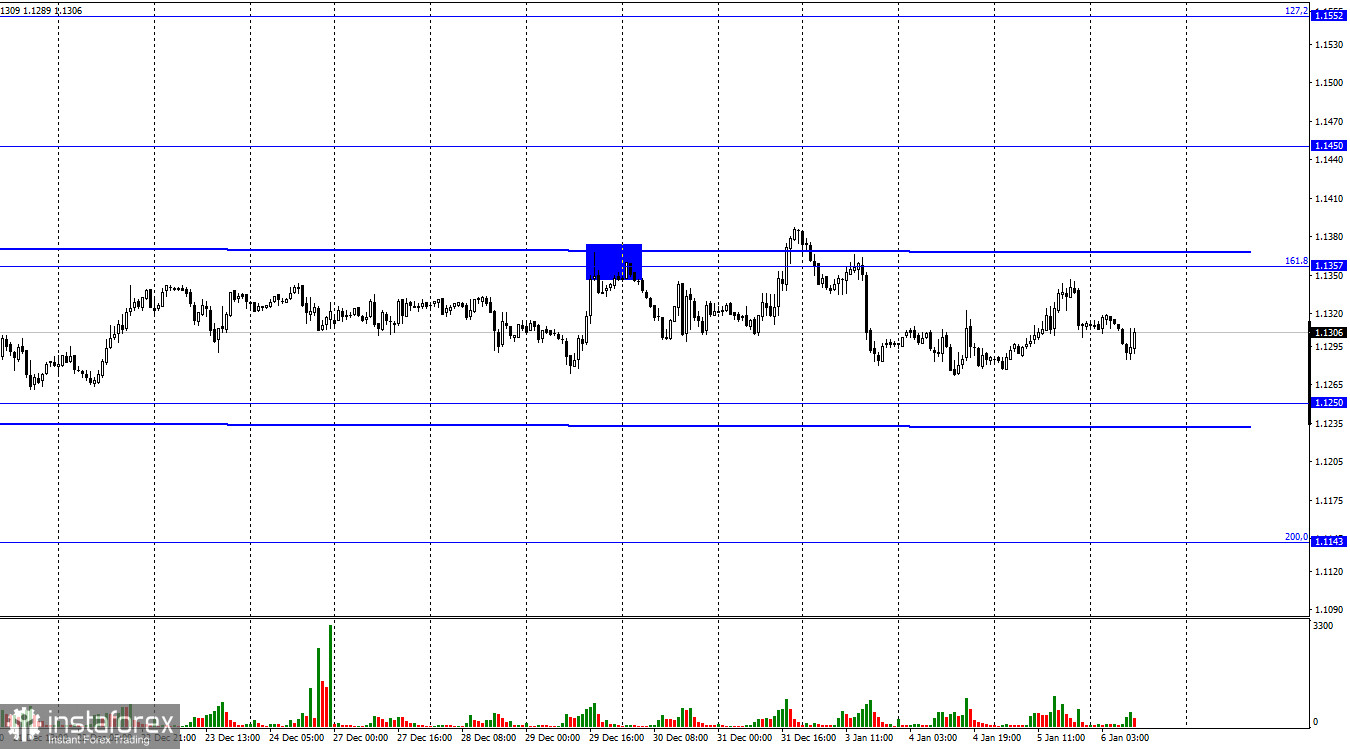

On Wednesday, the EUR/USD pair performed a reversal in favor of the EU currency and increased towards the corrective level of 161.8% (1.1357). However, in the evening, after the publication of the FOMC protocol, a reversal was made in favor of the US currency, and the process of falling inside the side corridor began. In general, the pair continues to trade within this corridor, which continues to characterize the mood of traders as "neutral". The key event of the last day was, as I have already said, the minutes of the Fed from the December meeting. It was after it that the dollar rose by 30 points. It's not much, but there was a reaction to the protocol, which means it contained interesting information. It was not difficult to guess what kind of information this was if the dollar rose in value. In recent months, the Fed has taken a course to tighten monetary policy, and traders have only one question left: how many interest rate hikes should we expect this year?

It was this question that was answered. All members of the Monetary Policy Committee believe that there will be at least one rate increase in 2022. Most are inclined to 2-3 increases. Next year, 2 or 3 more increases are expected. In addition, some FOMC members believe that it's time to start unloading the Fed's balance sheet. This process must also begin sooner or later, and in its essence, it is the opposite of the incentive process. That is, what do we see now? The Fed has already announced the beginning of the rate hike season, the quantitative stimulus program is actively decreasing and may be completed in the coming months, and the Fed is already thinking about unloading its balance sheet, which has grown to almost $ 9 trillion during the pandemic. There is every reason to assume that the Fed will follow this "hawkish" path in the coming years. This is good for the US dollar, especially in the coming months, since the ECB is not even thinking about raising rates or reducing its balance sheet after the PEPP program.

