US stocks fell for the first time in five days amid a drop in technology stocks of metropolitan areas.

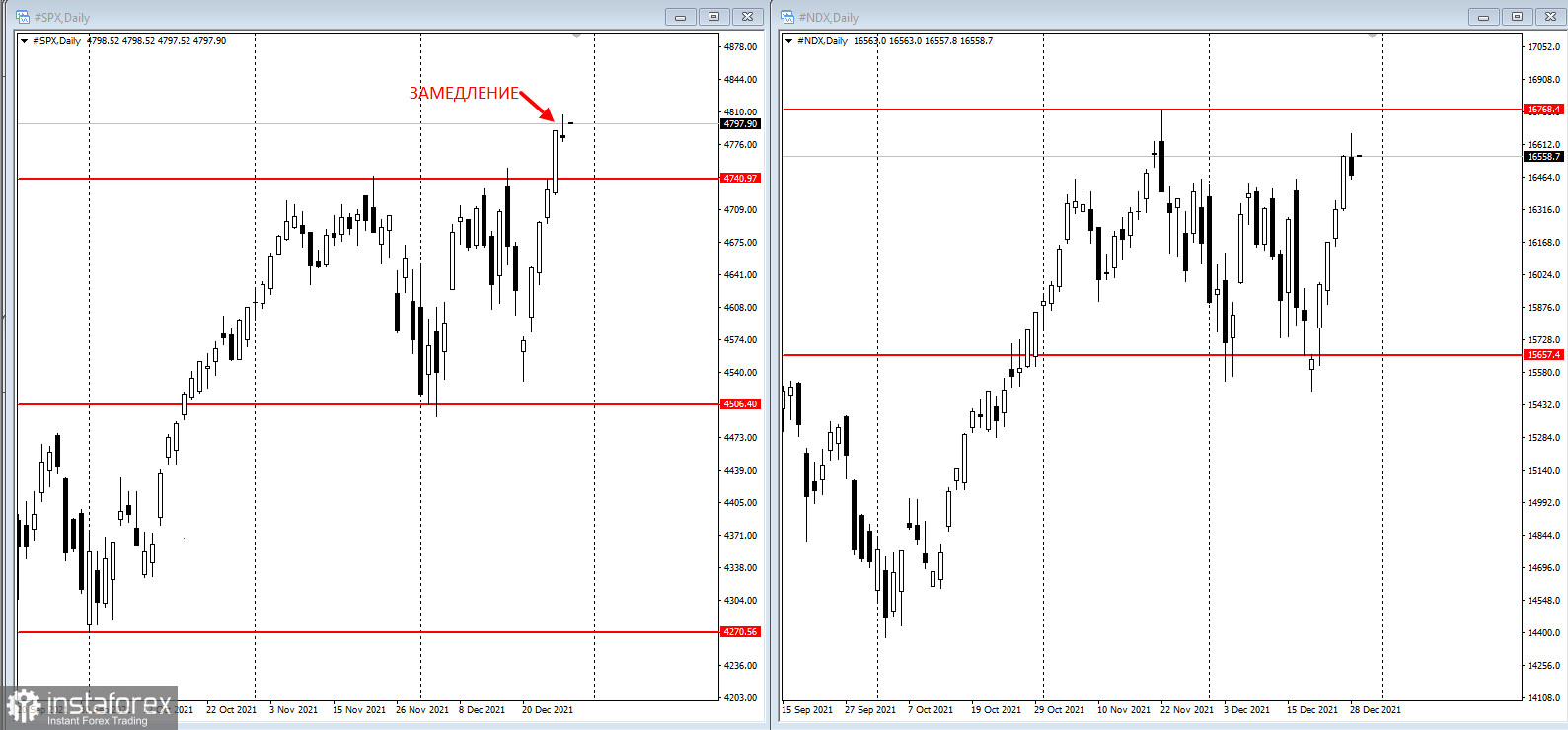

The S&P 500 index rebounded on Tuesday and set a new all-time high for the 70th time this year, while the Nasdaq 100 index started declining after updating a month's high amid a four-day rally by Nvidia Corp, Apple Inc. and Alphabet Inc. However, US 10-year Treasury yields fell.

Stocks swung between gains and losses as investors assessed the resilience of the global recovery amid a record surge in coronavirus cases. Low volumes also exacerbated volatile trading, with stocks changing hands in the major benchmarks about a third below their daily averages over the past 30 days.

A tidal wave of Omicron infections lifted global Covid-19 cases to a daily all-time high on Monday. Meanwhile, investors have taken some comfort from studies suggesting Omicron causes less severe illness. A University of Oxford immunologist said that the Omicron variant is not "the same disease we were seeing a year ago, reinforcing reports about the strain's milder nature.

"What we're seeing with each of these variants is they're just not as severe," Anderson Lafontant, Miracle Mile Advisors senior advisor on Bloomberg TV said.

On Tuesday, the data showed the Richmond Fed's manufacturing survey rose in December, beating estimates, with the previous reading revised higher, while growth in US home prices slowed for a third straight month in October.

Stuart Kaiser, head of equity derivatives research at UBS Group AG, said that the reason for markets' growth was that they had entered an endemic phase out of the pandemic phase. He considered this fact to be positive for the markets and for the economy. He noted that they would have new options over time, however it was essential to deal with them, taking risks into account

Global shares are on course for a third year of double-digit returns, powered by the US surge. Analysts remain optimistic about the earnings outlook even amid coronavirus waves and a shift by some key central banks towards tighter monetary policy to fight high inflation. Concerns remain that these variables could trigger increased volatility.

What key events to watch this week:

- Oil inventories, Wednesday;

- US initial jobless claims, Thursday;

- On Friday, markets in Germany and Japan are closed;

- On Friday, markets in Australia will close earlier at 2:30 pm.