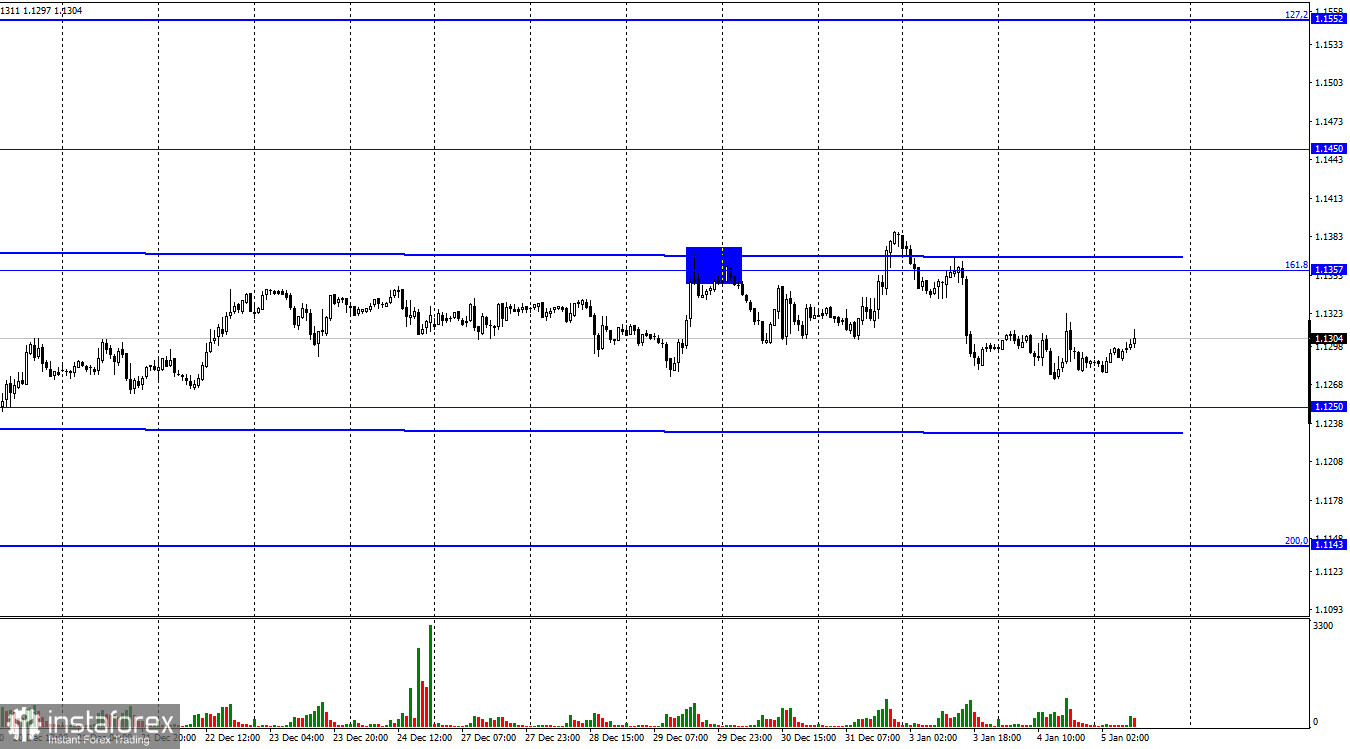

The EUR/USD pair on Tuesday did not want to continue the process of falling, but could not start a new growth process. Thus, the pair's quotes are now exactly in the middle of the side corridor, which has been present on the chart for more than a month. Twice and for a very short time, the pair left this corridor but spent most of the time inside it. Therefore, I characterize the mood of traders at this time as "neutral". Trading volumes were quite weak yesterday - weaker than a day earlier. If traders manage to close above or below the corridor, this may increase the likelihood of a tangible process of growth or decline. The information background of yesterday was presented only by a report on ISM business activity in the US manufacturing sector. This indicator decreased compared to November, but the pair could not determine the direction of movement for most of the day. Thus, if traders did not ignore this report, it did not have a big impact on the pair's movement.

In addition, another record was set in the United States for the number of new diseases with the Omicron strain. This time, the number of infections exceeded 1 million in one day. This is a gigantic figure, but the US authorities still do not even think about introducing quarantine. Of course, certain measures are being taken. In particular, school holidays are being extended, and in many companies and fields work is almost stopped. The most striking example is the aviation sphere, where for several weeks there has been a shortage of pilots, which leads to the cancellation of hundreds and thousands of flights around the world. However, if we talk about the health of the nation, omicron still rarely leads to hospitalization or death. Therefore, the US authorities are in no hurry to quarantine. In most cases, the patient only needs self-isolation and treatment at home. That is, nothing serious. Thus, traders are still not paying due attention to the new wave of the COVID epidemic.

