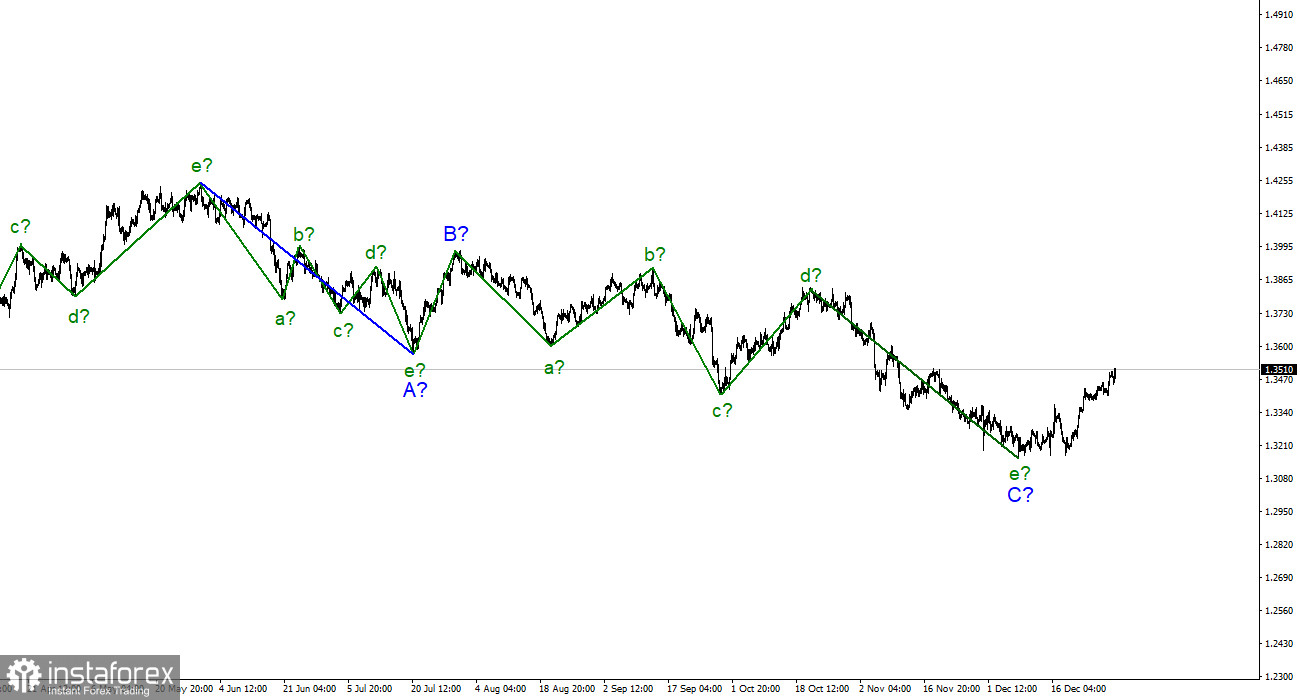

The wave pattern for the Pound/Dollar instrument continues to look quite convincing. The increase in quotes in recent weeks suggests the construction of wave D. However, the current increase in quotes can also be interpreted as the first wave of a new upward trend segment. A three-wave structure is visible inside this wave. If it is still wave D, then this "fairy tale" can end very quickly for the pound. If not, then the increase of the instrument will continue with the targets located around the 36th and 38th figures.

