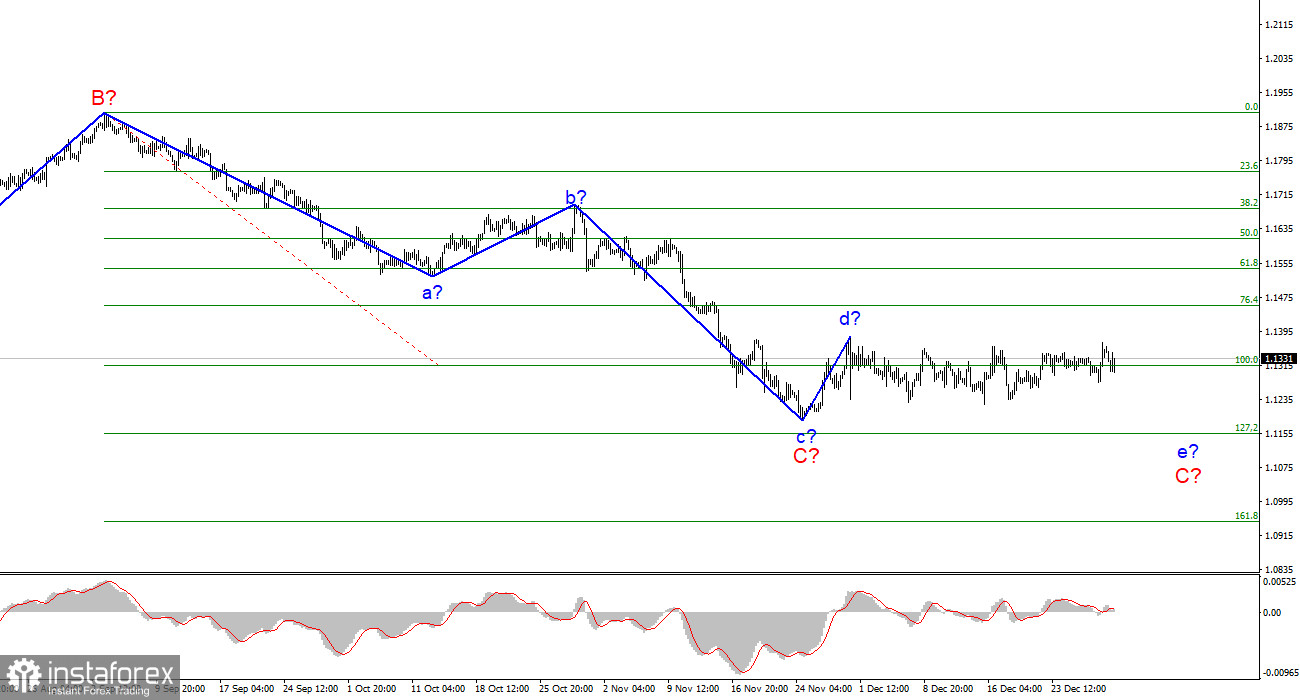

The wave pattern of the 4-hour chart for the Euro/Dollar instrument continues to remain integral and does not require additions. The construction of a downward wave e in C is still questionable since the current wave takes a very extended, horizontal form. If the downward wave does not continue its construction, then wave C will have to be recognized as three-wave and completed, although I believe that it should still take a five-wave form.

The wave that originates on November 30 still cannot be attributed to either wave C or the first wave of a new upward trend segment, if it really is, since neither the peak of wave d in C nor the low of wave c in C has been broken over the past few weeks. In the current situation, we can only wait for the situation to develop.

Given that the holidays have already begun and are continuing, the internal wave structure of the last wave may take on an even more extended form. And now it makes no sense to understand its internal ones, since this structure can turn out to be almost any length.

New Year's Week continues

There was again little news background for the EUR/USD instrument on Thursday. European Union was completely empty, while the U.S. released its report on jobless claims for the week. According to the report, this week's claims amounted to 198,000, while continuing claims dropped to 1.7 million. Note that the second indicator is often called the indicator of real unemployment. In any case, unemployment in the U.S. continues to decrease, which is very good for their economy.

