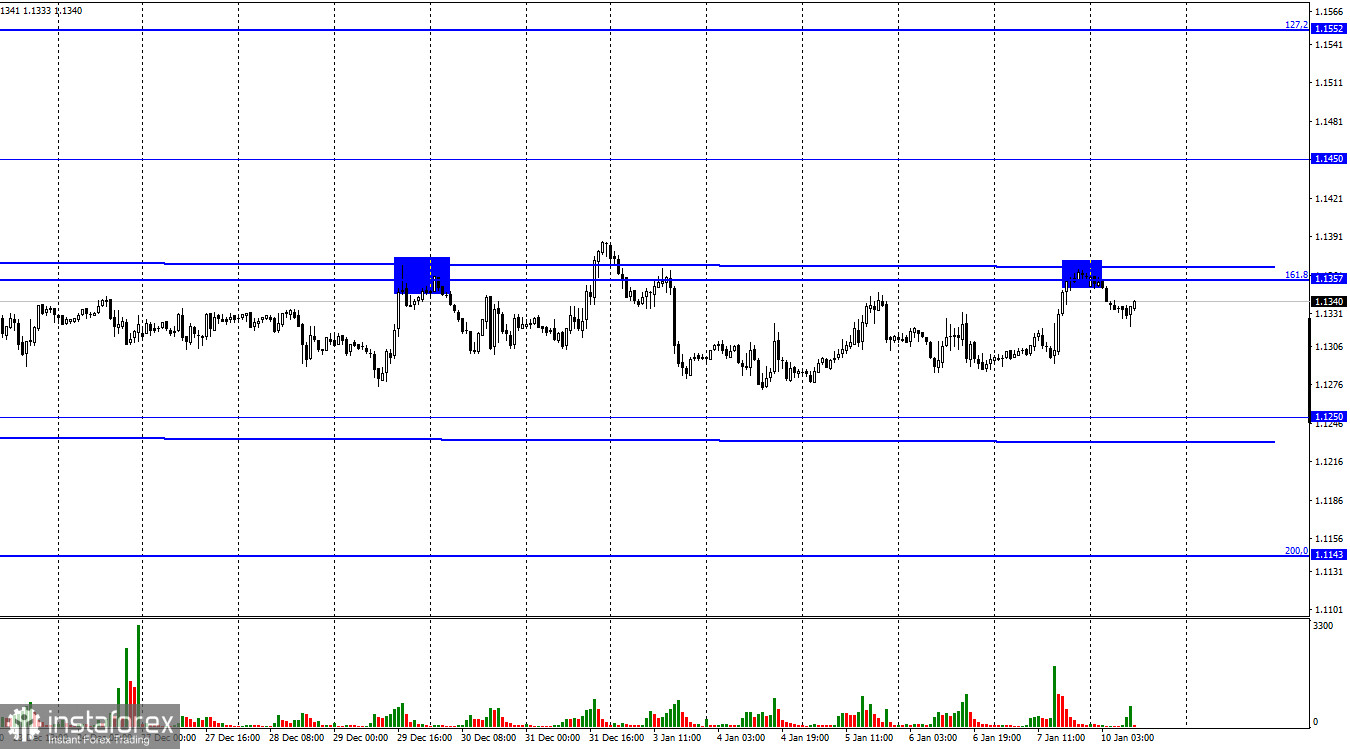

Hello, dear traders! The euro/dollar pair rose to the 161.8% retracement level (1.1357) and the upper limit of the sideways channel on Friday. The sideways movement describes traders' sentiment as neutral. So, the level of 1.1357 and the upper limit of the channel are of utmost importance at this point. EUR bulls may try to close above them. This would allow the uptrend to resume in the coming weeks. However, market participants have been unable to leave the sideways channel for over a month even despite the important macroeconomic reports released during that time. Bulls pushed the price up by just 70 pips on Friday amid strong macroeconomic data in the United States. The movement stopped near the 161.8% retracement level and the upper limit of the channel. On Monday, the euro/dollar pair reversed down. The quote may fall to the level of 1.1250 and the lower limit of the channel.

Nonfarm Payrolls in the US disappointed traders on Friday. The American economy added only 200K new jobs, which was well below market forecasts of 400K. At the same time, unemployment dropped to 3.9% versus the expected rate of 4.0-4.1%, and average hourly earnings increased by 0.6% m/m in December, above market expectations of 0.4%. Nevertheless, Nonfarm Payrolls were of greater importance to traders. Therefore, the greenback plummeted on Friday. However, the pair remained within the sideways channel. Likewise, an important macroeconomic report came out in the eurozone. Inflation in the euro area accelerated in the month of December to 5.0% y/y, and core inflation remained at 2.6% y/y. Anyway, traders showed no reaction to the report.