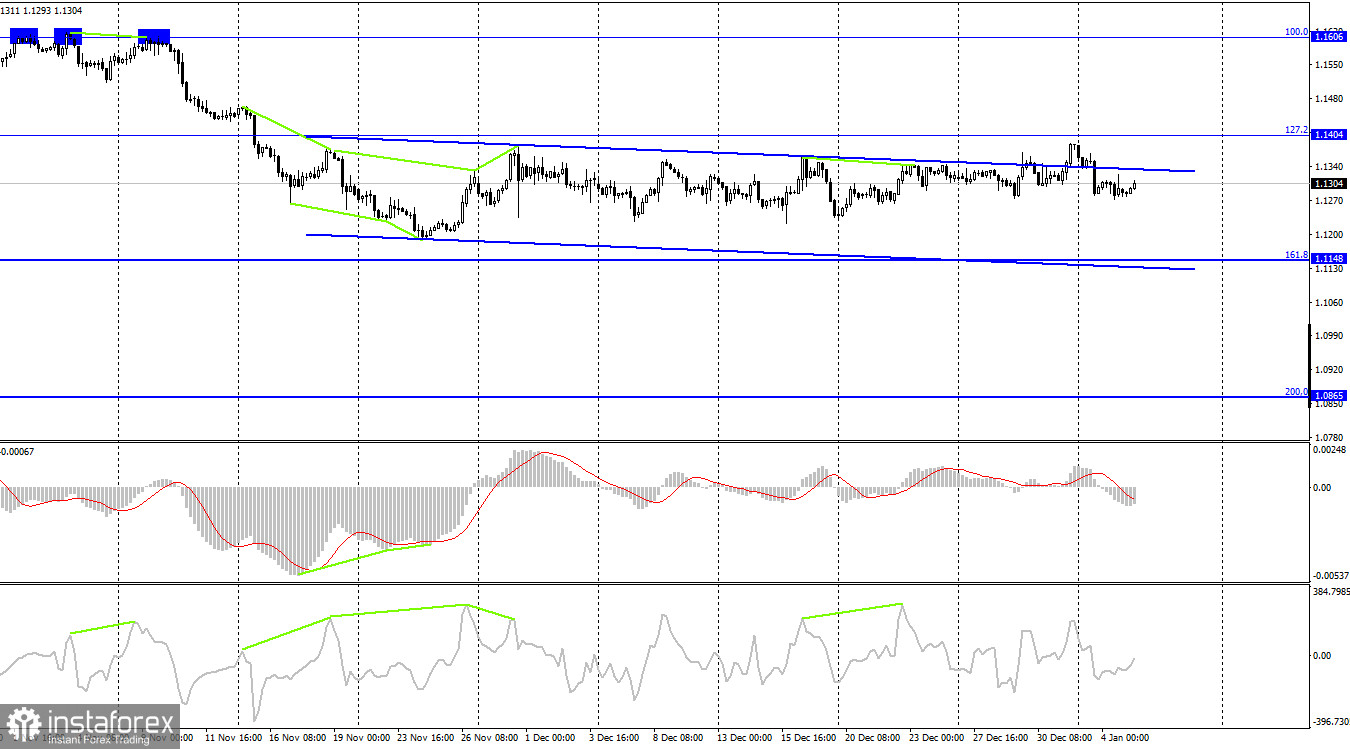

On the 4-hour chart, the pair performed a return to the semi-descending-semi-lateral corridor. Thus, the graphic picture is almost similar to the hourly chart. Emerging divergences are not observed in any indicator today. Closing above the corridor does not guarantee that the pair will be able to continue the growth process. I believe that it is necessary to wait for the closing at least above the corrective level of 127.2% (1.1404) to be able to count on a change of movement.

News calendar for the USA and the European Union:

EU - index of business activity in the service sector (09:00 UTC).

US - change in the number of employees from ADP (13:15 UTC).

US - publication of the minutes of the Fed meeting (19:00 UTC).

On January 5, the calendars of economic events in the European Union and the United States contain several interesting entries. The minutes of the Fed's meeting should be of the greatest interest, as it can show what the mood of the majority of the members of the American central bank is now, on which the future monetary policy in the United States will depend. The ADP report may also be of interest to traders.

EUR/USD forecast and recommendations to traders:

After the pair closed under the corrective level of 1.1357, it was possible to sell with a target of 1.1250. Now, this deal can be kept open. I recommend buying a pair when rebounding from the level of 1.1250 or the lower border of the side corridor on the hourly chart with a target of 1.1357.