To open long positions on EUR/USD, you need:

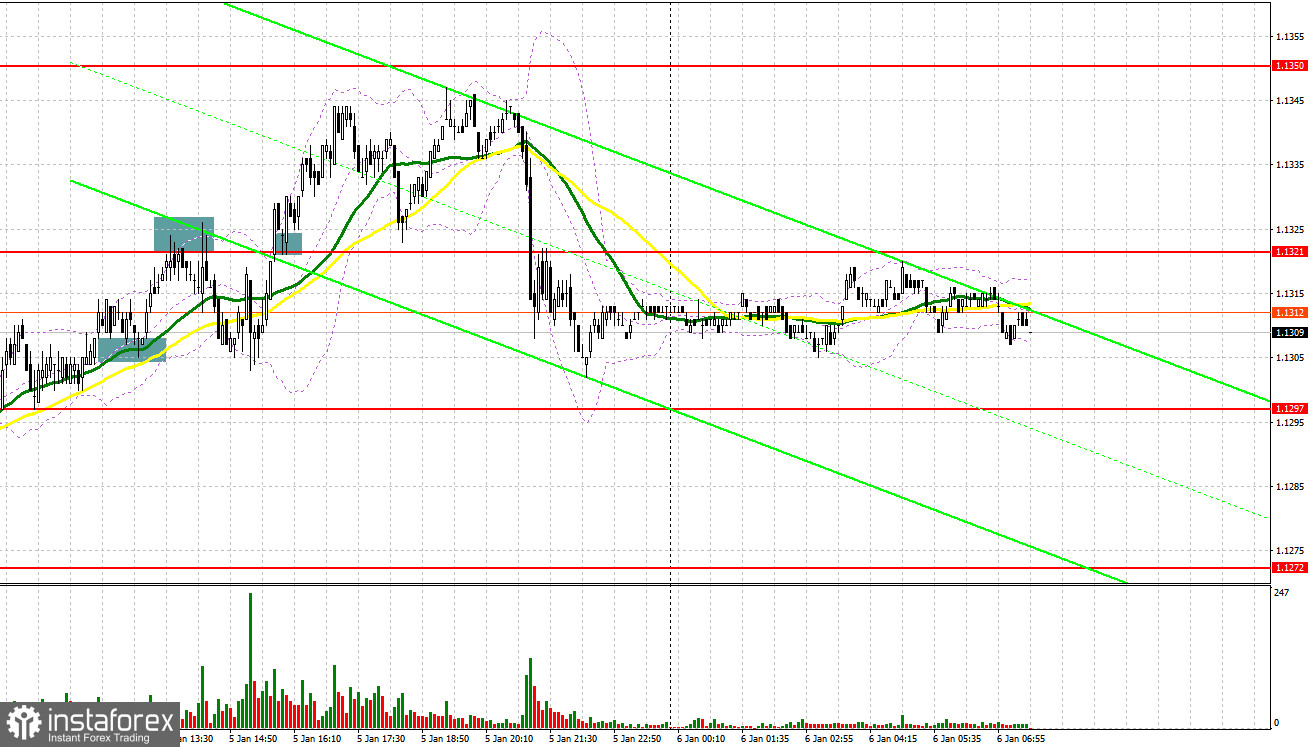

Several good signals to enter the market were formed yesterday. Let's take a look at the 5 minute chart and see what happened. I drew attention to the 1.1306 level in my morning forecast and advised you to make decisions on entering the market. Fundamental data that was released in the morning had a negative impact on the European currency. As a result, the formation and false breakout at the level of 1.1306 is a signal to sell the euro. However, this did not lead to a major drop in the pair, and after a marginal decline, the bulls tried to take control of 1.1306, breaking above this range. The consolidation and reverse test from top to bottom of this level gave an excellent signal for the growth to the next target of 1.1321. There, the bears fought off the initial attack, and a false breakout formed a sell signal, which brought about 15 points of profit. In the afternoon, the bulls managed to break above 1.1321. A downward test of this range gave a buy signal. As a result, the growth was about 25 points.