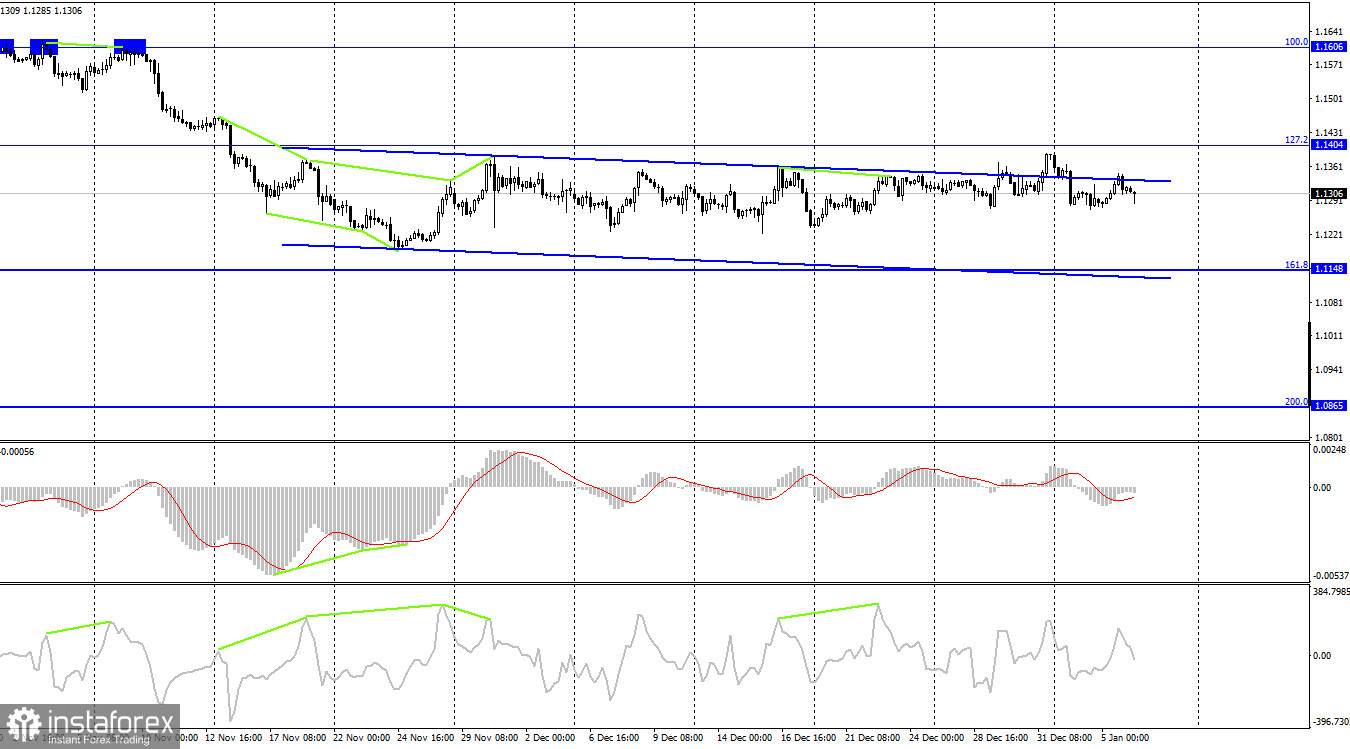

On the 4-hour chart, the pair has made a return to the semi-descending-semi-lateral corridor and continues to move along its upper border. Thus, as on the hourly chart, the "neutral" mood of traders remains. Fixing above the corridor will allow us to count on some growth of the euro currency, but I recommend waiting for the closure above the Fibo level of 127.2% (1.1404). The drop in quotes is also not too obvious now.

News calendar for the USA and the European Union:

US - number of initial applications for unemployment benefits (13:30 UTC).

US - ISM index of business activity in the service sector (15:00 UTC).

On January 6, the calendar of economic events in the European Union does not contain a single interesting entry. In the US today, the most important report will be the ISM index. The influence of the information background on the mood of traders will be weak today.

EUR/USD forecast and recommendations to traders:

After the pair closed under the corrective level of 1.1357, it was possible to sell with a target of 1.1250. Now, this deal can be kept open, but bear traders have not been able to bring the pair to the target in 2.5 days. I recommend buying a pair when rebounding from the level of 1.1250 or the lower border of the side corridor on the hourly chart with a target of 1.1357.