To open long positions on EURUSD, you need:

In my morning forecast, I paid attention to the 1.1325 level and advised making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The released fundamental data on the confidence of eurozone investors and the labor market helped buyers to protect the support of 1.1325, forming a signal there to open long positions. However, after an increase of 15 points, the initiative gradually dried up, which led to a return of EUR/USD back to this level - a bad sign for buyers. And even though the technical picture has not changed in the second half of the day, the market remains under the control of sellers, so I recommend looking closely at the scenario for the sale of euros. And what were the entry points for the pound this morning?

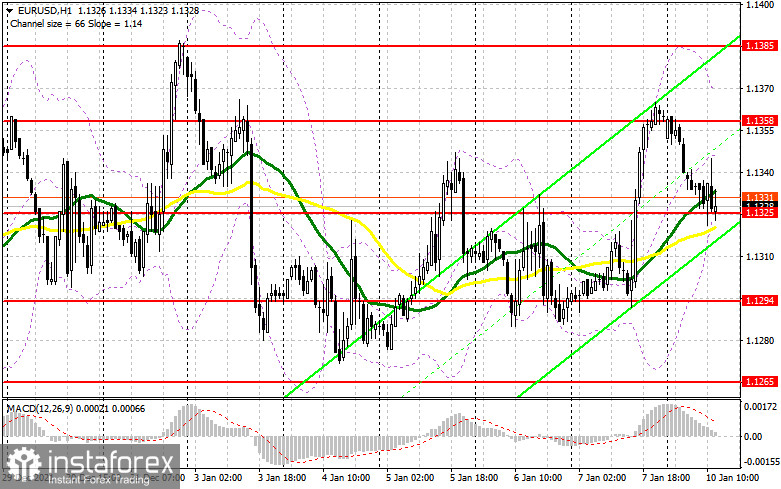

In all likelihood, the bulls need to try very hard to prevent the euro from returning to the 1.1294 level. In the afternoon, there are no statistics on the American economy that would prevent the bears from implementing their plans. In the absence of bulls at the level of 1.1325, and most likely it will be since we have already worked it out in the first half of the day, it is best to postpone purchases until the next major support of 1.1294. However, I advise you to open long positions there when forming a false breakdown and weak fundamental statistics on changes in the volume of stocks in wholesale warehouses and the volume of consumer lending in the United States. From the level of 1.1265, you can buy EUR/USD immediately for a rebound with the aim of an upward correction of 20-25 points within the day, or even lower - from the minimum of 1.1248. An equally important task for euro buyers will be the growth to the upper border of the side channel in the area of 1.1358, which could not be held above yesterday. A breakdown of this range and a reverse test from top to bottom will open up the possibility of a jump to the area of levels: 1.1385 and 1.1415, where I recommend fixing the profits. A more distant target will be the 1.1442 area, the test of which will be evidence of the resumption of the bullish trend.

To open short positions on EURUSD, you need:

Today, sellers have again done everything possible to bring the market back under their control. The first attempt to break 1.1325 was unsuccessful, but the bears also did not allow the euro to go up. In the case of EUR/USD growth today during the American session, sellers need to try to protect the 1.1358 level. Only the formation of a false breakdown there forms the first entry point into short positions in the expectation of a return of pressure on EUR/USD and a repeated decline to the area of 1.1325. As we can see on the chart, there is an active struggle for this level. A breakdown and a bottom-up test of this range, together with strong data on the US economy and lending, will give an additional signal to open short positions with the prospect of reducing the pair to the next low of 1.1294. Only going beyond this area will change the market direction to a downward one and demolish several buyers' stop orders, which will cause a larger drop in EUR/USD with the update: 1.1265 and 1.1248, where I recommend fixing the profits. In the case of the growth of the euro and the absence of bear activity at 1.1358, it is best not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1385. You can sell EUR/USD immediately on a rebound from the maximum of 1.1415, or even higher - around 1.1442 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for December 28 recorded an increase in both short and long positions, but the latter decreased slightly more, which led to a reduction in the negative value of the delta. These data take into account recent meetings of the Federal Reserve System and the European Central Bank. However, judging by the balance of forces, nothing has changed much, which is generally confirmed by the schedule. Many problems in the economy of the eurozone and the United States remain due to the omicron coronavirus strain, which does not allow representatives of central banks to live in peace. Most likely, the further monetary policy of the Fed and the ECB will depend on how the situation will develop with the coronavirus after the New Year. The report shows that buyers of risky assets, and we are talking about the euro now, are not in a hurry to build up long positions even after recent statements by the European Central Bank that it plans to fully complete its emergency bond purchase program in March next year. On the other hand, the US dollar also has support: The Federal Reserve system plans to raise interest rates in the spring of next year, which makes the US dollar more attractive. The COT report indicates that long non-commercial positions increased from the level of 189,530 to the level of 196,595, while short non-commercial positions increased from the level of 201,409 to the level of 206,757. This suggests that traders will continue to actively fight for the further direction of the market. At the end of the week, the total non-commercial net position decreased its negative value from -11,879 to -10,162. The weekly closing price, due to the side channel, almost did not change - 1.1277 against 1.1283 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates market uncertainty.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.1370 will act as resistance. A break of the lower limit of the indicator in the area of 1.1325 will lead to a larger drop in the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.