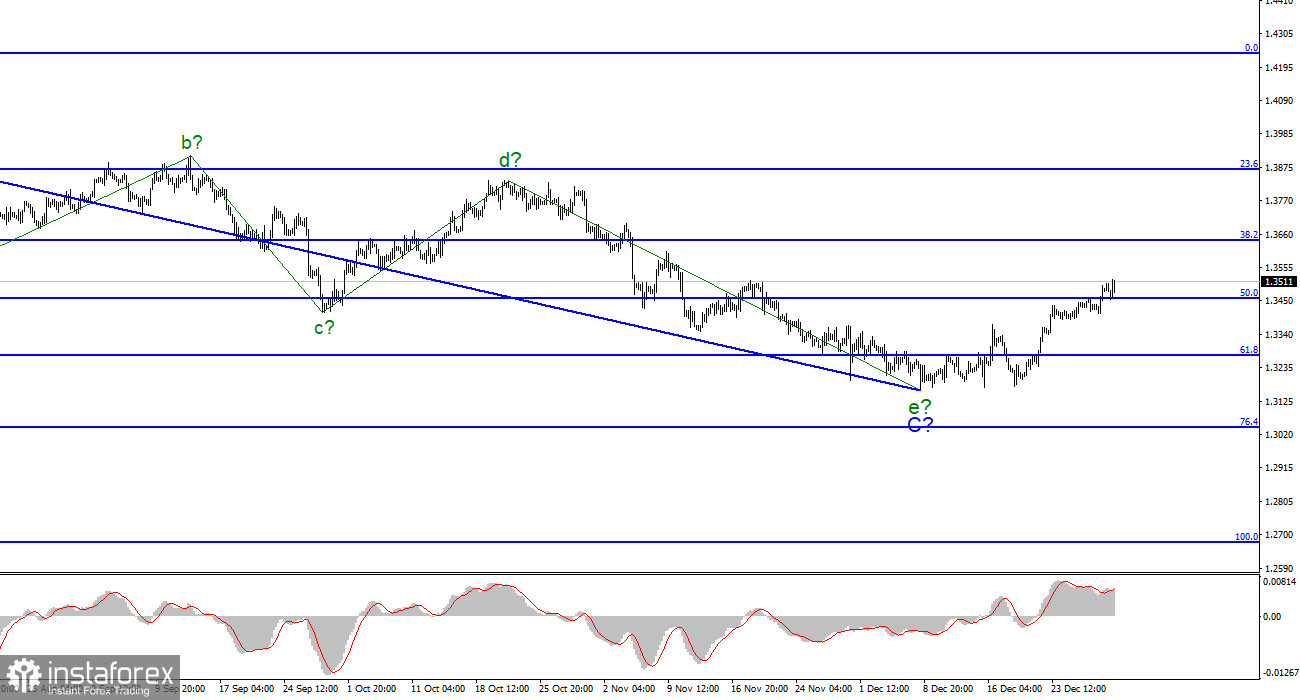

The second attempt to break the 50.0% Fibonacci level was successful, which indicates the readiness of the markets for further purchases. Now I conclude that the construction of an upward wave continues.

COVID-19 cases continue to rise in the U.K.

The exchange rate of the Pound/Dollar instrument moved with average strength on Thursday. The instrument dropped by 50 basis points, and then rose by 65, which was not bad at all, plus the construction of an upward wave continues.

It is hard to say that the rise of the British pound is due to the news background. There were no interesting events in the U.K. or the U.S. today. And there haven't been any for quite some time. Thus, the British pound continues to rise only on the desire of the market to buy it. If the market had now paid attention to the growing number of Omicron cases in the U.K., it is unlikely that the purchases of the pound would have continued.

At the same time, it is still too early to conclude that the construction of a downward trend section has been completed. After the completion of wave D, the decline in quotes may resume, and at the moment, we are faced with the need to build a corrective wave that has no news basis.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. The supposed wave C has completed its construction, and wave D may be nearing this moment. Thus, now it is possible to consider selling the instrument with targets located near the calculated marks of 1.3272 and 1.3043, which corresponds to 61.8% and 76.4% by Fibonacci levels, for each downward signal from the MACD, counting on the construction of wave E.

However, it is also advisable to wait for either a successful attempt to break through the 1.3454 mark, which corresponds to 50.0% Fibonacci level, or an unsuccessful 1.3642 mark, which equates to 38.2% Fibonacci level.

Starting from January 6, the construction of a downward trend section continues, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed). However, the entire downward section of the trend may lengthen and take the five-wave form A-B-C-D-E.