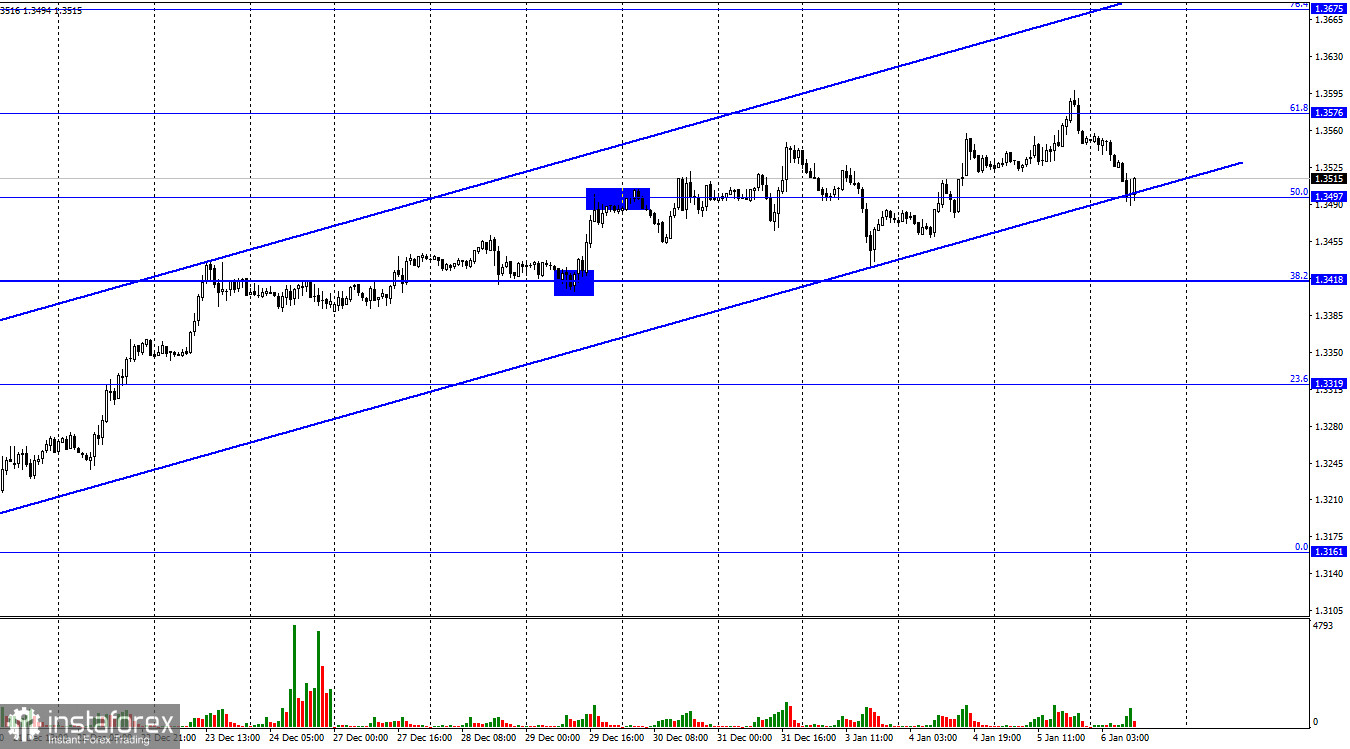

According to the hourly chart, the GBP/USD pair was on the rise for most of the day on Wednesday. By the end of the day, it performed a reversal in favor of the US currency and fell to the corrective level of 50.0% (1.3497). The rebound of quotes from this level, and at the same time the lower boundary of the new ascending corridor, allows us to count on a reversal in favor of the British and the resumption of growth in the direction of the level of 61.8% (1.3576). Fixing the pair's rate under the ascending corridor will increase the chances of a new fall towards the next Fibo level of 38.2% (1.3418). I note that the fall of the pair (that is, the growth of the dollar) began yesterday after the publication of the Fed minutes, which turned out to be very "hawkish". As I said in the article on the euro/dollar pair, the Fed showed its intentions to further tighten monetary policy, curtail QE, raise rates, and even unload its balance sheet, which caused dollar purchases in the market. In addition, a few hours earlier in America, the ADP report on the change in the number of people employed in the private sector was released, which turned out to be twice as good as traders' expectations.

However, immediately after the release of this report, the dollar continued to fall, so it is unlikely that traders paid attention to it. The information background of yesterday was generally weak, and nothing was interesting in the UK at all. There won't be any interesting events in Britain today either. Traders are already preparing for Friday's Nonfarm Payrolls report, which is the most important this week. Previously, payrolls could be associated with a future Fed meeting, since the higher the payrolls were, the more likely it was to tighten monetary policy. Now, this dependence is no longer there. In November, the labor market report was weak and it may be the same in December since it was during these months that a new wave of the pandemic under the influence of the omicron strain began.