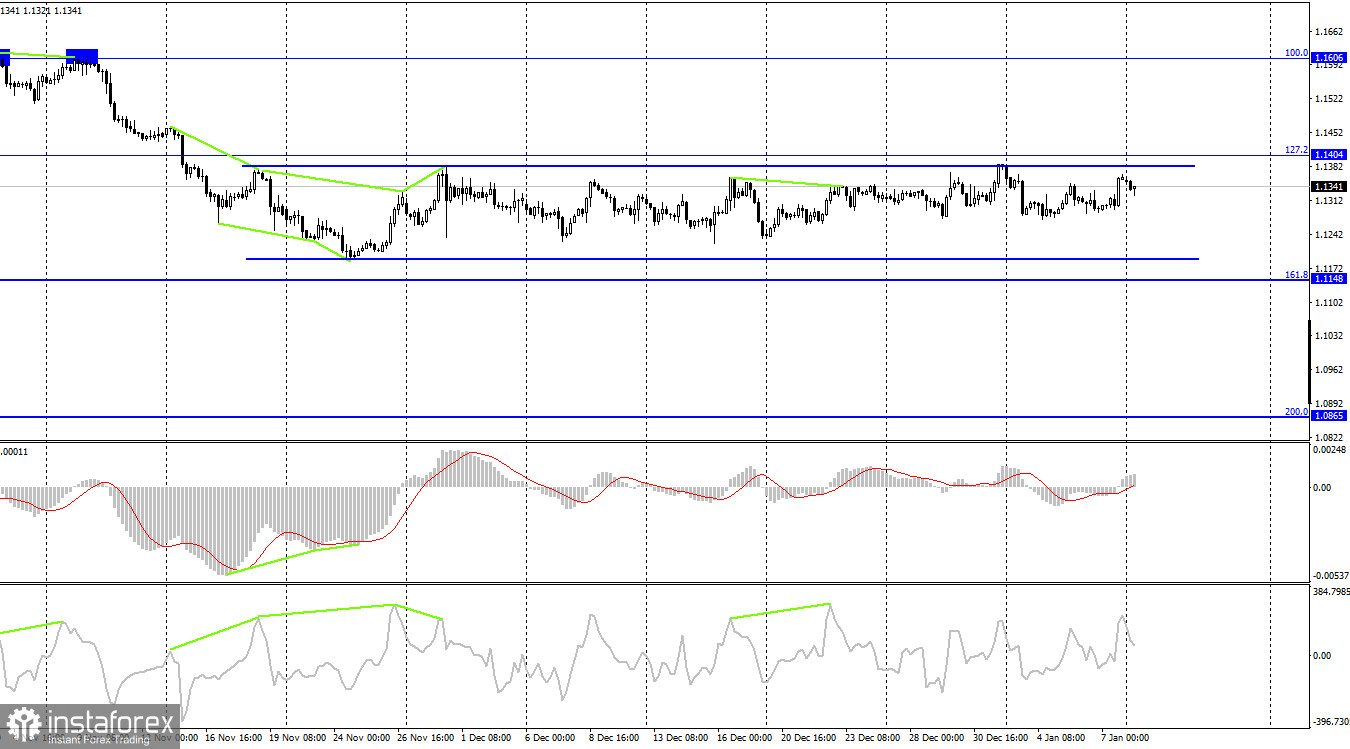

I have rebuilt the semi-descending and semi-sideways channel on the H4 chart. It now looks like a sideways channel. On Friday, the pair failed to reach its upper limit and no pullback occurred. Nevertheless, there is an almost identical channel on the H1 chart where a pullback took place. Therefore, I expect the price to fall this week. In the case of consolidation above both channels, the euro may soar to 1.1606.

Macroeconomic calendar in the US and the eurozone:

On January 10, the macroeconomic calendar in the US will be completely empty. The eurozone's calendar will contain a single report - the unemployment rate. So, macroeconomic data is unlikely to somehow affect the market today.

Outlook for EUR/USD:

Short positions could be opened with the target at 1.1250 following a pullback from the level of 1.1357 on the H1 chart. In the case of consolidation above both sideways channels, traders could go long with targets at 1.1450 and 1.1606.