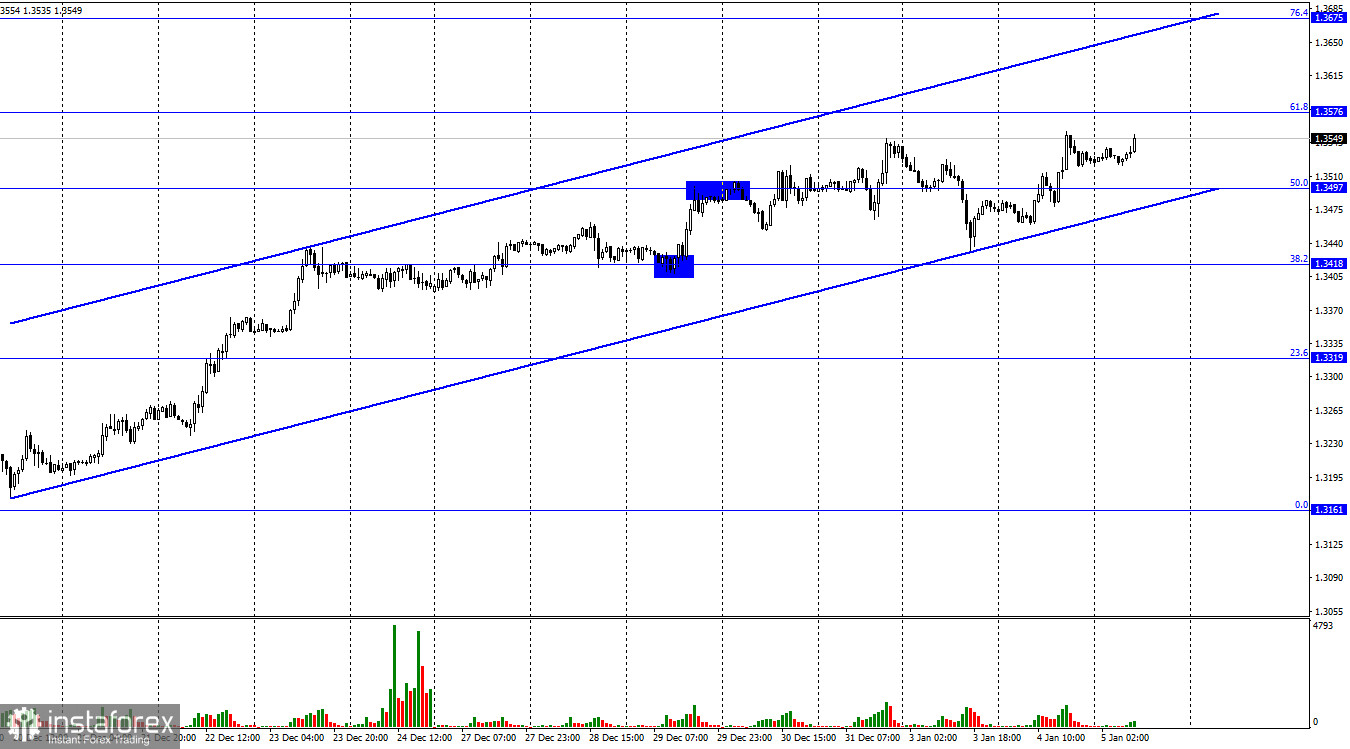

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the UK currency on Tuesday and resumed the growth process towards the corrective level of 61.8% (1.3576), although it had previously closed below the upward trend corridor. This caused the need to rebuild the corridor, and now it again characterizes the mood of traders as "bullish". At the same time, I do not rule out that the bears will try to close under it again, which will again mean a reversal in favor of the US currency and the beginning of a fall towards the levels of 1.3418 and 1.3319. The information background of yesterday was rather weak. I have already mentioned the ISM index in the US, which could cause a slight drop in the dollar. But the PMI index in the UK manufacturing sector did not attract the attention of traders, although it turned out to be higher than their expectations. Also yesterday, an article was published on the website of the Federal Reserve Bank of Minneapolis, in which its president Neel Kashkari said that he expects two interest rate hikes in 2022.

This is a very neutral statement, which also did not arouse the interest of traders because it is precisely the two rate increases that the absolute majority of market participants and analysts put into forecasts for 2022. There is an opinion that there may be three increases, but this is not the most common opinion. In addition, Mr. Kashkari said that inflation in America has long exceeded all acceptable forecasts, and the price increase turned out to be much longer than expected. Mr. Kashkari did not say anything new for traders, Jerome Powell and other Fed representatives had repeatedly stated the same thing earlier. As for the UK, the situation with COVID there is about the same as in the USA. The number of diseases continues to grow, but the country's authorities hold the same opinion as in America: while Omicron does not cause a large number of hospitalizations and complications, there is no sense in quarantine.