Today there are quite a large number of reports on the eurozone countries that can help the euro continue to grow. However, before they are published, it is best for bulls to focus on the 1.1294 level. Forming a false breakout there, by analogy with yesterday, and good data on the eurozone producer price index and the German consumer price index – both of these indicators should demonstrate significant growth, can create a signal to buy the euro in hopes of a repeated recovery to the resistance of 1.1321, as the bulls failed to settle above it yesterday. The release of the Federal Reserve minutes hurt the bulls' plans. Surpassing this range is an important task, and the reverse test from top to bottom will open up the possibility of growth in the area of 1.1345 and 1.1375, where I recommend taking profits. The 1.1415 level is a more distant target. With the pair declining during the European session and the lack of bullish activity at 1.1294, and the moving averages playing on the bulls' side are slightly above this level, it is best to postpone long positions to a larger support of 1.1272. However, I advise you to open long positions there when forming a false breakout. You can buy EUR/USD immediately for a rebound from the 1.1248 level, counting on an upward correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Yesterday, the bears did a lot to close the day below 1.1321 - it is very important to determine the pair's succeeding direction. In case EUR/USD rises in today's European session after the reports on Germany and the eurozone are published, bears need to try to do everything possible to protect the resistance of 1.1321 again, since the pair cannot be released above this level – this will lead to a change in direction of movement. Forming a false breakout at 1.1321 creates the first entry point into short positions in hopes of returning the pressure on EUR/USD and a repeated decline to the area of 1.1294. A more active struggle will unfold for this level. A breakdown and test from the bottom-up will give another signal to open short positions with the prospect of a decline to a large low like 1.1272. Going beyond this level will change the direction to a downward one and remove a number of bulls' stop orders, which will cause a larger drop in EUR/USD with the update of the lows: 1.1248 and 1.1224, where I recommend taking profits. In case the euro grows and the bears are not active at 1.1321, it is best not to rush with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1345. You can sell EUR/USD immediately on a rebound from the high like 1.1375, or even higher - around 1.1415, counting on a downward correction of 15-20 points.

I recommend for review:

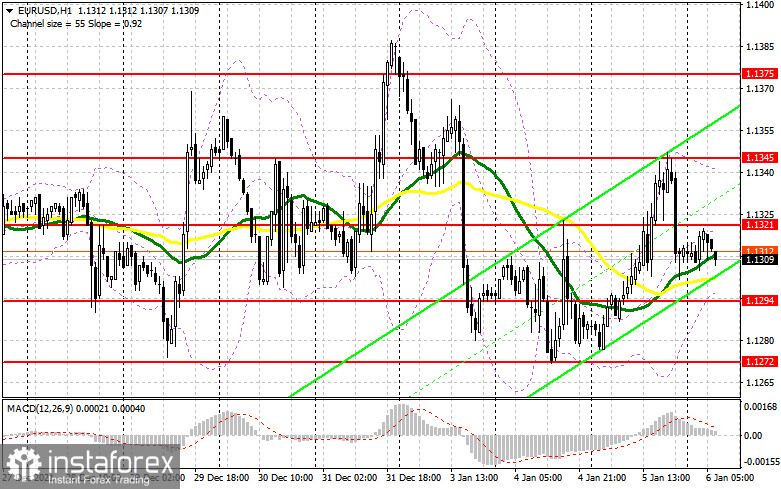

The Commitment of Traders (COT) report for December 21 revealed that both short and long positions increased, but the latter declined slightly more, which led to a reduction in the negative delta value. This data takes into account the recent meetings of the Federal Reserve and the European Central Bank. However, judging by the alignment of forces, nothing has changed much, which is generally confirmed by the schedule. Many problems in the economies of the eurozone and the United States remain due to the Omicron strain of coronavirus, which does not allow representatives of central banks to live peacefully. Most likely, the further monetary policy of the Fed and the ECB will depend on how the situation with the coronavirus will develop after the New Year. The report shows that the buyers of risky assets, and we are talking about the euro, are in no hurry to build up long positions even after the recent statements by the ECB that it plans to fully complete its emergency bond buying program as early as next March. On the other hand, the US dollar also has support: the Fed is planning to raise interest rates as early as next spring, which makes the US dollar more attractive. The COT report indicated that long non-commercial positions rose from 189,530 to 196,595, while short non-commercial positions rose from 201,409 to 206,757. This suggests that traders will continue to actively fight for further direction. market. At the end of the week, the total non-commercial net position decreased its negative value from -11,879 to -10,162. The weekly closing price, due to the horizontal channel, remained almost unchanged - 1.1277 against 1.1283 a week earlier.

Indicator signals:

Trading is carried out just above the 30 and 50 day moving averages, which indicates some market uncertainty with direction after the New Year holidays.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, support will be provided by the lower border of the indicator in the area of 1.1294. In case of growth, the upper border of the indicator in the area of 1.1340 will act as a resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.