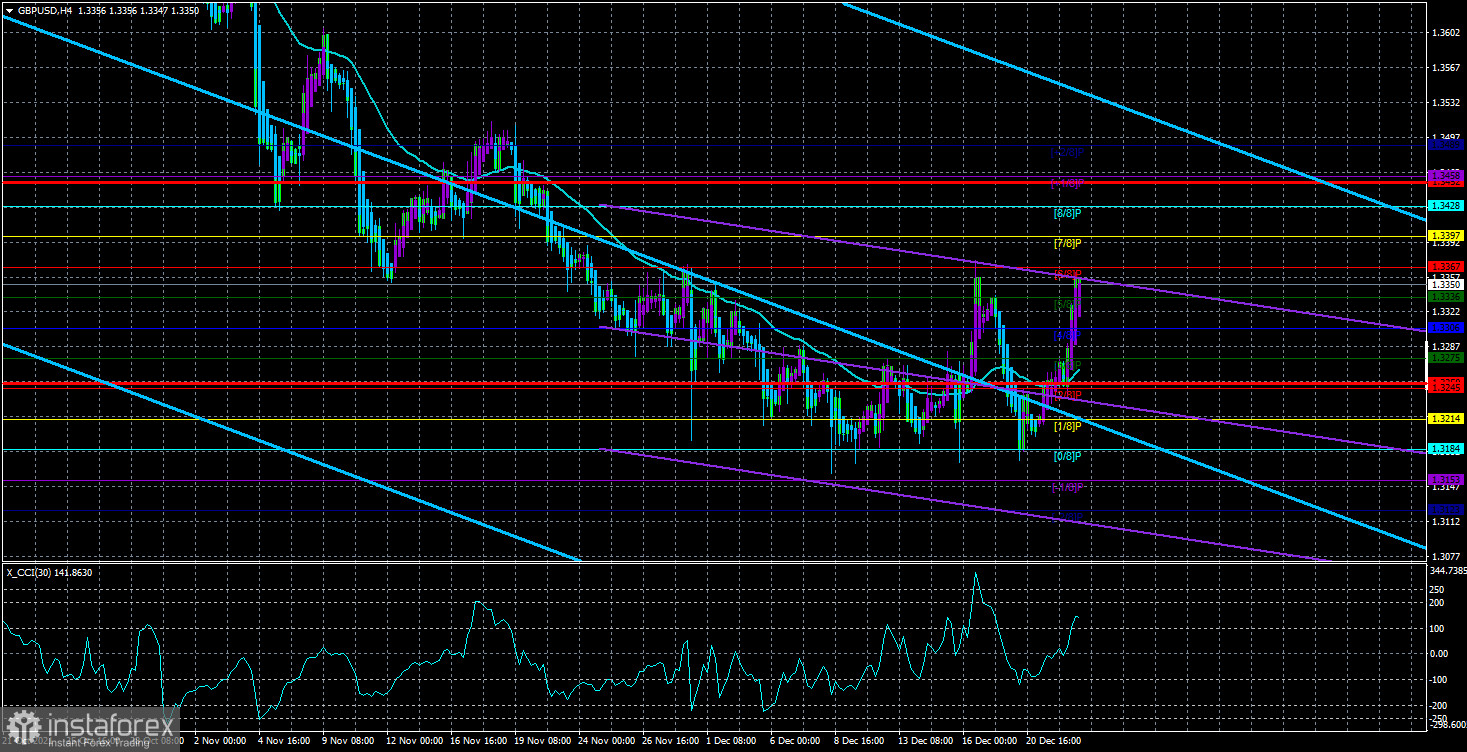

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - upward.

The GBP/USD currency pair on Wednesday, quite unexpectedly for many, soared up. The growth of the British currency was quite strong, so it clearly could not do without fundamental or macroeconomic justifications. Thus, the pair could not stay inside the side channel, which we talked about in recent articles. This also confirms our opinion that the probability of maintaining a flat during the holidays is high, but not one hundred percent. The pound was the first to prove this, gaining a foothold above the Murray level of "3/8" - 1.3275. Thus, at this time, it can be concluded that the pair will continue its upward movement in the coming days. But at the same time, the festive mood may again lead to a drop in volatility and the absence of a trend movement for the pound/dollar pair. Until the New Year itself, we would advise you to expect a flat every day, and not a strong trend. However, it doesn't make sense to talk about any trend now anyway. The pound has been trying for more than a month to start a corrective movement or even the formation of a new upward trend. The most convincing attempt took place last week when the Bank of England unexpectedly raised the key rate to 0.25%. However, after that, the pair's quotes again fell to annual lows, and now they are again striving upwards. As for the fundamental reasons for the sharp growth of the pound, they were not ordinary macroeconomic reports. Yesterday, the GDP for the third quarter became known in the UK, which showed a decrease from 1.3% q/q to 1.1% q/q. Thus, this report should have provoked a fall, not an increase in the pair.

The British Prime Minister refused to introduce a "lockdown" before Christmas.