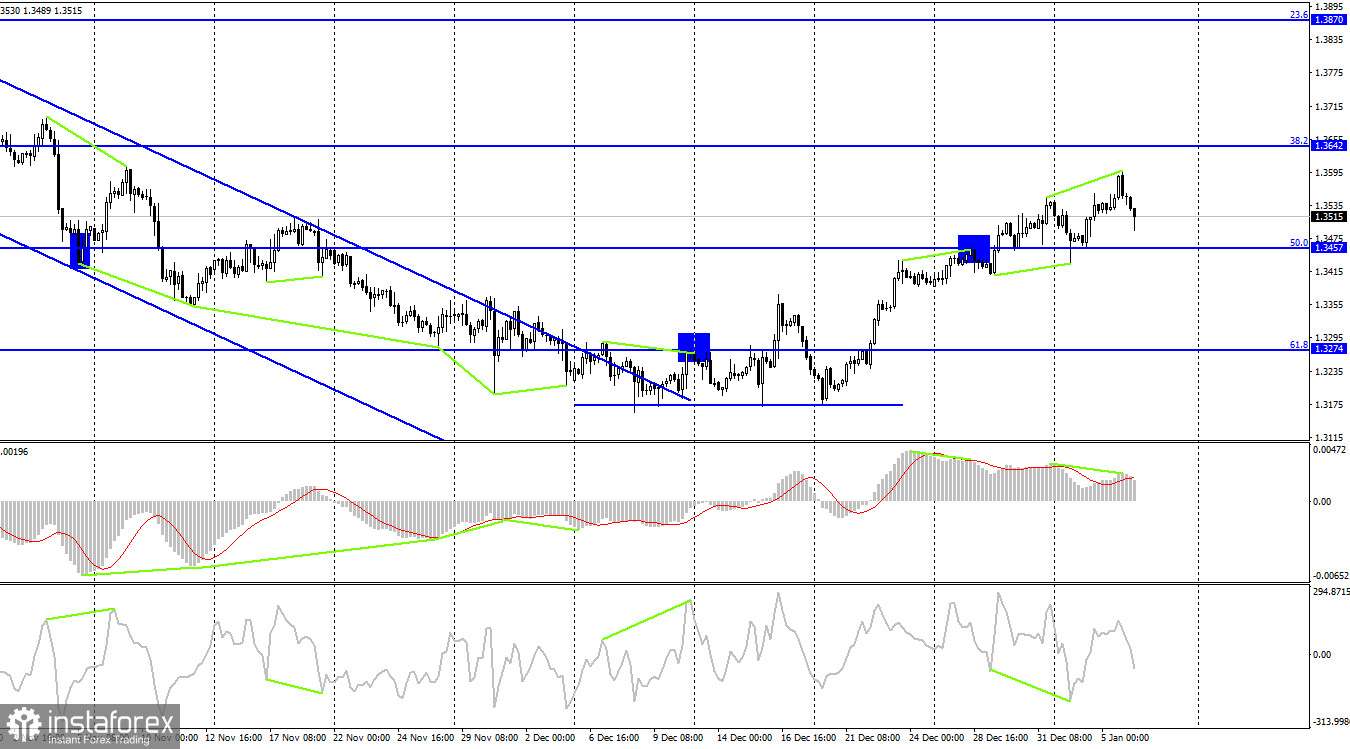

On the 4-hour chart, the pair performed a rebound from the corrective level of 50.0% (1.3457). However, yesterday a bearish divergence was formed at the MACD indicator, which worked in favor of the US currency and began to fall towards the level of 1.3457. A new rebound from it will work again in favor of the British and some growth in the direction of the Fibo level of 38.2% (1.3642). Fixing the pair's exchange rate below the 50.0% level will increase the probability of a further fall towards the next Fibo level of 61.8% (1.3274).

News calendar for the US and the UK:

UK - PMI index for the service sector (15:00 UTC).

US - number of initial applications for unemployment benefits (13:30 UTC).

US - ISM index of business activity in the service sector (15:00 UTC).

The business activity index for the services sector has already been released in the UK on Thursday. It turned out to be slightly better than traders' expectations, but this did not affect the fall of the British dollar during Thursday. A little later in America, two also not the most important reports will be released. The information background will be weak today.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the pound if there is closure under a new upward trend corridor on the hourly chart with a target of 1.3418. I still recommend buying the British with a target of 1.3576, since the rebound from the level of 50.0% (1.3497) was performed.