for at least two more weeks. Although this option is also possible. Most importantly, the euro/dollar pair continues to be near its annual lows. If the downward trend had been completed, then most likely we would have seen a sharp rebound. But there is nothing like that. It seems that the market just took a break for the holidays. And it started preparing for the holidays on November 26, but when this period ends, the European currency will resume its decline.

EU countries continue to be quarantined.

Unfortunately, in the last days of the outgoing year, almost the only messages that arrive on the foreign exchange market are messages about omicron, its rapid spread in a particular country, and the measures that the government of a particular country is taking to contain the next "wave" of the pandemic. By and large, this news does not affect the euro/dollar pair right now, as every trader can personally verify by just looking at the 4-hour timeframe. However, there is no other news, so there is nothing else to do but to discuss Omicron and the possible damage it will cause to humanity and the economy. If you pay attention to the European Union, not all countries have declared a "lockdown" here. Austria was the first to do this (back in November), now the Netherlands has followed its example. In Germany, "lockdown" was not introduced, but quarantine measures were tightened, in particular, a ban on visiting any sports and cultural events was introduced. In other EU countries, they either simply tighten quarantine measures, or do nothing at all. For example, in the UK (although it no longer belongs to the European Union), the government only forced the population to wear masks in all public places. And this is although it is the UK that is again in first place in Europe in terms of the spread of the "coronavirus" and "omicron". Therefore, even the authorities of not every country are ready to introduce a "lockdown" and thus stop their economy. And the foreign exchange market is especially not going to react to the next "wave" of the pandemic, to which everyone seems to have become accustomed. From our point of view, the reaction can only be to macroeconomic indicators, which may be affected by increased quarantine restrictions, "lockdowns", as well as the "coronavirus" itself. Experts have already stated that they expect a slowdown in economic growth in many countries of the world and, in particular, the EU. GDP is expected to fall in some countries. The markets can respond to these data with a reaction, but first, you need to wait for these data. Omicron has only been in the world for a month, so it can terrorize humanity for the next few months. So conclusions will need to be made later.

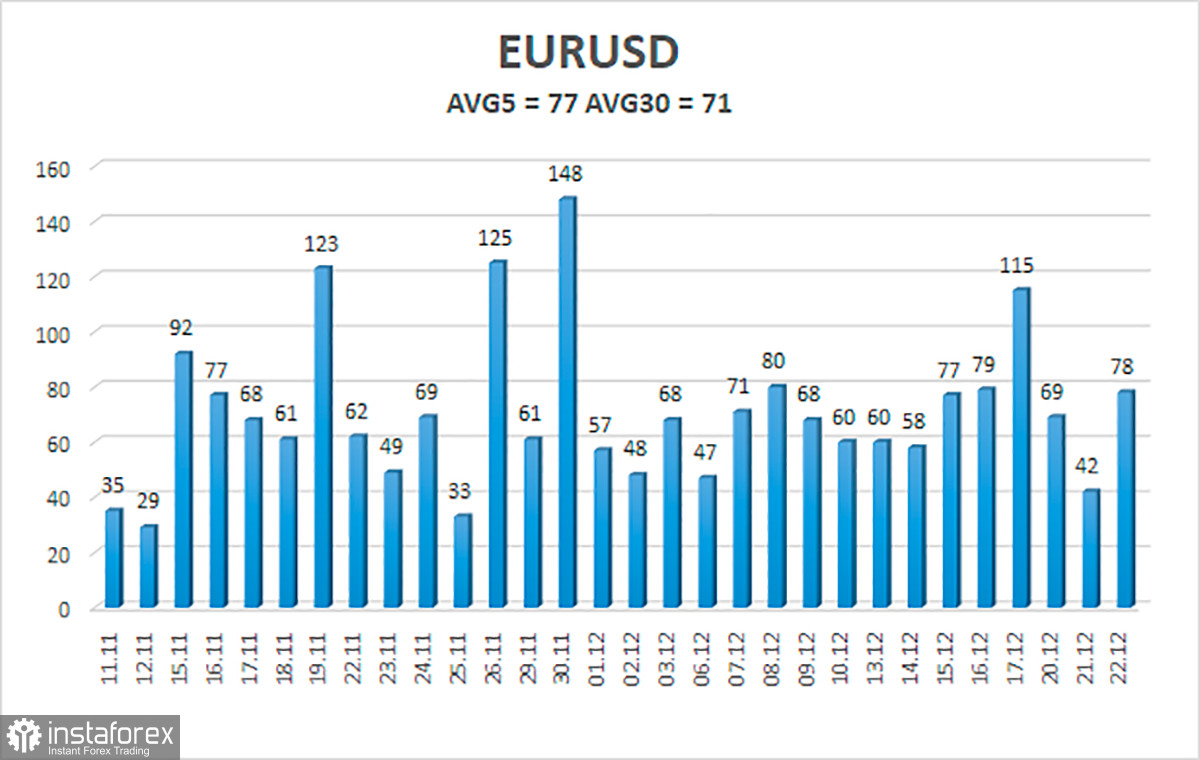

The volatility of the euro/dollar currency pair as of December 23 is 77 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1252 and 1.1408. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement in the side channel 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230-1.1353 side channel. Thus, you can continue to trade for a rebound from the upper or lower border of this channel. However, it should be remembered that we are talking about a flat, and volatility may decrease with the approach of the holidays.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.