The Chicago PMI index was also released today. It rose to 63.1 points in December, which is also good for the U.S. currency.

The amplitude of the instrument was more than 30 points, and the dollar went in high demand. However, all this happens inside the same horizontal movement in which the instrument has been for more than a month. Thus, if the markets took into account today's statistics from the U.S., then no special changes have happened anyway. It is unlikely that anything will happen tomorrow, although I note that the amplitude remains quite high. Especially for holidays.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C can be completed. However, the internal wave structure of this wave still allows the construction of another downward, internal wave. Thus, I advise selling the instrument with targets located around the 1.1152 mark, for each downward signal from the MACD, until a successful attempt to break the peak of wave d occurs. A restrictive order can be placed above the peak of wave d.

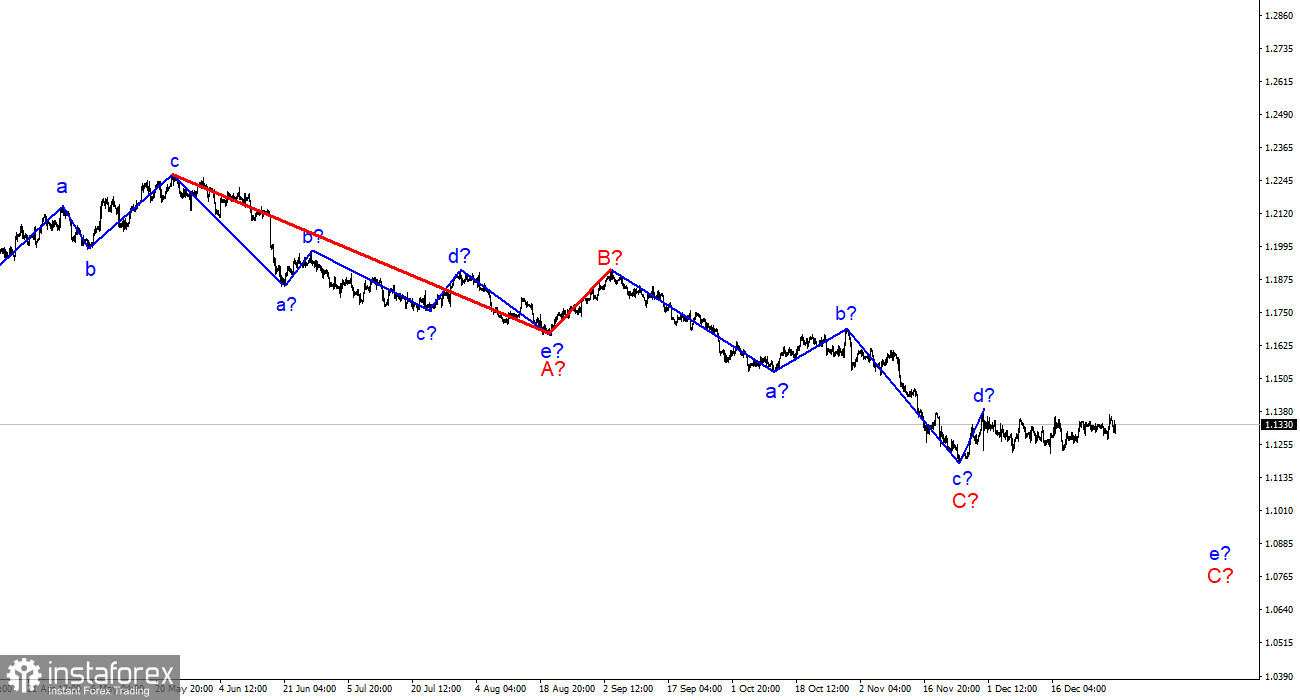

The wave pattern of the higher timeframe looks quite convincing. The decline in quotes continues, and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more weeks until wave C is fully completed (it should take a five-wave form in this case).