Meanwhile, the UK continues to beat its anti-records for the incidence of "coronavirus" and "omicron". However, Boris Johnson, who spoke in Parliament yesterday, refused to introduce a "lockdown" before Christmas. "There is no doubt that Omicron continues to spread with great speed. The epidemiological situation remains extremely difficult. We do not rule out that additional measures will be introduced after Christmas to contain the pandemic. We will constantly monitor the statistics. We will do everything possible to protect the health of our nation," the Prime Minister said. It is noted that some ministers and parliamentarians have a negative attitude to the idea of introducing a strict quarantine. In particular, Finance Minister Rishi Sunak opposes this idea. He believes that despite the high incidence rates, an extremely small number of people suffer from the disease hard, an extremely small amount of information is available on this issue, so it is not advisable to make a decision that will entail multibillion-dollar losses now. The quarantine is supported by the Minister of Health Sajid Javid, who believes that if the new strain is not stopped now, then it will be much more difficult to do it later, and there will still be economic consequences. At the cabinet meeting, no unambiguous decision was made, and Boris Johnson took the side of the Finance Minister and said that the data on omicron would be constantly updated and reviewed, and appropriate measures would be taken in case of further deterioration of the situation.

Thus, the pound could have soared yesterday precisely because of the decision taken by Boris Johnson. He could, but he didn't necessarily take off because of this. We have already said that the market is now "thin", so Johnson's statement could provoke a reaction that would hardly be expected in a normal, non-holiday time. At the same time, the reasons could be different. Usually, the foreign exchange market reacts to news related to the economy or monetary policy, as well as to major geopolitical topics or large-scale crises. Right there is Johnson's ordinary speech, which hardly came as a surprise to anyone, given that earlier the British prime minister had repeatedly stated that he opposed the "lockdown". From a technical point of view, the pound still gained a foothold once again above the moving average line and could not overcome the Murray level of "0/8" - 1.3184 at least four times, so there is still a chance of a new upward trend forming.

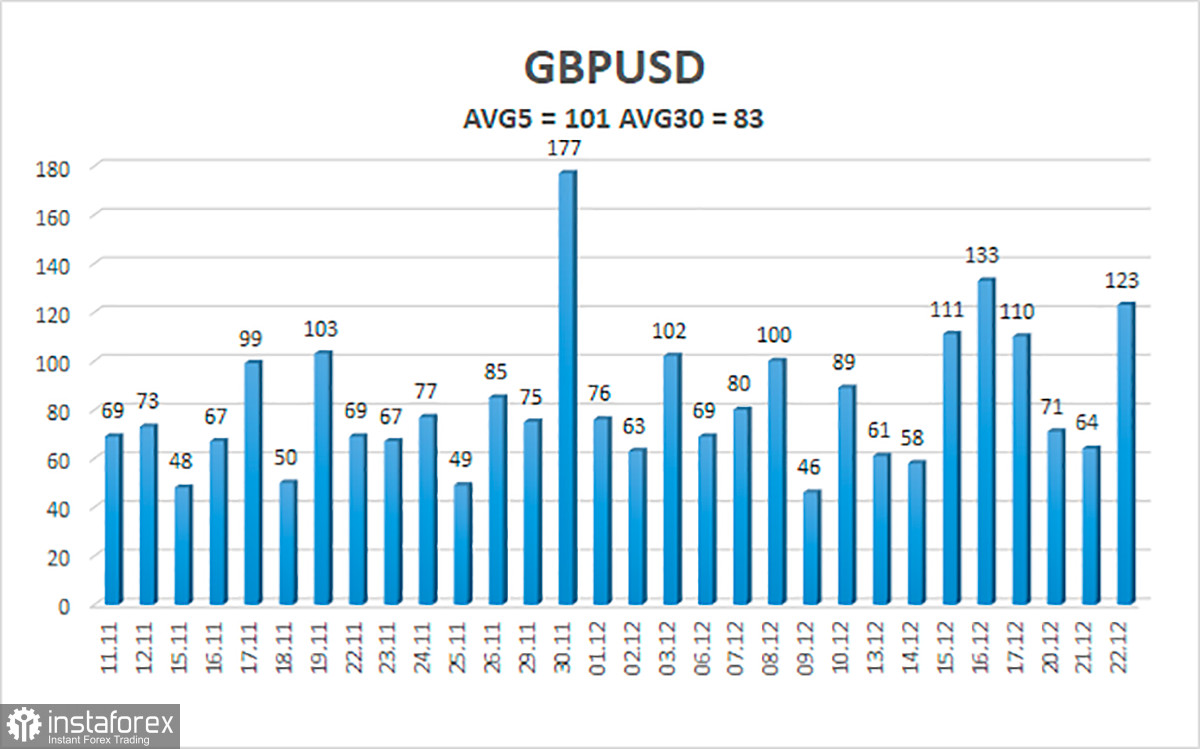

The average volatility of the GBP/USD pair is currently 101 points per day. For the pound/dollar pair, this value is "high". On Thursday, December 23, we expect movement inside the channel, limited by the levels of 1.3250 and 1.3452. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.3336

S2 – 1.3306

S3 – 1.3275

Nearest resistance levels:

R1 – 1.3367

R2 – 1.3397

R3 – 1.3428

Trading recommendations:

The GBP/USD pair broke out of the side channel on the 4-hour timeframe and is above the moving average. Thus, at this time it is necessary to stay in the longs open after fixing above the moving average line. The goals are 1.3397 and 1.3428. Exit the longs if the Heiken Ashi indicator turns down. Short positions should be considered if the pair is fixed back below the moving average with targets of 1.3214 and 1.3184.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.