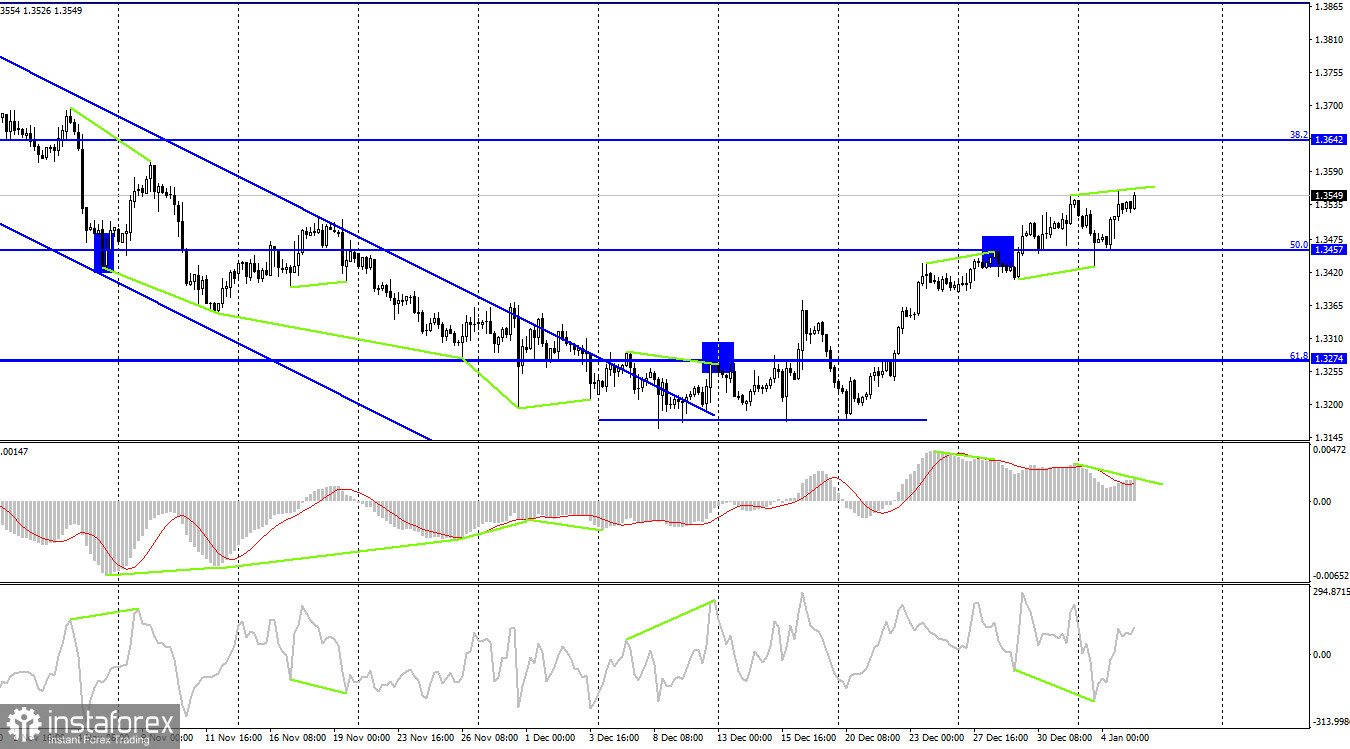

On the 4-hour chart, the pair performed a rebound from the corrective level of 50.0% (1.3457), a reversal in favor of the British, and began the process of growth in the direction of the Fibo level of 38.2% (1.3642). The bullish divergence of the CCI indicator also worked in favor of the beginning of growth. However, now a new bearish divergence is brewing in the MACD indicator, which may work in favor of the US currency and start the process of returning quotes to the level of 1.3457. Closing the pair below this level will increase the probability of a further fall towards the next corrective level of 61.8% (1.3274).

News calendar for the US and the UK:

US - change in the number of employees from ADP (13:15 UTC).

US - publication of the minutes of the Fed meeting (19:00 UTC).

On Wednesday, the calendar of economic events in the UK is empty, and in the US there will be two releases that deserve attention. Both can affect the mood of traders, so I believe that the information background today will be average in strength.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British if there is closure under a new upward trend corridor on the hourly chart with a target of 1.3418. I still recommend buying a pound, as the growth process continues, but I don't see any new and accurate buy signals yet.